Why Foot Traffic to Fast Food Restaurants is Slipping

December 13, 2022

Fast food foot traffic may be suffering, but why? While typical fast food chains focus on convenience and quick service, consumer preference is pivoting to fast-casual restaurants that offer more menu variation and ambiance.

As the year has progressed and people have adjusted to a new normal, we’ve been seeing a common foot traffic theme: people are placing an emphasis on social opportunities. Fast casual and fast food foot traffic echo the recent trends seen in our Q3 2022 Consumer Trends Report, which showed increased foot traffic for shopping destinations, cinemas, and entertainment venues. It seems consumers prefer buying—and dining—where they can spend time together.

This is likely why fast casual dining is seeing foot traffic growth while fast food locations are seeing declines or minimal growth YoY. We analyzed foot traffic to McDonald’s and other market leaders in fast food, as well as Chipotle and other market leaders in fast casual dining and analyzed the changes from Q3 2021 to Q3 2022. Our data shows there is one major difference between fast food and fast casual restaurants: consumer foot traffic to fast food establishments has remained stagnant YoY, as folks made their way to more fast casual dining options instead.

Fast Casual vs. Fast Food Foot Traffic

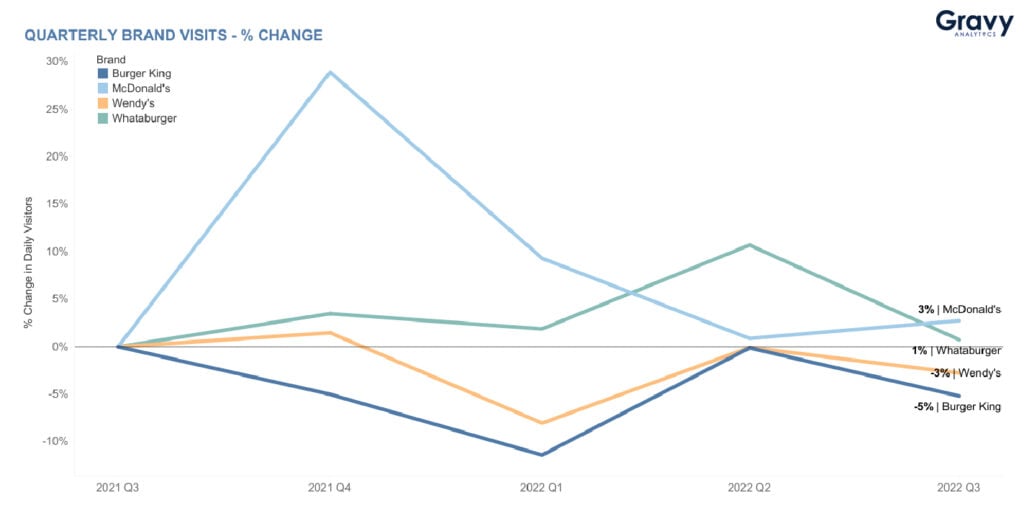

Although McDonald’s saw a major spike in foot traffic in Q4 of last year, the chain saw just a 3% increase in foot traffic in Q3 2022, compared to the same quarter in the year prior. This was the greatest YoY increase we saw out of the fast food brands we analyzed. Whataburger, Wendy’s, and Burger King each showed a 1%, -3%, and -5% YoY change, respectively. On the other hand, our fast casual category told a different story.

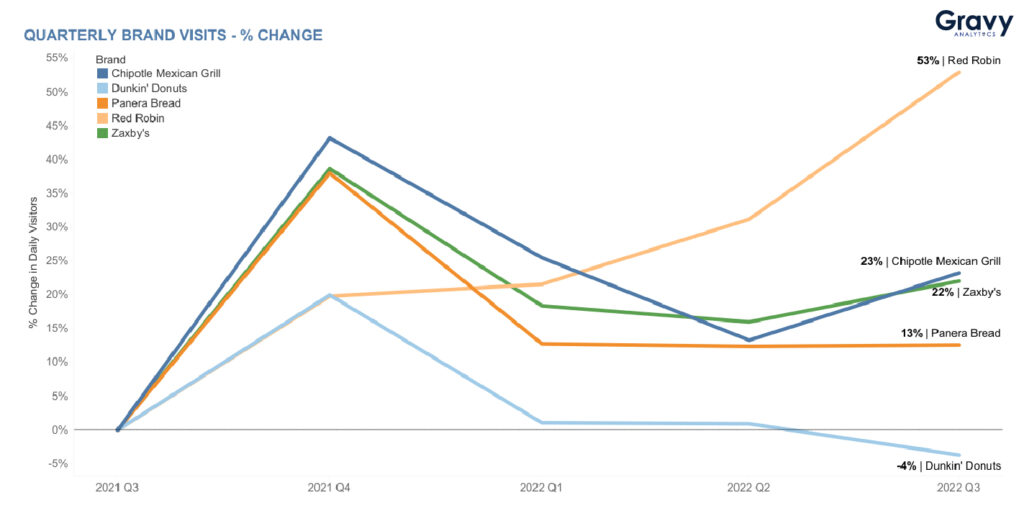

All five of the fast casual chains we looked at experienced spikes in visits during Q4 2021. After a brief downslope, many chains ended Q3 2022 with foot traffic well above the levels each experienced during the same quarter of the previous year. Foot traffic to Chipotle locations increased by 23% YoY, while Panera, Zaxby’s, and Red Robin also saw increases of 13%, 22%, 53%, respectively.

The only exception is Dunkin’ Donuts, which ended Q3 2022 with a negative 4% change compared to 2021. Dunkin’ could be feeling the growing pains that came with their revamped rewards program. This new program disappointed many loyal Dunkin’ customers, likely causing less habitual visits. Nonetheless, the overall trend we’re seeing is a greater increase in consumer visits to fast casual chains than fast food chains.

The Customer Experience

Consumers not only crave interaction, but inflation has increased all year, so folks want value while connecting with each other. This may be why consumers are choosing to stop in at a Chipotle or Red Robin rather than take a quick trip to a drive-through or QSR counter. At Chipotle, and other fast casual locations, you’ll often find more inviting ambiance, healthier menu items, and only slightly higher prices compared to McDonald’s or other fast food locations. These things could seem more favorable for an outing with friends and family, while fast food chains can seem more suitable for a quick, less glamorous, bite. Let’s not forget that during the pandemic, most fast casual restaurants closed their doors to the public. Many were offering only pickup or delivery options atop traditional drive-through options. This could have led to the drive-through fatigue that’s setting in.

Fast casual restaurants often emphasize a memorable customer experience more than fast food restaurants do, which could be their biggest advantage today. After a couple years of social distancing, consumers are back in fast casual restaurant seats and saving the fast food for later, so foot traffic to fast food locations is quickly slipping. But, there could be another factor in play.

Convenience Has a New Face

Fast food was developed with convenience in mind. The quick service of tasty meals at a low price enthralled baby boomers, and consumers’ love of convenience eventually led to drive-throughs as well. Convenience isn’t a thing of the past, although it looks different today than it did when QSR chains first emerged. That same love of convenience has led to a new level of ease: delivery. Online delivery services changed the game by offering familiar fast foods in a consumer’s home or office. Convenience lovers are likely spending less time at a drive-through or fast food lobby, and more time ordering from a distance. For this reason, fast food foot traffic is likely to remain slower than at fast casual chains.

Although McDonald’s may see increased foot traffic during the rest of 2022, we think the other fast food chains we analyzed may remain at a minimal or negative foot traffic change. As the holidays approach, a stronger emphasis will be placed on get-togethers and shopping, which may mean that Chipotle and other fast casual restaurants could continue seeing the foot traffic growth they’ve been seeing all year, something that we think will also continue into 2023.

Connect with one of our experts to learn more about our enterprise location intelligence.