Brand Case Study: Taco Bell vs. Chipotle

November 10, 2020

It’s no secret that 2020 has been a hard year for the restaurant industry. A lot of strategies to bring customers in, like great marketing, for example, were no match for a pandemic that shut the doors of so many businesses. Restaurants who have thrived during the pandemic did so because of innovating and actively embracing a digital footprint in a COVID-19 world. Today, we’re taking a look at two beloved chain restaurants: Chipotle Mexican Grill and Taco Bell. We’re going to analyze our foot traffic data to understand what the numbers can tell us about how they have weathered the storm.

We all remember the little tan chihuahua and his famous tagline “Yo quiero taco bell”. Many of us have driven through late at night for a quick midnight chalupa or those fried cinnamon sticks. Or perhaps, you preferred the fresh taste of Chipotle and their massive burritos and bowls. Their signature guac is the stuff that dreams are made of. Let’s take a look at the foot traffic data for the last few months and see how they compare.

Comparing Taco Bell and Chipotle Foot Traffic

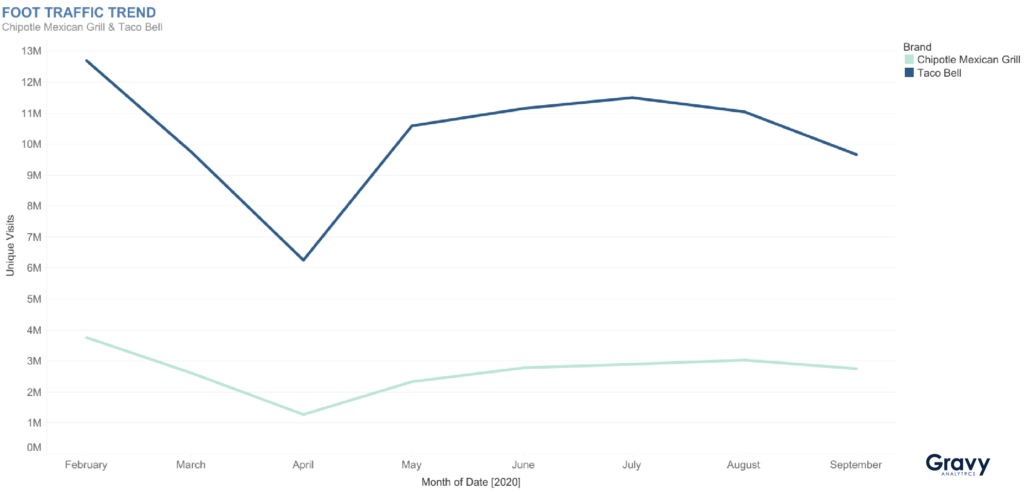

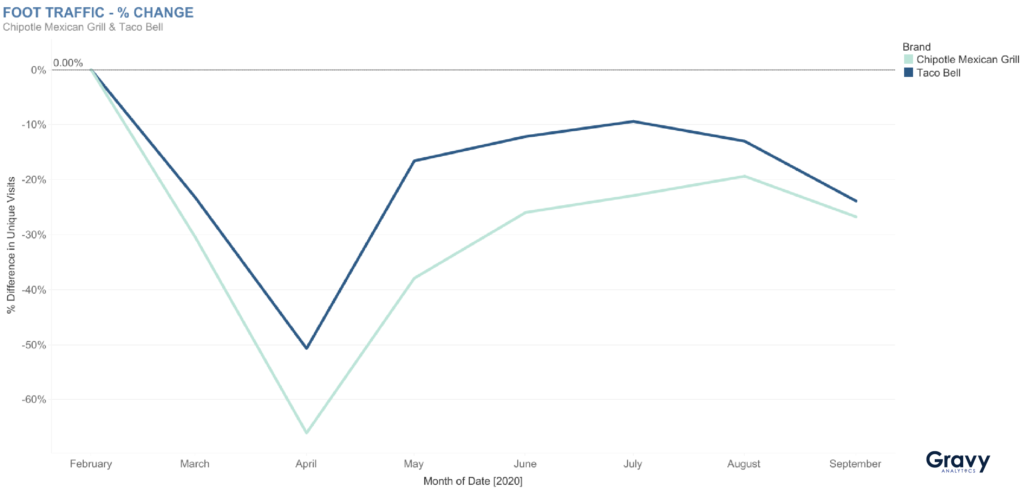

Based on our data comparing foot traffic from February, one thing that is prevalent from the data that we’ve gathered is that Taco Bell has stayed ahead of Chipotle in foot traffic numbers. In April, at the start of the lockdowns, Taco Bell was 51% lower compared to February, and Chipotle was 66% lower. These numbers are expected, but what wasn’t expected was Taco Bell’s lead over Chipotle. Why was Taco Bell ahead, especially when they are considered by some to be less healthy than Chipotle, especially when so many people were taking a closer look at their own health?

There are several reasons for this. Before we get into that, let’s look at the rest of the numbers. As 2020 progressed and restaurants slowly began the reopening process, Taco Bell continued to stay ahead of its competition. Taco Bell’s July foot traffic was 9% lower compared to pre-COVID levels. In contrast, Chipotle’s foot traffic was 23% lower in July compared to February. In September, foot traffic to Chipotle was 27% below pre-pandemic levels while Taco Bell was 24% lower than in February.

Why has Taco Bell Stayed in the Lead?

There are several reasons why Taco Bell is outperforming Chipotle. Let’s first address the simple economic reasons. For one thing, everyone knows that Taco Bell is far less expensive than Chipotle. When so many people have suffered from job losses, furloughs, and general economic instability, that craving for tacos may have driven them to the less expensive option: Taco Bell.

Also to be considered is the simple fact that Taco Bell has a drive-through. This means that instead of having to order from Uber Eats, Grubhub, or DoorDash, people could drive up and order their food. Taco Bell is not only the less expensive option but their drive-through also saves customers on high delivery fees and tips for drivers. Although Chipotle offers healthier and fresher food options, their higher prices, and the lack of a socially distanced order option that doesn’t involve food delivery apps may have cost them in foot traffic.

Foot traffic data tells only part of the story, however: although the pandemic ravaged the restaurant industry, Chipotle has seen a 14.1% increase in revenue and they recently announced that Q3 digital sales have tripled year-over-year. For Chipotle, their digital sales accounted for 48.8% of sales for the quarter. Taco Bell, though they have been ahead in foot traffic numbers, only saw a 5% system sales growth increase for Q3 compared to 2019 data.

Fast-Food Foot Traffic in America

Compared to February, foot traffic to American fast-food restaurants was 51% lower in April. This was expected as this is when the lockdowns really began for us. Ever since May, we have seen a steady recovery in foot traffic for fast-food dining. So far for October, foot traffic is 33% below pre-pandemic levels. What do these numbers tell us?

Although 2020 has been a rough one for so many industries, there’s still hope for recovery. Fast-food dining foot traffic will eventually recover, despite the pandemic, and innovative applications like food delivery services are helping keep the restaurant economy afloat in the meantime. Sometimes, it isn’t always about who is willing to go out and visit their favorite spot, sometimes it’s about how innovative a restaurant can be to help bring the experience to their customers.

For more foot traffic data related to top fast-food brands, visit our Economic Activity dashboard.