Car Dealerships and COVID-19: A Foot Traffic Data Analysis

November 12, 2020

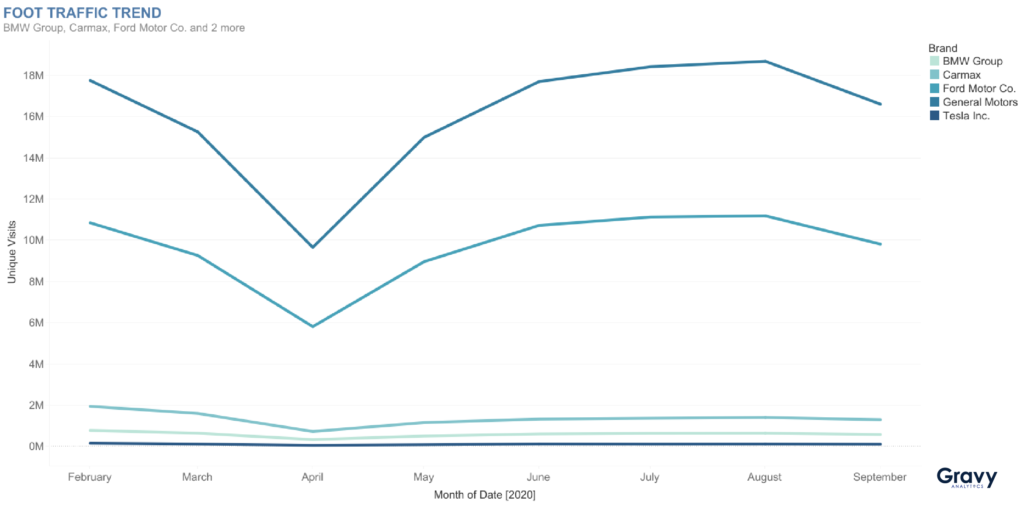

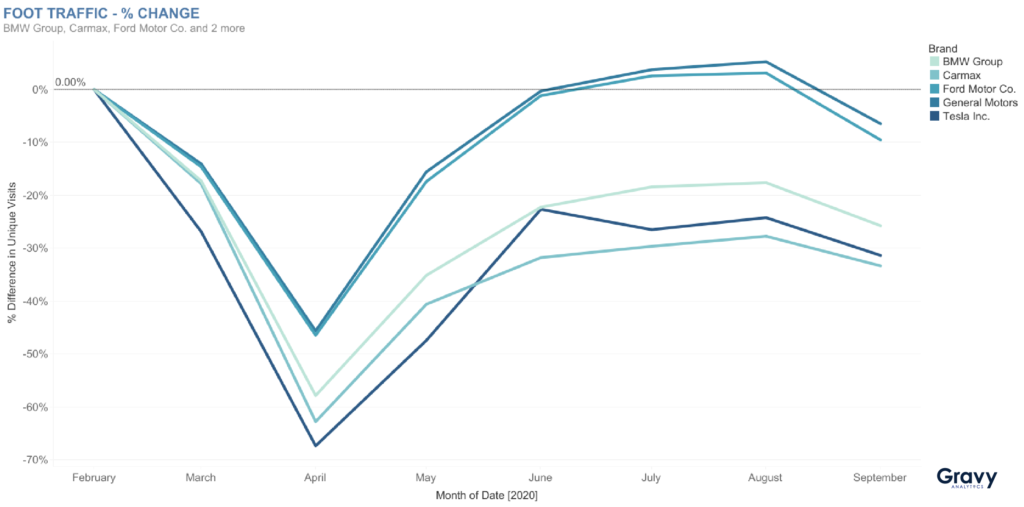

While the auto industry is slowly recovering sales, foot traffic remains below pre-COVID levels. In September, foot traffic to used and new car dealerships was 20% lower compared to February 2020. With more consumers commuting to their living rooms rather than the office, price and convenience are now higher priorities. Consumers probably aren’t as inclined to purchase new cars as in previous years, and are more likely to buy used cars during a recession. While the used car market is getting a boost, new cars aren’t being driven off the lot as often as they did before. We analyzed consumer foot traffic to five major car dealerships to gauge the demand for new and used cars in post-COVID economy.

A Summer Boost in Foot Traffic

Overall, foot traffic to dealerships began to decline in March, and reached its lowest point in April. Although many car dealerships were declared essential businesses during COVID-19 lockdowns, consumers weren’t prioritizing car shopping. Throughout the late spring and summer, foot traffic began to increase, but it started to slightly decline again in September. This summer boost in foot traffic might be due to consumers, who want to avoid taking public transportation due to the risk of COVID-19, deciding to find their ideal car before a change in weather.

General Motors and Ford Emerge Ahead

General Motors and Ford are recovering faster than CarMax, Tesla, and BMW. In September, foot traffic to Ford and GM was 6% and 10%, respectively, lower than pre-COVID levels. Both Ford and GM sell a wide range of cars, and this balance might have helped them continue to drive in consumer foot traffic. BMW outperformed Tesla; the German luxury car company saw 26% lower foot traffic in September while Tesla was 31% lower, compared to February. Consumers might not be too interested in luxury cars at the moment due to cost.

CarMax didn’t perform as well as the other auto brands; foot traffic was 33% below pre-pandemic levels. CarMax sells used cars, but it also has a significant online presence along with car delivery and curbside pickup. With convenience emerging as a top priority for consumers, CarMax’s focus on delivery might have reduced its car dealership foot traffic.

Car Dealerships in a Post-COVID World

The car buying experience is only going to continue to evolve towards a more digital experience in the wake of the COVID-19 pandemic. Both new and used car dealerships are going to need to make sure that they keep up with new and innovative competition, such as Carvana and Shift Technologies, by undergoing further digital transformation. As car dealerships prepare for the holiday season and begin marketing campaigns for their new models, they’ll need to focus on convenience and customer safety.