Coffee Trends: Starbucks, Dunkin’, Peet’s Coffee, and Mom-and-Pop Coffee Shops

March 16, 2021

Did you know that 70% of seniors need a cup of joe to get going in the morning? Along with this, nearly half of 18-24 years get their caffeine kick from coffee, too. With these averages, it’s safe to say that coffee is the preferred caffeinated beverage of choice in the United States. Ask any American what their brand of choice is and you’re likely to get the same response across the board: Dunkin’, Starbucks, Peet’s Coffee, or non-chain coffee shops.

No matter what the preference may be, there’s no denying that a high percentage of Americans can’t start their day with their favorite brew. Because of this, we’ve decided to conduct an analysis of how our favorite coffee brands fared in 2020 and into February 2021. In this piece, we’ll be looking at regional visits, weekday vs. weekend visits, and daily trends. Keep reading to find out who came out on top.

A Classic Coffee Pairing Thrives

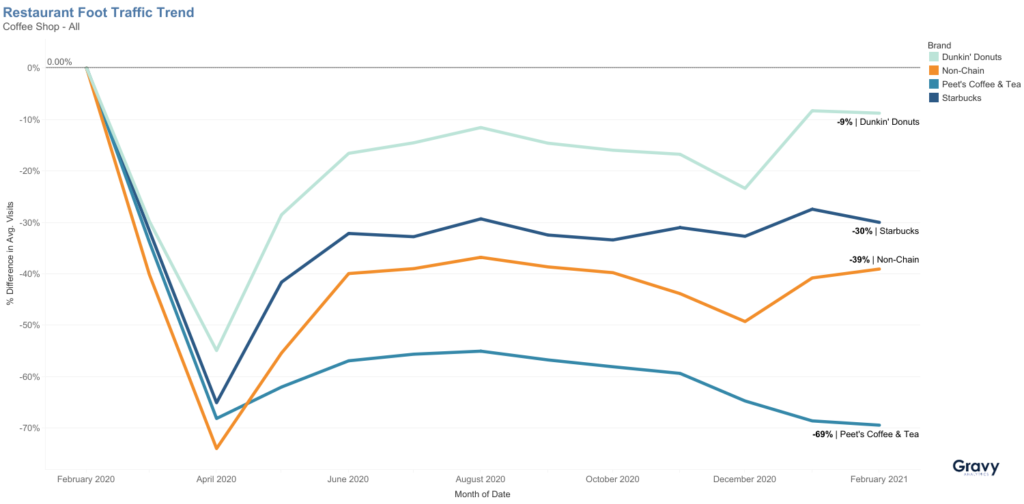

Although all Dunkin’, Peet’s, Starbucks, and non-chain coffee shops all saw an expected decrease in foot traffic in April, late spring and summer are when things got really interesting. The first thing that is immediately prevalent is that non-chain coffee shops saw the most dramatic impact in April 2020, but recovered sharply once summer arrived. Seattle-based chain Starbucks was both less impacted initially and recovered more of its foot traffic more quickly.

Dunkin’ saw the least impact on foot traffic when compared with the other three; as of February 2021, visits were down just -4% from pre-COVID levels. Peet’s was the most impacted by and continues to struggle to regain its foot traffic. During the April lockdowns, most of its coffee shops were closed, and while one would think that more of the shops would see foot traffic return after lockdowns were lifted, the data says otherwise.

Foot traffic to coffee shops remained lower than pre-COVID throughout the rest of the year. Both Dunkin’ and non-chain coffee shops saw dips in December that took them to their lowest daily foot traffic numbers since the pandemic began. Starbucks was the exception, suggesting that they benefit from customers doing a bit of holiday shopping in stores.

Coffee Trends by Region

Midwesterners Love Dunkin’

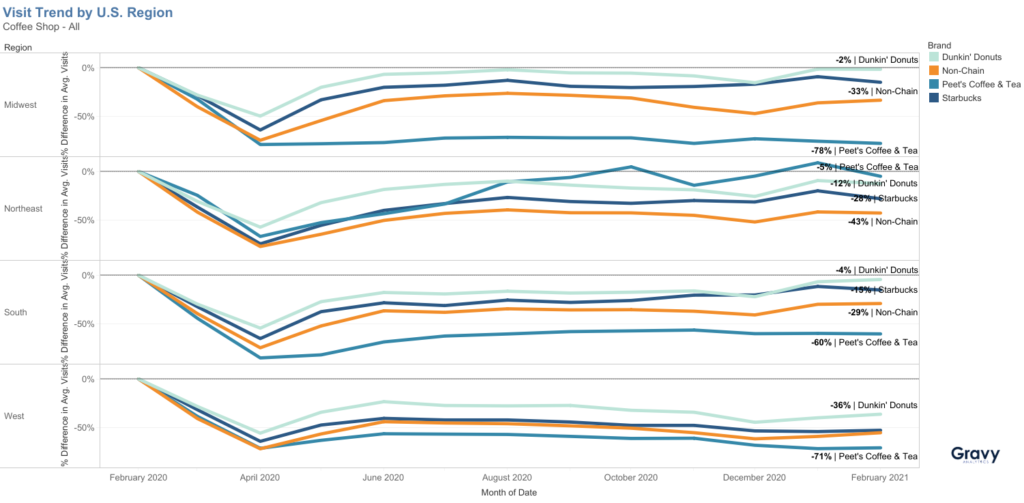

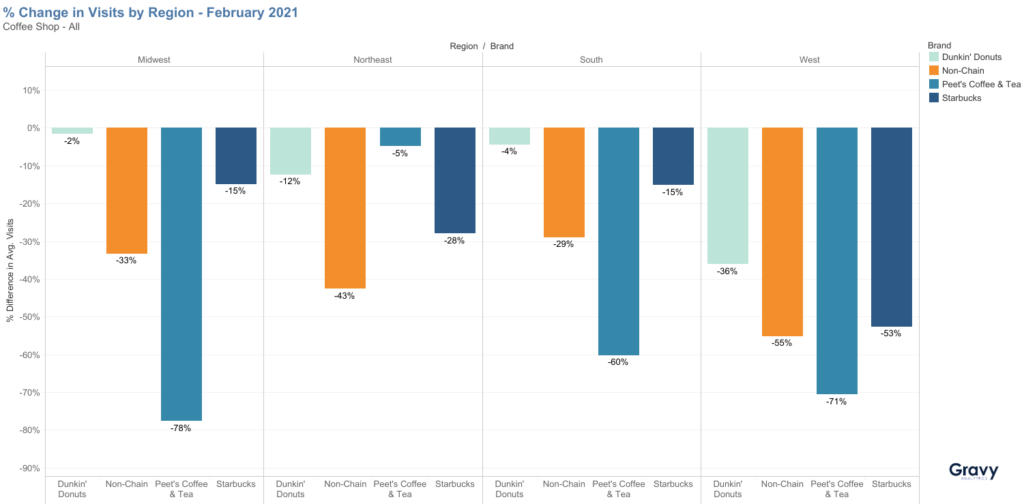

If we take a closer look at how coffee shops fared in the Midwest, one thing is immediately obvious: Midwesterners love their donuts. In the Midwest, Dunkin’s foot traffic was just -2% lower in February 2021 compared to pre-COVID. Non-chain coffee shops also seem to be recovering in the Midwest; foot traffic to non-chains was -33% lower compared to pre-COVID levels. three.

Northeasterners Prefer Peets

Unlike folks in the Midwest, Northeasterners seem to love their Peet’s coffee. Foot traffic was only -5% lower year-over-year, while Massachusetts-based Dunkin’ came in just a bit below at -12%. Starbucks, surprisingly, came in second to last at -28%. Non-chain coffee shops didn’t fare well at all in the Northeast.

The South Loves Dunkin’

In the South, Dunkin’ was again ahead of the curve, with foot traffic only -4% lower. Starbucks came in at second place while foot traffic to Peet’s as of February 2021 was -60%. There are several reasons for this that we’ll explore later in this piece: things like location, dining restrictions, and revenue.

The West Loves Dunkin’, Too

Considering that Peet’s was founded in San Francisco, it’s a bit of a shock to see that foot traffic was still -71% in February 2021. Starbucks and non-chain retailers were nearly “tied” in February, and Dunkin’ Donuts was the foot traffic champion in the West. Foot traffic to Dunkin’ stores was -36% compared to pre-pandemic levels.

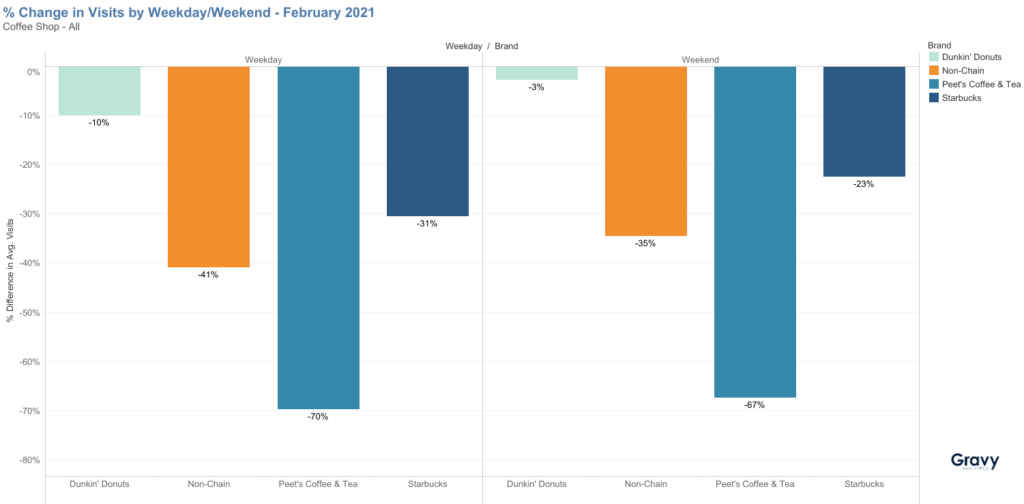

Weekday Remote Workers or Weekend Coffee Cravings?

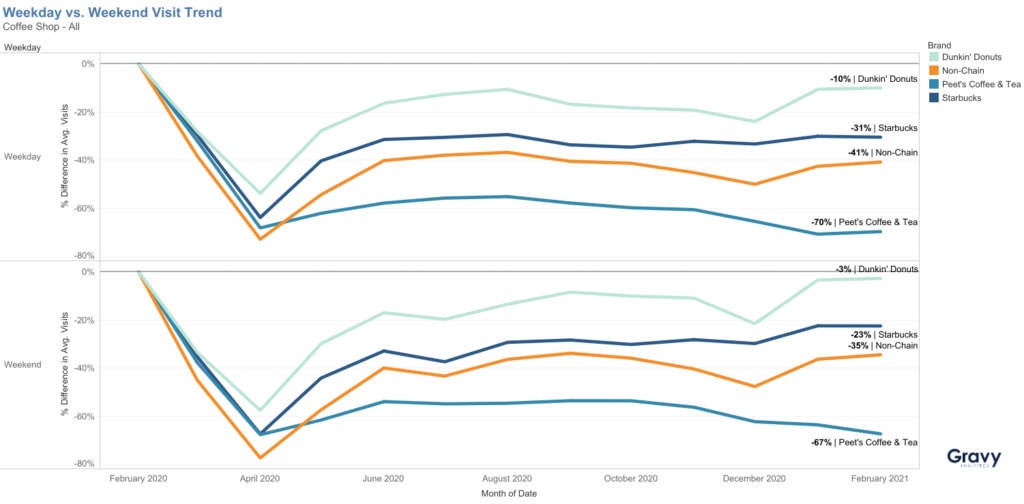

We all have that image in our minds: the remote worker packing up their laptops and heading to a local coffee shop to get some work done with the ambient sounds of coffee machines and clinking mugs. As we all know, that wasn’t the case in 2020 because of COVID-19. So the fact that weekday foot traffic dropped to a greater degree doesn’t come as much of a surprise, especially when so many Americans are working remotely with children (who are also learning remotely) and not easily mobile.

The weekend was the sweet(er) spot for our coffee goers, with better foot traffic numbers at all 4 brands across the board. Consumers flocked to Dunkin’ on the weekend, in particular, for their coffee and donut fix.

What’s the Verdict on Coffee Shops?

There are a lot of factors to consider when conducting foot traffic analysis. On the surface, it may seem like the brand that has recovered the most foot traffic wins the coffee war, but thinking about things like retail locations and revenue can make a huge difference.

For example, Peet’s has recovered much less foot traffic but this could be due to the regional locations of its 200 retail stores in the United States. Compared to Starbucks’ 8,791 brick-and-mortar locations and Dunkin’s 8,500, Peet’s is tiny. Peet’s also primarily sells its coffee in grocery stores versus physical locations.

Starbucks is interesting one because it is a mainstay in the United States. How did Dunkin’ Donuts win back more of its foot traffic? While Starbucks has a plethora of storefront locations, many people likely opted for shopping for their coffee online or in grocery stores instead of waiting in long pickup lines. Starbucks also closed their lobbies completely, making customers order via their mobile app and pick up at the front door. This posed a challenge for folks who either don’t understand how to use the mobile app or didn’t want to download it at all.

Dunkin’ might have recovered more of its foot traffic because coffee isn’t their only specialty. You can’t buy Dunkin’s fresh chocolate munchkins in grocery stores, whereas Peet’s coffee and Starbucks beans are easily available. Donuts are something that most people want to buy fresh and hot, so customers are more likely to hop in their cars to get their donuts and coffee in person (or even via the drive-through).

As for non-chain coffee shops, here is another one whose coffee can’t easily be bought in-store, at big chains, or online. For small mom-and-pop shops, the appeal is in the experience. There are also plenty of consumers out there who prefer to put their hard-earned dollars into local shops instead of big chains. Unfortunately, it’s the mom-and-pop coffee shops that have been the hardest hit.

We have a question for you: if we would have asked you who would come out on top before reading this report, would you have said Starbucks? Let us know what you think on social media.

For more information on how location intelligence can help your business understand consumer behavior, contact us to speak with an expert today.