Consumer Insights Series: Automotive Retail Trends

April 21, 2021

According to Cox Automotive’s Q1 webcast, the overall automotive economy was up 5.0% year-over-year in Q1. The automotive industry is looking up, especially considering that Americans are spending a little bit more on new vehicles. This upturn in automotive sales is reason for hope that the industry is moving into a prosperous 2021.

What about auto repair shops? As many U.S. consumers are purchasing newer vehicles, they will need to be able to keep up with car maintenance. We analyzed consumer foot traffic numbers for four of America’s favorite auto retail shops: AutoZone, O’Reilly Auto Parts, NAPA Auto Parts, and non-chain shops to see who fared best in Q1 2021.

Big Competition: AutoZone and Mom-and-Pop Auto Stores

For a lot of us, visiting these shops means that something is already wrong with the cars that we have, but for others, it’s an exciting shopping trip to level up their cars.

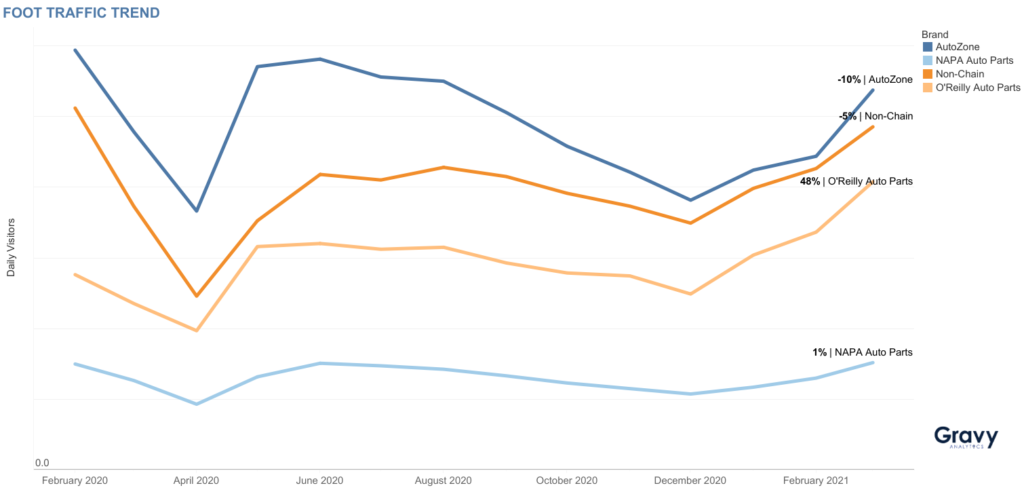

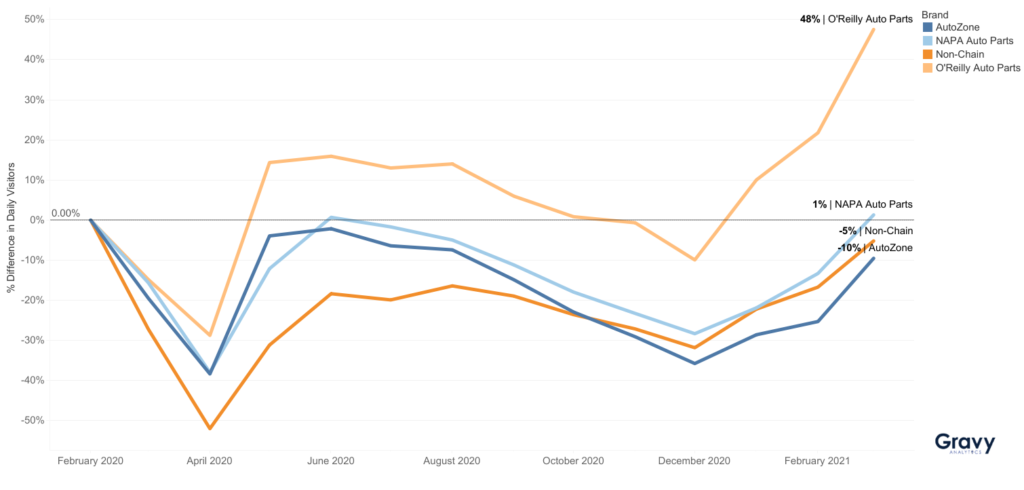

Before we talk about Q1 2021 trends, we have to understand where auto repair and parts stores started. Foot traffic to all auto stores dropped dramatically in April 2020, but largely recovered in May and June. During Fall 2020, auto repair stores saw foot traffic taper off, with December 2020 a low point in terms of consumer visits. In Q1 2021, foot traffic increased across the board; AutoZone and mom-and-pop auto shops received more foot traffic in total than O’Reilly Auto Parts and NAPA Auto Parts.

O’Reilly Auto Parts, however, has recovered far more of its foot traffic than others in the category; in March 2021 its foot traffic was 48% higher than pre-pandemic. In comparison, foot traffic at NAPA Auto Parts (+1% as of March 2021) has returned to normal. O’Reilly’s and NAPA’s rates of recovery tells us that they have managed to pivot their strategies and that their changes seem to be working well. While AutoZone and mom-and-pop auto stores also saw strong consumer visits in Q1, they haven’t recovered foot traffic as quickly as either O’Reilly or NAPA.

Moving Forward: Taking a Page from O’Reilly’s Book

O’Reilly Auto Parts has a total of 5,460 shops in the United States, AutoZone comes in with 6,003, NAPA Auto Parts has 6,000, and there isn’t any definitive number for how many non-chain shops there are in the United States. The playing field here is fairly even, so what exactly did O’Reilly Auto Parts do to recover its foot traffic so quickly, and why is AutoZone lagging behind?

O’Reilly offers free curbside pickup as well as compelling promotions like a free gift card with specific purchases. O’Reilly has also done an impressive job at modifying its in-store experience to ensure that their customers feel safe when visiting. In addition, O’Reilly offers curbside pickup of online orders – appealing to those customers who urgently need an item but can’t wait for shipping and are uncomfortable shopping in-store. This pivot to accommodate and improve the customer experience for in-store shoppers has most certainly contributed to its fast recovery.

Although AutoZone has the most store locations and the most total foot traffic, its recovery has been slower. Its competitive rewards program may no longer be enough to keep its customers coming back.

Shops in this category should take a page out of O’Reilly’s book for Q2 by examining the customer experience and what is being done to retain (and attract) new customers. Given recent consumer trends in auto retail, we predict that things are starting to look up for all facets of the auto industry. For more information on how you can use consumer foot traffic to understand economic and consumer trends, contact us to speak with an expert today.