Consumer Insights Series: Beauty Retail Trends

May 24, 2021

The beauty industry is the chimera of retail. While the retail industry as a whole has seen a sharp decline in foot traffic over the past few years, due to Amazon and eCommerce, the retail beauty industry has barely been affected. When it comes to beauty products and makeup, people still prefer to shop in-store over online.

Sephora has been at the top of the beauty store chain game since the 90s. You couldn’t visit a shopping mall without seeing that signature black and white bag that smelled like a million perfumes in one. Many partners sat by the food court while their significant other popped in to “just buy a new shampoo”. Needless to say, when one thinks of beauty, one usually thinks Sephora.

While Sephora may be the grand dame of the chain beauty industry, mom-and-pop beauty stores have been around, well, since the beginning of time. While we won’t get into the history of beauty stores here, we will talk about how one of the industry’s top beauty chains fared against mom-and-pop beauty stores around the U.S. during COVID-19.

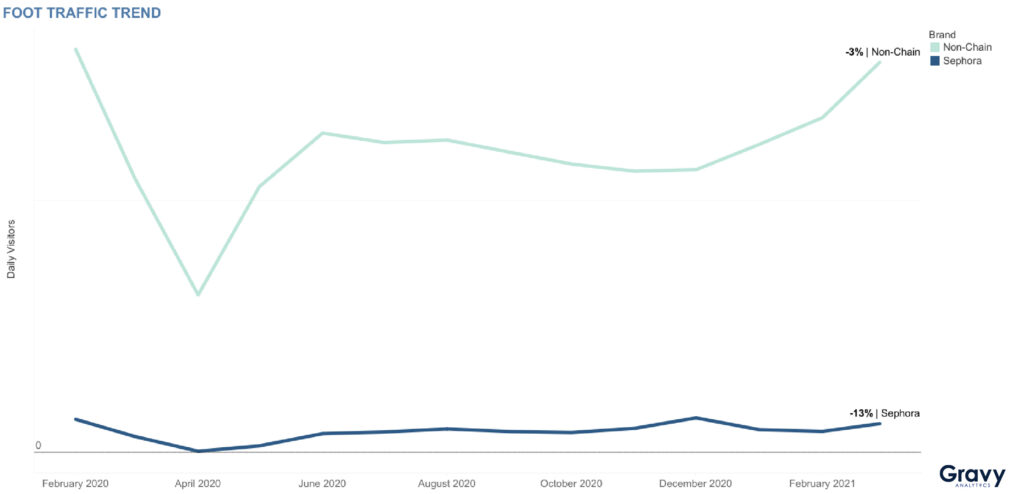

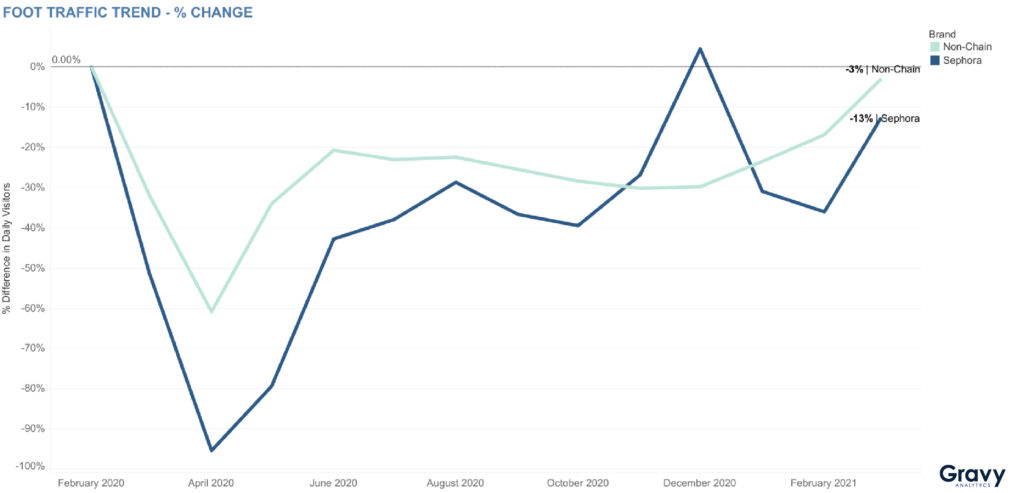

To understand how the beauty industry is doing in the wake of the pandemic, we analyzed foot traffic data at Sephora and mom-and-pop beauty store locations from February 2020 until March 2021.

Mom-and-Pop Beauty Stores: Leading the Way

Though both saw obvious changes in foot traffic numbers at the onset of the pandemic, Sephora has yet to bounce back the way that mom-and-pop beauty shops have. Both Sephora and non-chains saw foot traffic decrease significantly in April 2020, and both recovered foot traffic throughout the summer of 2020. However, as the fall approached, foot traffic declined again. It’s not surprising to see that foot traffic for both went back up during December 2020. Foot traffic to mom-and-pop beauty stores continued to increase into 2021, but not at Sephora. Why have mom-and-pop beauty stores recovered more foot traffic than Sephora?

Let’s take a closer look.

Non-Chain Beauty Stores Ahead of Sephora in Q1 Recovery

Both mom-and-pop chains and Sephora recovered foot traffic, but only non-chains have recovered fully. Where foot traffic to Sephora was 13% lower in March 2021, non-chain beauty stores were only 3% lower, compared to pre-pandemic levels. It does seem that consumers preferred to shop at Sephora for their holiday shopping needs over non-chain shops, however.

While Sephora remains a giant in the beauty retail industry, it’s obvious that mom-and-pop beauty shops now have the advantage. There may be several reasons for this, but the most likely is that consumers don’t value the high-end luxury brands—at least not as much—as in years’ past. Now, consumers are more interested in niche, natural, and affordable beauty products that aren’t as likely to be on Sephora’s shelves.

Social media may have a lot to do with this trend. The products that many beauty gurus on YouTube and TikTok recommend are more often than not niche brands and products like Morphe or Glossier, and international brands like the Korean skincare craze. While Sephora may hold the upper hand among holiday shoppers, those folks are likely buying for someone else—which is why they would purchase luxury brand items and gift sets from Sephora over, say, a shampoo conditioner bar combo made from organic ingredients.

How Can Sephora Catch Up to Mom-and-Pop Beauty Stores?

It is surprising that non-chain beauty shops were able to recapture as much foot traffic as they have, so let’s get into the possible reasons why they might be ahead. Sephora is known to sell luxury beauty brands and therefore, shopping there guarantees a higher price tag. In a time where there was (and still is) so much economic uncertainty, many consumers may have decided to shop on a smaller scale. In addition to this, non-chain beauty stores tend to be much smaller and located in outdoor strip malls, so it’s possible that consumers chose less hubbub over hovering beauty gurus, touch-screen foundation matchers, and the traditional indoor shopping experience.

No matter the reason, it’s safe to say that non-chain beauty stores are faring better with today’s consumers. We predict that, despite the pandemic’s impact on foot traffic numbers, Sephora isn’t going anywhere and will continue to be a worthy opponent for beauty brands in the future.

Curious about how to get consumer insights for your industry? We’ve got you covered. For more information on how to use location intelligence, contact us today.