Consumer Insights Series: Target, Walmart, and Costco

March 17, 2021

There’s no denying that Americans love to shop. Even when malls were closed (ahem, 2020), the shopping cart aficionados got their fix online. When online shopping just wasn’t cutting it, many of us relied on the three pinnacles of American consumerism: Walmart, Costco, and Target.

Who hasn’t seen the TikTok and Instagram memes about someone going to Target for “one thing!” and walking out with a shopping cart full of bags? We’ve all been there. Or maybe you needed something in a pinch and drove to Walmart late at night to get it? Perhaps you rushed to your nearest Costco during “Toilet Paper Gate” to buy your own stockpile? There’s a reason why these three are America’s favorite retailers. Let’s see who had the most success in bringing customers back to their doors.

Big Retail in 2020

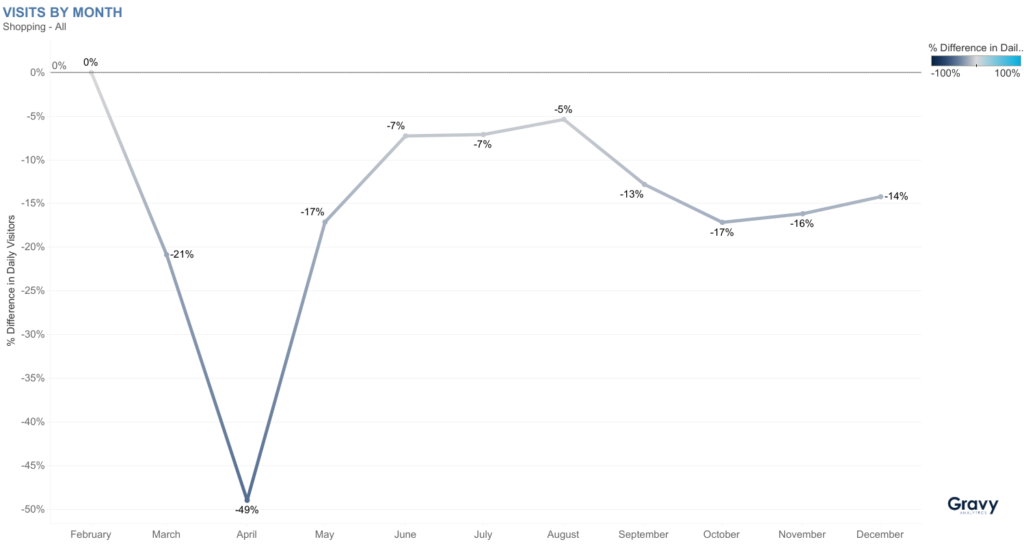

Target, Costco, and Walmart all have reputations for good customer experiences and great prices. During a time of both social and economic unrest, it isn’t surprising that many people braved the outdoors to visit places that not only brought them joy but also saved them money. In addition, the variety of goods that they sell is a huge draw for shoppers; all three retailers are a one-stop-shop for any of your lockdown needs. For these reasons all three brands outperformed the shopping category, on average.

A Tale of Three Big Retailers

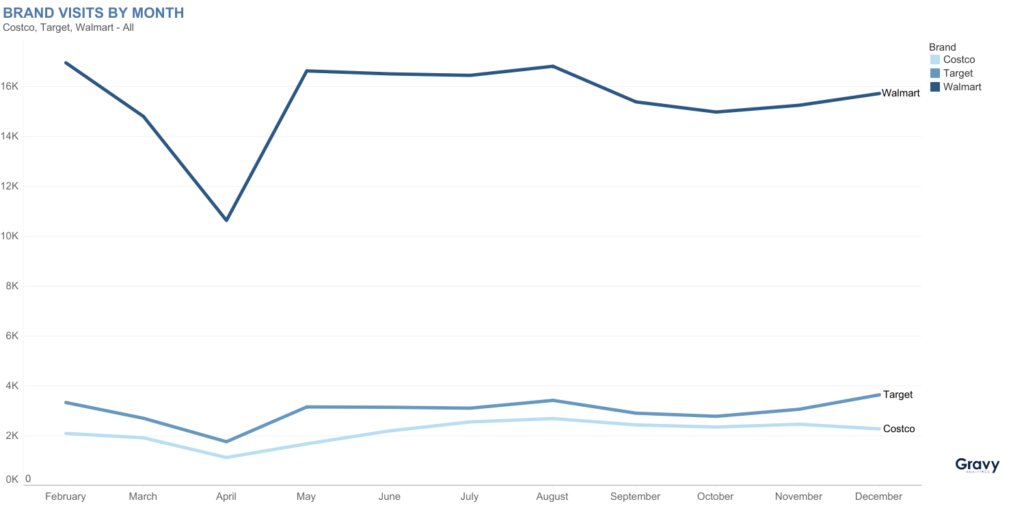

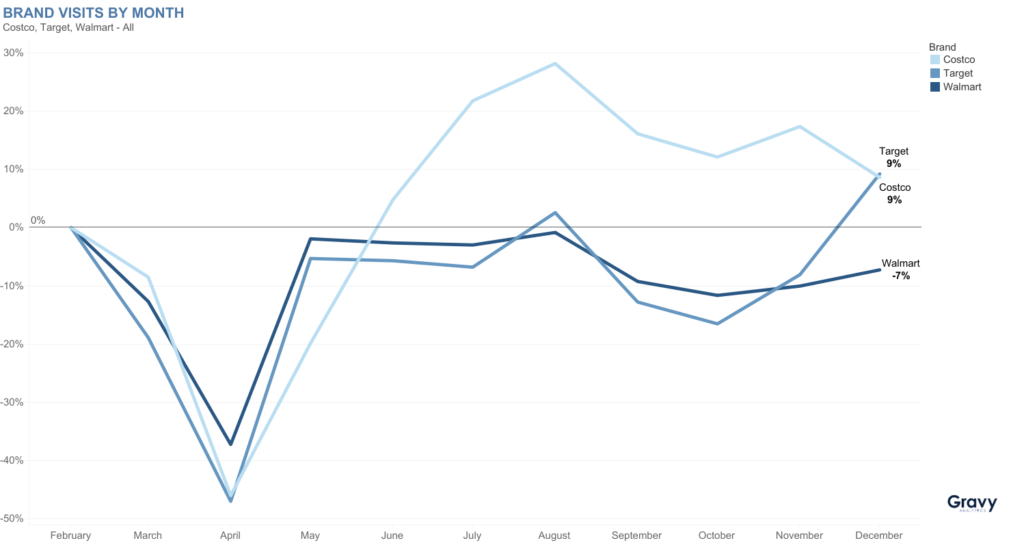

If there’s anything that we can pick up about these three, it’s that Walmart retained more of its foot traffic, generally speaking, after the onset of the pandemic. Generally, Walmart’s footfall was more stable than Costco and Target, and they continue to have larger foot-traffic numbers than Target and Costco in terms of overall visits. However, they also saw the least amount of recovery amongst the three.

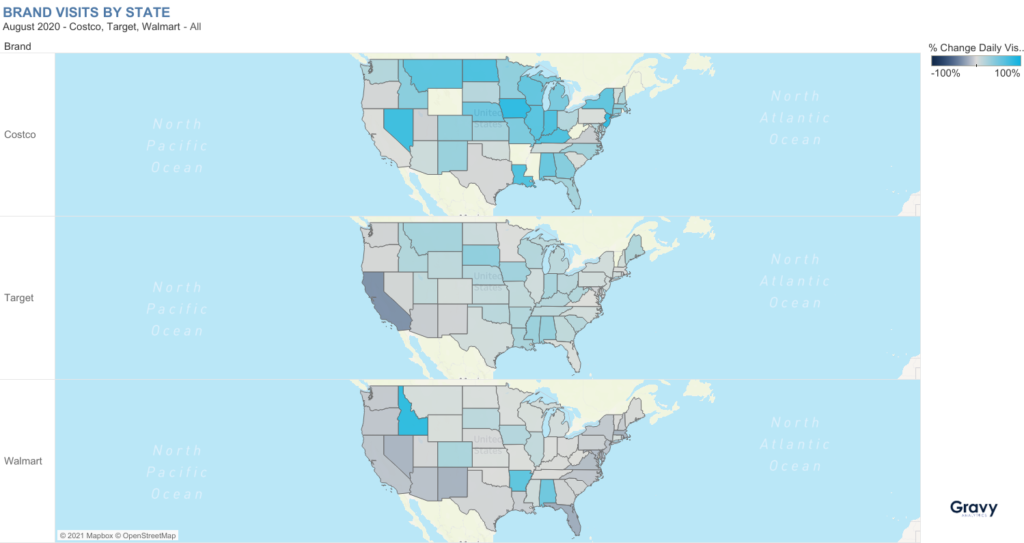

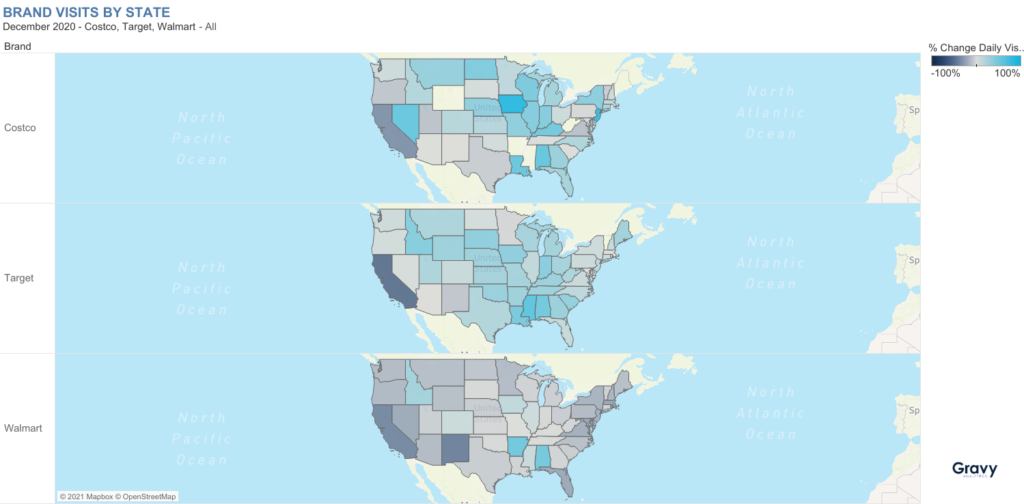

While Walmart held the first-place trophy for retail footfall, Costco took the lead in terms of recovery. An interesting thing to note is that when viewing our foot traffic data for only big-box stores, Target and Walmart led the category for almost all of 2020. Target and Costco both saw foot traffic recover more strongly in the Midwest and South compared to Walmart. Spikes in Target traffic in August and December suggest that the Minneapolis-based retailer does back-to-school and holiday shopping better than Walmart does, and Costco’s high point in November is likely Thanksgiving-related. Costco’s lead in the summer months could be because that’s when consumers are buying in bulk for camping trips and vacations.

2021 Predictions

In 2021, things are going to look very different for these stores. We think that Target and Costco will continue to see an upward trend. Costco, because of its bulk buying options, and Target, because of its curbside pickup options, provide a shopping experience that is casual, bright, and effortless. While Target and Walmart hopped on the curbside pickup option fairly early, Costco has only just started offering it. This definitely gave Walmart and Target a headstart on providing a good contactless shopping experience and likely increased footfall to their retail stores as well.

Another thing that is important to note here is the disparity between the summer months and the holiday season. All three brands would do well to dial back on holiday advertising and focus more on marketing and advertising during the summer months. At first glance, this might sound counterproductive, however, this makes more sense when we consider that December didn’t perform as well for shopping.

Walmart will more than likely continue to recover in-store visits faster than Target and Costco. To keep up with their competition especially in the Midwest and South, they should analyze real-world data like location intelligence to build out more accurate personas and build ad campaigns to reach those target audiences.