COVID-19 and Pet Retail: PetCo, PetSmart, and Banfield Pet Hospital

November 17, 2020

Foot traffic in 2020 has been just as unpredictable as the virus that sent us all into lockdown. Datasets from this year are unlike any we’ve seen before. We know that the most affected industries were travel and hospitality, and we’ve talked extensively about how the pandemic has affected retail and restaurant foot traffic. But, what about our furry friends?

Considering that pets are more than just man’s best friend — they are an integral part of the family unit for most –, it’s fascinating to explore how COVID-19 has affected foot traffic at both pet stores and pet services. To determine how the pet industry is performing, we analyzed foot traffic data for pet retail stores and pet services locations, including Petco, PetSmart, and Banfield Animal Hospital, and explored the reasons why one area is recovering faster than the other.

The State of Pet Retail Stores and Pet Service Businesses

Are Pet Service Businesses Recovering Foot Traffic?

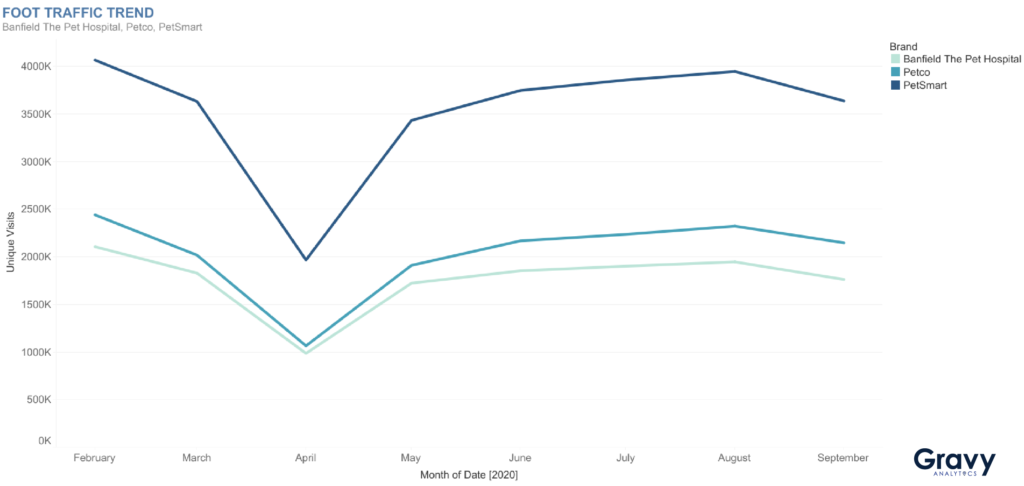

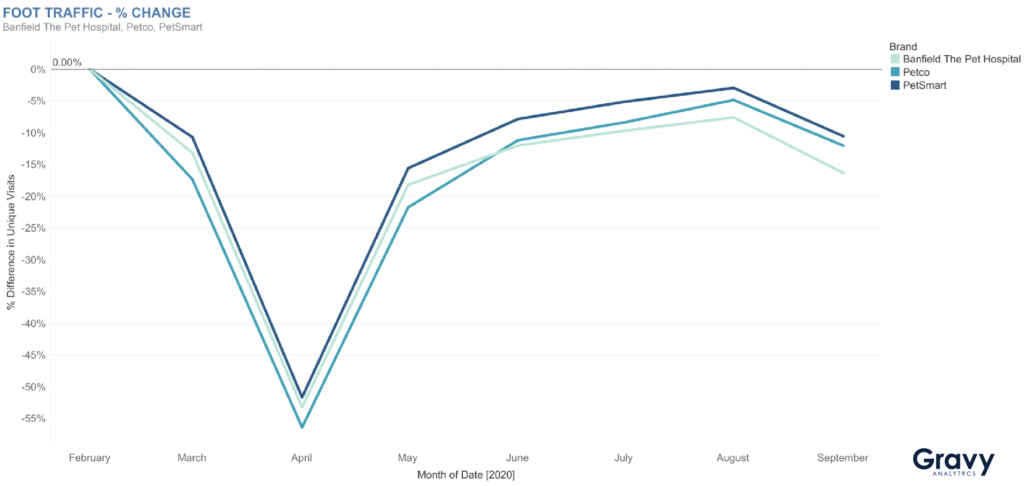

Pet services started to see a shift in their foot traffic in March due to store closures. April’s foot traffic to pet service businesses was 54% lower compared to February. As we moved into May, foot traffic began to gradually recover but remained 30% below pre-COVID levels. This gradual recovery of foot traffic continued in June, July, and August. As we entered the fall season, foot traffic declined again in September to 13% below pre-COVID levels.

Brand Study: Banfield Pet Hospital

For a closer look at how pet services are recovering, let’s take a look at Banfield Pet Hospital. As expected, Banfield saw a decline in foot traffic when the coronavirus lockdowns were enforced in April; foot traffic was 53% lower than it had been in February. As spring turned into summer, and the COVID-19 restrictions began to loosen, we see that June’s foot traffic was 12% lower than February’s foot traffic data.

In July and August, Banfield continued to see a gradual recovery in foot traffic. In August, foot traffic was just 7% lower when compared to pre-COVID lockdown levels. To make things even more interesting, foot traffic dipped again in September. Perhaps the most recent change in foot traffic was due to warnings that another COVID-19 spike was imminent, or maybe it was because fall marks the end of flea and tick season in the United States.

Are Pet Retail Stores Recovering Foot Traffic?

Much like the entire retail arena, pet stores suffered during the lockdowns in March and April. Foot traffic to pet stores in April was 57% lower compared to February. Like pet services businesses, pet stores saw a gradual foot traffic recovery in the summer months, but traffic still remained below pre-COVID levels. In September, foot traffic was 23% lower than in February.

Brand Study: Petco and PetSmart

Even more interesting is the side-by-side comparison of Petco and PetSmart, both well-known pet stores. Comparing data to pre-COVID February numbers, PetSmart saw a faster rate of recovery post lockdown than Petco. For example, Petco’s foot traffic in June was 11% lower while PetSmart’s numbers were 7% lower than its February foot traffic numbers.

There could be several reasons for this difference in foot traffic: PetSmart may be more competitive with their pricing and curbside pickup options, or perhaps Petco simply has better delivery options so that people order delivery instead of having to visit the brick-and-mortar shop. “I happened to see that Petco delivers pet food and that it’s always in stock…it comes in every month and I never have to worry about it!” This positive review, written on November, 12th 2020 by a loyal Petco shopper on Best Company, reflects Petco’s investment in delivery.

Why Are Pet Services Recovering Faster?

While foot traffic to pet stores and pet service businesses generally move in tandem, pet services did recover faster than pet stores once the lockdown was lifted. Why is this the case?

Well, we can’t Amazon Prime veterinary care or grooming services. Once lockdowns were lifted, more people took advantage of the relaxed guidelines to have their pets groomed, or to take them in for an annual check-up or vaccinations.

Pet stores, like the rest of the retail industry, recovered slower because most pet necessities like food and toys, potty-pads, and treats could be found online. Most people didn’t want to walk into a retail location when they could guarantee their safety and order the pet items they needed online, without risking exposure to other shoppers who might not have been as careful.

Navigate Business Challenges with Location Intelligence

As the world navigates the uncertainty of an ever-changing 2020, location intelligence can give business owners the real-time foot-traffic data they need and answers to pressing questions like: “How has COVID-19 affected my business?”, “What can I do to target the right people at the right time?”, “How are my competitors faring compared to me, and what can I do to improve?”

If you’re interested in learning more about what the foot traffic numbers look like for your industry, check out our economic activity dashboard here.