How COVID-19 and Social Distancing Changed Foot Traffic at Top Retail Brands

April 10, 2020

Almost overnight, social distancing has changed how U.S. consumers shop. Across the country, foot traffic to shopping destinations, in general, declined by 36% by March 25. And yet, some consumers are waiting in long lines to enter stores, while others continue on in pursuit of baking supplies and toilet paper. Even during a pandemic, consumers are still shopping.

Gravy chose a selection of top retailers in key shopping categories – Wholesale, Big Box, Home Improvement, and Pharmacy – to explore how each has been impacted by COVID-19 and associated changes in consumer behavior. To do so, we compared average daily foot traffic for each retail brand during the month of March, with average same day-of-week foot traffic for the brand during the month of February.

Which retail brands experienced the most disruption to store foot traffic due to COVID-19? Which experienced the least? Were there any bright spots to be found in retail, and if so, where?

Here is what we discovered about foot traffic at top retail brands:

Foot Traffic at Pharmacy Brands

Pharmacies, like Food stores, provide essential goods and services. Daily device visits at pharmacy brands CVS and Walgreens followed a nearly identical pattern. Foot traffic at both peaked on March 13, before declining over the rest of the month. Note that foot traffic declines at both have slowed since March 21.

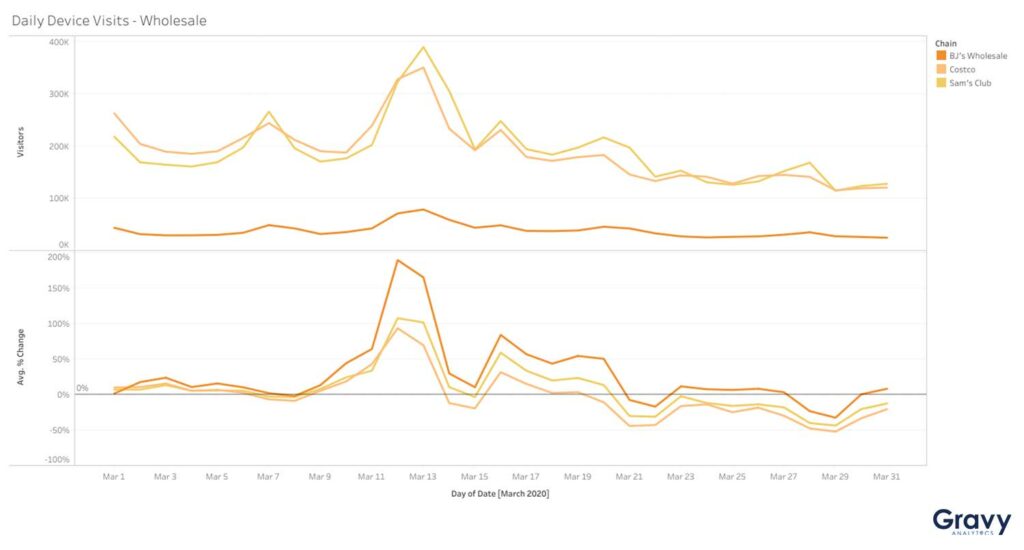

Foot Traffic at Wholesale Brands

Wholesalers, like Costco and Sam’s Club, experienced a significant spike in traffic on March 12 – a Black Friday of sorts for retailers in this category. At its peak, daily device visits at BJ’s Wholesale Club were 190% higher than average. While visitors have since declined, the category continues to outperform most others – suggesting that consumers, when they do venture out to shop, prefer to buy in bulk at a good price.

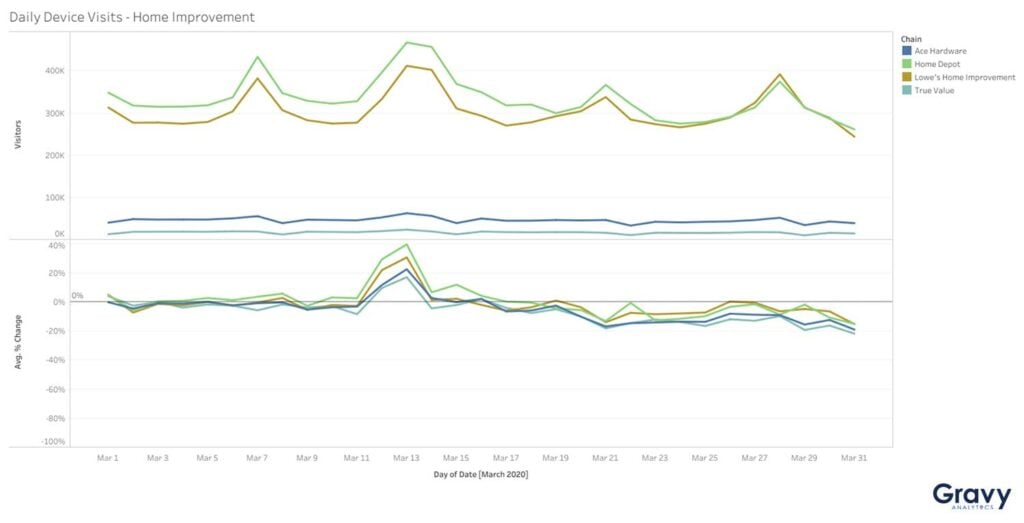

Foot Traffic at Home Improvement Stores

Compared with other retail categories, foot traffic at Home Improvement brands remained comparatively unchanged. Note that large-store home improvement retailers, like Home Depot and Lowe’s, fared somewhat better than retailers with a smaller store footprint, such as Ace Hardware and True Value.

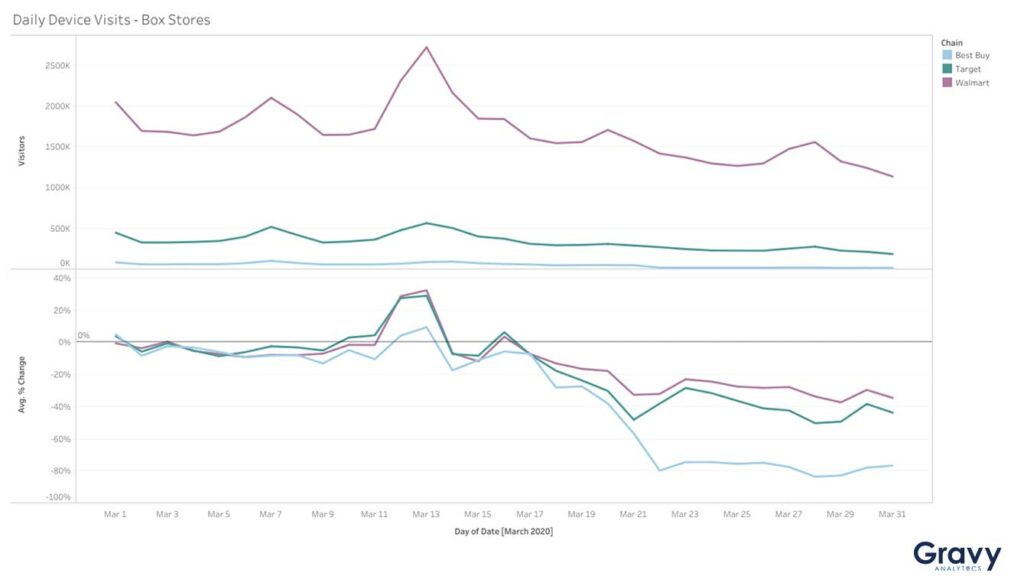

Foot Traffic at Big Box Brands

Big Box stores were a mixed bag. Walmart and Target, which tend to sell products at lower prices, benefitted from bigger boosts in foot traffic on March 12 and 13, and saw more subdued declines in foot traffic. Best Buy, with its focus on home entertainment and electronics, saw its foot traffic fall precipitously starting March 17.

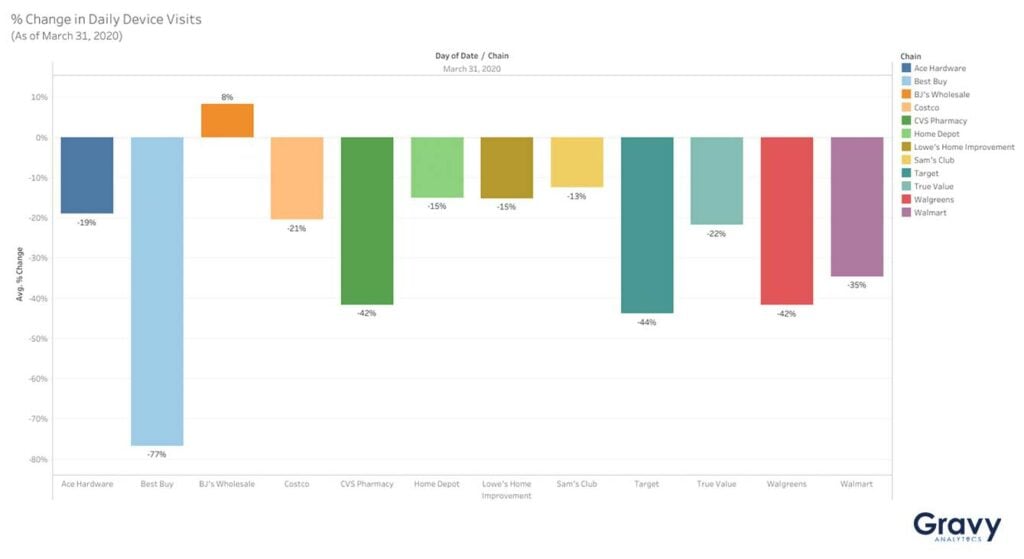

Consumers are Seeking Value from Big Retail Brands

U.S. consumers are still shopping for home supplies and basic necessities – at bigger stores and with a focus on value. Wholesalers as a group fared remarkably well, but BJ’s Wholesale Club was the only brand on our list to boast higher than average daily device visits as of March 31. Home Depot and Lowe’s experienced modest declines but continued to bring in customers. Stores selling more discretionary consumer goods, like Best Buy, experienced the most significant drop in foot traffic during the period.

How have the stores you shop at changed as a result of COVID-19? What could location intelligence tell you about social distancing and how consumer behavior has changed? Sign up for our weekly newsletter for more ideas.