Did Silicon Valley Bank’s Collapse Affect Consumer Foot Traffic to Banks?

May 18, 2023

Earlier this year, Silicon Valley Bank (SVB) failed after a bank run, making it the second-largest bank failure in United States history. This event, along with post-pandemic economic disruptions like inflation and nationwide layoffs, has caused concern among Americans regarding the overall economy, which has impacted consumer spending habits in recent months. So, how did this major bank failure affect consumer foot traffic to banks across the country, and what could this mean about the level of concern Americans have in regard to the economy today? Did this failure spark concern among customers of other banks, leading to surges in foot traffic to banks? Or perhaps, could this have led to a nationwide decrease in foot traffic to banks as consumers’ financial worries grew, leading them to make less transactions?

To learn more about the potential impact of SVB’s failure on consumer behavior, we analyzed foot traffic to banks across the country during the time of the failure.

Foot Traffic to Banks During SVB’s Collapse

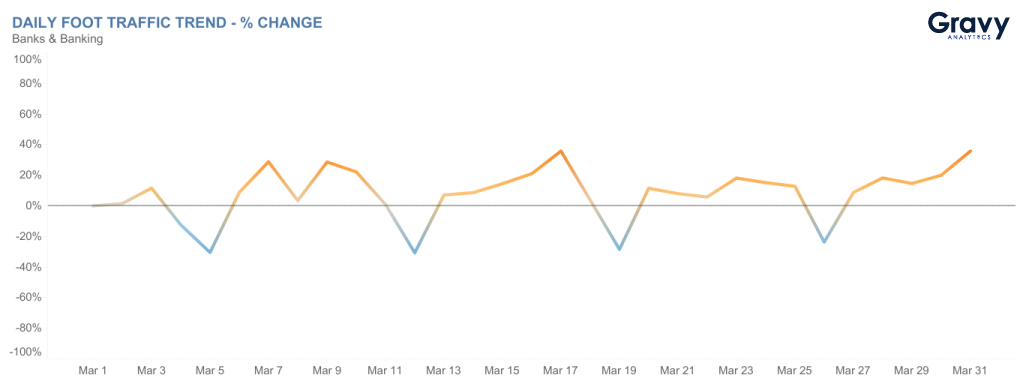

SVB officially collapsed on March 10, 2023, so we looked at consumer foot traffic to banks from March 1 to March 31 of this year to compare foot traffic before and after SVB’s collapse.

Overall, consumer foot traffic to banks in the U.S. ebbed and flowed over the month of March, with dips in foot traffic happening periodically. However, it seems the collapse of SVB did not have a real or lasting impact on consumer foot traffic to banks. Across the U.S., foot traffic seemed to continue its regular pattern of ups and downs during the month of March with no notable changes.

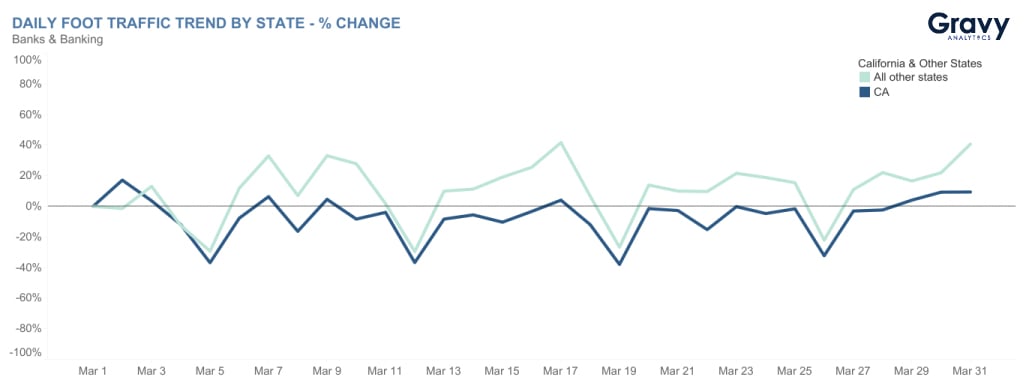

Furthermore, when examining foot traffic data to banks in the state of California, where SVB is headquartered, there is still no notable change. Compared to the rest of the U.S., California banks experienced the same foot traffic pattern as all other states, suggesting that consumers are going about their bank visits as per usual. This means that although there was widespread concern surrounding the SVB failure, consumers were not worried enough to visit their banks any more or less.

Banking Systems: Concern vs. Confidence

Although recent consumer foot traffic does not indicate a significant level of concern, the effects of the SVB failure may continue to be seen in the coming months when it comes to foot traffic. As SVB provided financing and services to businesses across the country, particularly in the tech industry, foot traffic to banks could be affected as more startups and other businesses seek financing or other financial services elsewhere. Furthermore, SVB’s failure will likely continue to have an effect on consumers for the long run.

While foot traffic didn’t immediately shift after the SVB failure, many consumers are considering starting new relationships with new banks or switching primary banks completely in the coming months. The initial lack of change in consumers’ real life behavior doesn’t mean that SVB’s collapse won’t continue weighing on the minds of U.S. consumers, potentially causing changes in the near future.

For now, consumers are showing some confidence in U.S. banking systems, and increasing confidence in their overall spending habits, so foot traffic to banks could continue to be stable and predictable despite any concerns.

For more consumer foot traffic insights like this, subscribe to the Gravy Analytics email newsletter.