Domino’s vs. McDonald’s: The Ultimate Food Fight

January 8, 2021

In 2017, we compared foot traffic data for some of America’s most beloved fast food restaurant chains. Prior data collected from Q4 2016 and Q1 2017 showed that pizza joints are what reigned supreme. With COVID-19 now dominating the daily headlines all over the world, and a year that has turned everything once familiar on its head, foot traffic data in 2020 might show something a little different.

Let’s take a closer look at two of America’s most popular fast food chains and see who is performing the best. We used 2020 foot traffic data from our COVID-19 economic activity by state dashboard to compare McDonald’s vs. Domino’s.

Are you ready for round two of Domino’s vs. McDonald’s: The Ultimate Food Fight? Let’s take a look at the foot traffic data.

2020 Foot Traffic Data: Domino’s vs. McDonald’s

McDonald’s Foot Traffic

Compared to February’s foot traffic data, McDonald’s saw 29% lower foot traffic in March. With the lockdowns taking hold all over the United States, foot traffic in April was 55% lower than in February.’ Over the spring and summer months, McDonald’s foot traffic was 32% and 28% lower in May and August.

With the fall season approaching and the threat of another wave of COVID-19 cases, October’s foot traffic was 42% lower than February.

Domino’s Foot Traffic

When looking at Domino’s foot traffic data in 2020, one thing is apparent right off the bat: they have kept a steady lead on McDonald’s all year. When we compare the foot traffic data, we can see that Domino’s outperformed McDonald’s very early on in the coronavirus pandemic. In March, foot traffic was 20% lower than in February, and when everything shut down in April, foot traffic was 46% below pre-COVID levels.

In spring and summer, Domino’s started to see recovery in foot traffic. The summer months remained at 23% below pre-pandemic levels. In October, Domino’s experienced a sharp shift in foot traffic, almost reaching April numbers; foot traffic was 43% lower compared to February.

Who is the Winner in 2020?

Why did Domino’s held onto a steady lead over McDonald’s in 2020? There could be a few reasons for this. As discussed in our last piece, diners preferred pizza and Mexican food over burgers and fries back in Q4 2016 and Q1 2017.

With McDonald’s limited menu during the lockdown and the long lines at the drive-through with no delivery option, perhaps diners were looking for variety and ease of use over the simplicity of a drive-through.

One thing is certain: even though Domino’s offers great delivery options where McDonald’s does not, they still manage to take the cake over McDonald’s in foot-traffic numbers. The verdict? Even in 2020, diners seemed to prefer pizza over burgers.

Q4 2016 and Q1 2017 Data Study: Domino’s vs. McDonald’s

Per a MSN poll, millennials are more interested in pizza and Mexican restaurant chains than burger and chicken joints. While fast food chains like McDonald’s and Burger King have dominated in the past, it’s pizza places like Domino’s and Papa John’s that now reign supreme.

Contributing to their success, pizza chains Domino’s and Papa John’s have become especially adept at using digital to drive product sales. Thanks to digital ordering, Domino’s sales reached $10.9 billion in 2016 — nearly double their sales in 2008. Meanwhile, burger chains like McDonald’s and Wendy’s have largely failed to capitalize on digital trends. As millennials favor intuitive, easy-to-use technology, restaurants that make the most of the power of digital may continue to find competitive advantage.

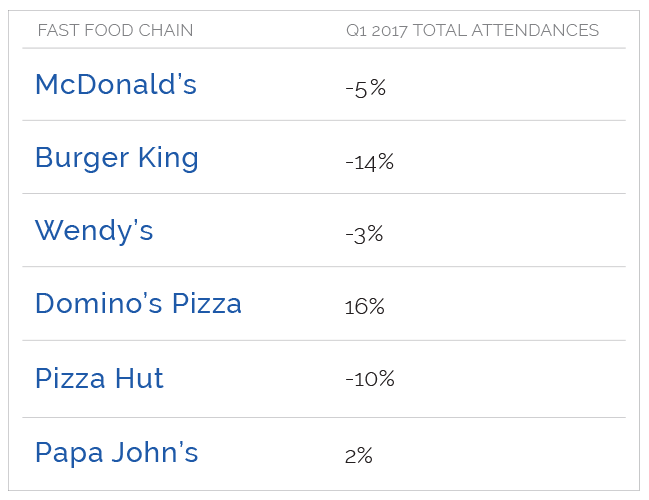

Curious to see what our location intelligence might tell us about foot traffic trends at leading burger and pizza restaurants, we analyzed Q4 2016 and Q1 2017 attendance data for select fast food chains in the U.S. Here’s what we found:

McDonald’s, Burger King and Wendy’s all saw foot traffic declines in Q1 2017, with Burger King foot traffic down nearly 14%. McDonald’s sales in the U.S. grew by 1.7% in Q1 2017, while parent company Restaurant Brands International reported flat sales for Burger King. In contrast, Domino’s and Papa John’s saw foot traffic increases of 16% and 2%, respectively. This correlates with Domino’s reported U.S. sales increase of 10.2% and Papa John’s reported sales increase of 2% in Q1 2017. Pizza Hut foot traffic was down by 10% during a period in which Yum! Brands reported a 7% decline in Pizza Hut U.S. sales. Note that Pizza Hut, Dominos and Papa Johns are delivery-centric, so consumer foot traffic patterns differ from other listed chains.

Digital transformation is clearly making an impact on the restaurant industry. Could location intelligence be the next source of competitive advantage? Quick service restaurants are already using location data for insights into their customers’ interests, affinities and lifestyles. For the first time, marketers can benchmark store performance against their competitors in near real-time – measuring relative foot traffic and customer engagement. Advertisers can also use these same insights to reengage current customers with timely promotions, or to target competitors’ customers with conquesting campaigns.