How Far are Consumers Traveling to Sports & Athleisure Retailers in 2021?

October 27, 2021

With the rise of work-from-home culture, the fashion and apparel industry saw a big shift in 2021, especially for sports retailers. Consumers were suddenly trading traditional work clothes for athleisure wear. In addition, there has recently been an increase in at-home fitness and a renewed interest in outdoor activities. With that in mind, consumers might be traveling farther to get to their favorite sports retailer. A survey by Access Development found that 93.2% of consumers travel 20 minutes or less to make everyday purchases, but purchases at sports retailers aren’t necessarily everyday essentials.

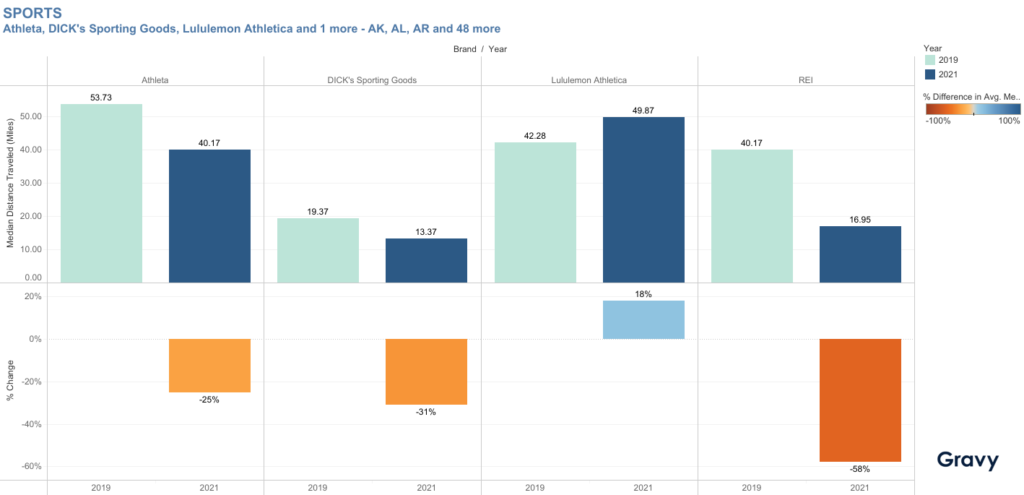

How far are consumers willing to travel to visit sports retailers? To determine this, we analyzed the median distance traveled to Athleta, Dick’s Sporting Goods, Lululemon Athletica, and REI stores in the U.S.

Consumers Travel Farther for Athleisure

Leading the athleisure movement are Athleta and Lululemon Athletica. Compared to other major sports retailers, consumers are traveling farther to visit Lululemon stores. The median distance traveled to Lululemon’s 491 stores was 18% higher in 2021 than in 2019. Lululemon is known for selling out of in-demand items like biker shorts and speed leggings online. This may indicate that consumers are willing to visit a store to purchase what they couldn’t get online.

The median distance traveled to Athleta stores was 25% lower in 2021, compared to 2019. Unlike Lululemon, Athleta only has a little more than 200 stores in the U.S. This could indicate that consumers interested in the Athleta brand may prefer to shop online rather than travel to an Athleta store.

Consumers Travel Shorter Distances to “Traditional” Sports Retailers

Both Dick’s Sporting Goods and REI carry a variety of sporting equipment and clothes from multiple brands at their stores. The median distance traveled to Dick’s Sporting Goods was 31% lower in 2021 than in 2019. With 730 stores nationwide, consumers shouldn’t have to travel very far to get to a Dick’s retail store.

REI saw the biggest shift in median distance traveled from 2019 to 2021. The median distance traveled to REI stores was 58% lower in 2021. REI only operates 168 stores across the U.S. and so consumers may simply prefer the convenience of shopping on REI’s website. Another possibility is that REI brand enthusiasts have already stocked up on what they need for their outdoor activities.

The Future of Sports Retail in a Post-COVID World

Consumer interest in sports and outdoor goods isn’t going away anytime soon, but in 2021, consumers aren’t willing to travel as far to get the equipment they need for sports and outdoor activities, such as exercising or camping. However, based on our data, we predict that consumers will continue to travel to visit athleisure retailers like Athleta and Lululemon.

For more information on location intelligence and how it can transform your business, contact us to speak with an expert at Gravy Analytics today.