Housing Market Trends: Analysis of Housing Services in U.S. Cities

March 22, 2021

Despite last year’s economic challenges due to COVID-19, the real estate market saw a boost as Americans re-evaluated their housing situations due to the rise of remote work. A study conducted by United Van Lines showed that many Americans moved South and West. More Millennials moved to rural areas rather than cities, either to escape the higher cost of living or for a simple change of pace. Those who didn’t move often invested in home improvement projects or in updating their home decor to improve their living spaces. All of these factors made the real estate market an ever more competitive landscape.

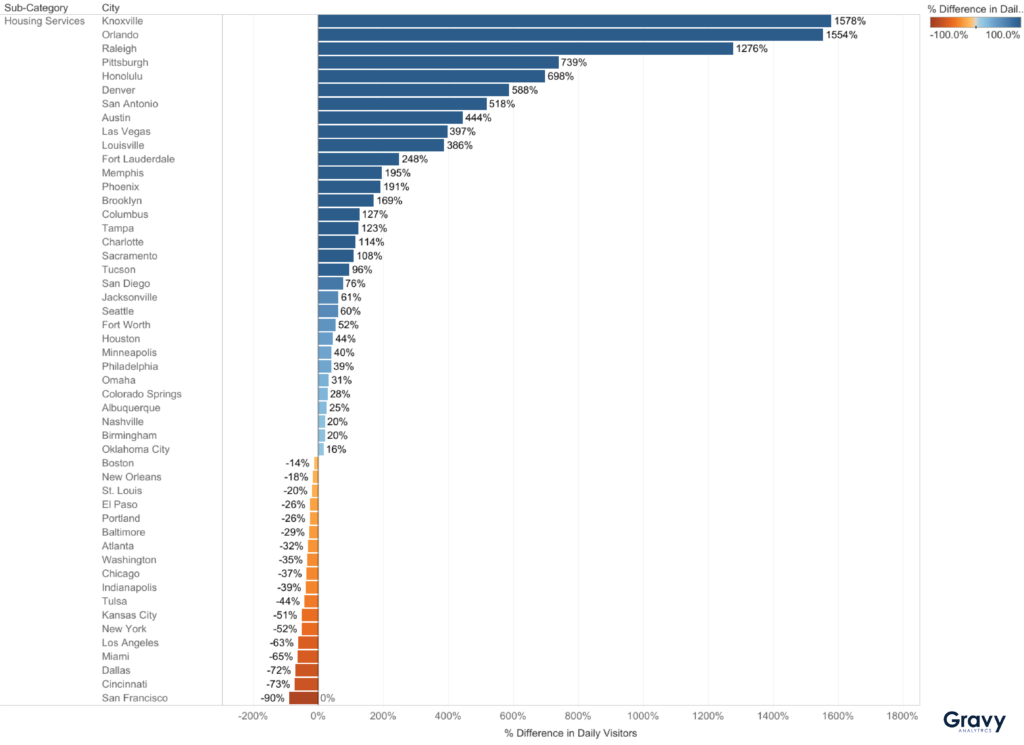

To understand housing market trends, we analyzed the change in average daily visitors at housing services from Feb 2020 to Feb 26, 2021, to determine which U.S. cities saw the most (and least) activity. Housing services include real estate businesses, moving companies, property management and maintenance, and apartment referral services.

Top 5 Comeback Cities for Housing Services

Top Comeback City: Knoxville, TN (+1578%)

Like many other small cities, Knoxville, TN saw an influx of interest from both renters and home buyers looking to leave bigger cities. However, this consumer demand for real estate caused home sales to become more expensive and competitive. This could explain why there was such a large increase in visits to places in the housing services category as homeowners and renters prepared for moving.

Here are four other cities, in addition to Knoxville, that saw extremely high foot traffic activity in the housing services category:

- Orlando, FL (+1554%)

- Raleigh, NC (+1276%)

- Pittsburgh, PA (+739%)

- Honolulu, HI (+698%)

Top 5 Hardest-Hit Cities for Housing Services

Hardest Hit City: San Francisco (-90%)

During 2020, Bay Area rentals dropped and demand for homes outside of the city increased. With this housing market trend, the demand for San Francisco housing services also dropped. California residents were also under some of the strictest lockdowns in the nation, so it isn’t too surprising that consumer visits to housing services decreased. It is also possible that many housing services shifted more towards online services rather than in-person services.

Here are four more cities, in addition to San Francisco, that are among the most impacted in the housing services category:

- Cincinnati, OH (-73%)

- Dallas, TX (-72%)

- Miami, FL (-65%)

- Los Angeles, CA (-63%)

Austin, Texas: The Next Silicon Valley?

Austin has been in the news recently as many coastal transplants are moving into the city. Austin is among the cities now seeing many more consumer visits to housing services; as of February 2021, foot traffic was 444% higher compared to pre-COVID levels. With a huge possibility of Austin becoming the next Silicon Valley, it makes sense that consumers would be seeking out housing services like real estate offices or apartment referral services to either list their house for sale or find their dream living space.

Location Intelligence for Housing Market Trends

We can infer that trends in our data within the housing services category reflect the changing housing market in those cities. With more people than ever working from home, these shifts in the real estate market are more than likely here to stay, despite the economic circumstances surrounding the COVID-19 pandemic. We predict that smaller cities and towns will continue to see an influx in new residents and an increased demand for housing services as many leave major cities in search of additional space and a lower cost of living.