How Does Consumer Foot Traffic to Starbucks Compare to its Competitors?

January 31, 2023

The pandemic’s economic disruptions are still in effect as the cost of food continues to skyrocket. As popular food and beverage destinations inflate menu prices in response, consumers are either adapting to the new prices or choosing more affordable brands. Specialty coffee—often considered an affordable luxury in the food and beverage industry—has not been immune to these disruptions. So, has consumer interest shifted away from these pricey pick-me-ups? Gravy analyzed three top specialty coffee chains to determine the effect inflation could be having on foot traffic and to better understand current consumer spending habits.

Foot Traffic to Starbucks and Competitors

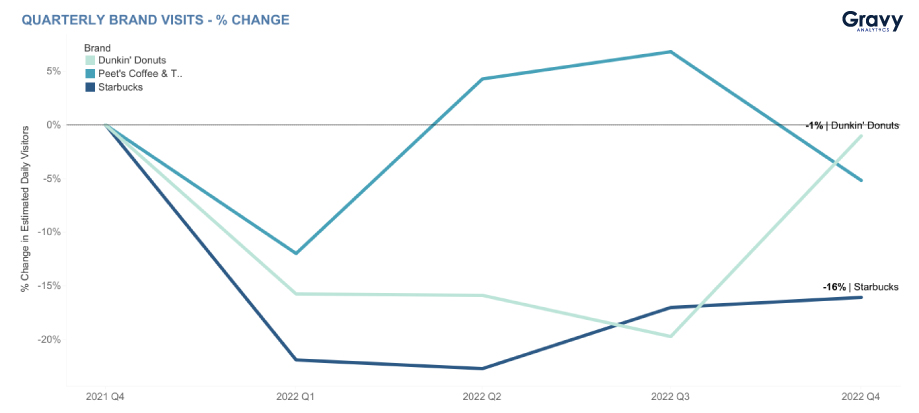

We analyzed foot traffic to Starbucks, along with Peet’s Coffee and Dunkin’ Donuts, from Q4 2021 to Q4 2022. Overall, the three followed different foot traffic patterns with slight similarities.

In Q1 2022, for example, all three companies experienced dramatic decreases in foot traffic compared to Q4 2021. After that, foot traffic to Peet’s Coffee skyrocketed before dipping back down, ending Q4 2022 with a -5% change year-over-year. After experiencing a steady decline in foot traffic in Q1, Q2, and Q3, Dunkin’ Donuts saw its biggest increase in foot traffic during Q4 2022, yet still ended the quarter with a -1% year-over-year change. Foot traffic to Starbucks, the market leader in specialty coffee, decreased the most. Starbucks ended Q4 2022 with a -16% year-over-year change in foot traffic.

During Q3 2022, Starbucks and Peet’s Coffee both experienced increases in foot traffic while Dunkin’ Donuts saw a decrease. Other than this and the initial declines seen by each brand in Q1, the three coffee chains seem to be following unique patterns in foot traffic, with Starbucks having the most subtle shifts in foot traffic after Q1. Peet’s Coffee and Dunkin’ Donuts both experienced relatively dramatic ups and downs in foot traffic over the last year. So, is the “lipstick effect” still in play, and are consumers still prioritizing coffee?

Are Starbucks Customers Evolving?

Consumers are still prioritizing their daily coffee, however, inflation may be creating a shift in who prioritizes which brand’s coffee. As the cost of food increases, it is likely that many Americans are making coffee at home to save time and money. On the other hand, there are many Americans still spending hundreds of dollars a year at Starbucks and other coffee destinations, and they may be spending more than usual.

In 2022, the average customer spend per visit at Starbucks increased. This means that people began to spend more, accelerating demand. Consumers may be treating Starbucks as a one-stop-shop for both coffee and food more often, purchasing more food items and increasing average spend. Groups may also be purchasing more Starbucks together to reduce delivery fees or other added costs. Whatever the case, Starbucks had a record-breaking quarter last year in spite of its lowered foot traffic, but will this trend continue in its latest quarter?

Starbucks is currently the most expensive specialty coffee chain in the market, so cost-conscious Starbucks customers could be switching to competing brands like Dunkin’ Donuts, explaining Dunkin’s recent boost in foot traffic. As inflation increases, consumer interest favors coffee, and Starbucks grows, the company is likely to attract more affluent consumers who have the means to spend more. This may be why Starbucks continues to lead the specialty coffee market in spite of its menu prices.

Starbucks: Offsetting Changes in Foot Traffic

Despite inflation and shifts in consumer foot traffic, Starbucks is the largest coffee chain in the world, boasting the most store locations and sales of the three companies we analyzed. Because of this, Starbucks has become the default coffee destination for most Americans. As many choose Starbucks over other coffee choices, this brand affinity could also be growing among groups: families, friend groups, workplaces, etc. Groups may be ordering for delivery more often as well, having Starbucks during meetings, events, or other gatherings. As Starbucks and third-party delivery services’ revenues increase, it could be that consumers are preferring to get their coffee delivered and this may be helping Starbucks offset its current decline in in-store foot traffic.

Starbucks beverages remain the company’s most popular product, but the rise in interest for other products is likely contributing to the increase in average customer spend per visit. Along with food options, Starbucks’ product line includes gift cards, mugs, and tumblers, among other goods. As more consumers become stronger coffee connoisseurs, Starbucks customers are likely purchasing coffee-drinking accessories while on their coffee run.

Based on recent foot traffic to Starbucks locations and company sales, the average Starbucks customer is likely spending more and ordering more, regardless of whether they make in-person visits or not. It will be interesting to see how foot traffic to Starbucks locations changes throughout 2023, and if competitors continue attracting more in-person visits.

For more information on how your company can benefit from location intelligence, contact an expert today.