How Recent Target Foot Traffic Data Suggests Increasingly Cost-Conscious Spending

February 21, 2023

Last year, as pandemic restrictions fully lifted, foot traffic began to shift greatly from the year prior. As post-pandemic economic disruptions persist, could those foot traffic shifts continue ebbing and flowing in 2023? In Q2 of last year, Target experienced substantial foot traffic growth compared to the year prior, while its big-box competitor, Walmart, saw minimal foot traffic growth. Target foot traffic data showed dramatic spikes in year-over-year foot traffic growth as well.

Target reported having a strong Q3 2022, with a year-over-year increase of 2.7% in sales. The company also reported a foot traffic increase of 1.4% year-over-year. To understand what this means for the relatively pricey big-box chain in 2023, Gravy analyzed recent Target foot traffic data and compared it with some of the company’s top competitors.

Target Foot Traffic Data Analysis

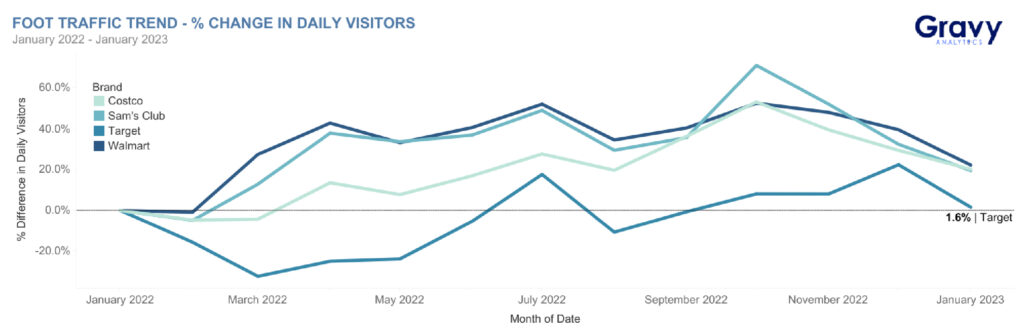

We analyzed Target’s foot traffic data along with Walmart, Sam’s Club, and Costco from January 2022 to January 2023. When looking at foot traffic data for the last 12 months, Target experienced declines in foot traffic in the first half of 2022 to levels below January 2022. In July, foot traffic spiked at Target to 17.6%. This is perhaps due to prep for 4th of July parties and back-to-school shopping. Following this, foot traffic declined again, before gradually increasing through December, due to holiday shopping demand. However, after the holidays, foot traffic declined once more in January 2023.

This contrasts with the foot traffic data seen during the last 12 months at Target’s major competitors, Walmart, Costco, and Sam’s Club. Throughout the last year, these brands experienced very similar trends in foot traffic. While foot traffic declined slightly at the start of 2022, following March, foot traffic at these retailers rose significantly. It then remained above January 2022 levels for the year and into January 2023.

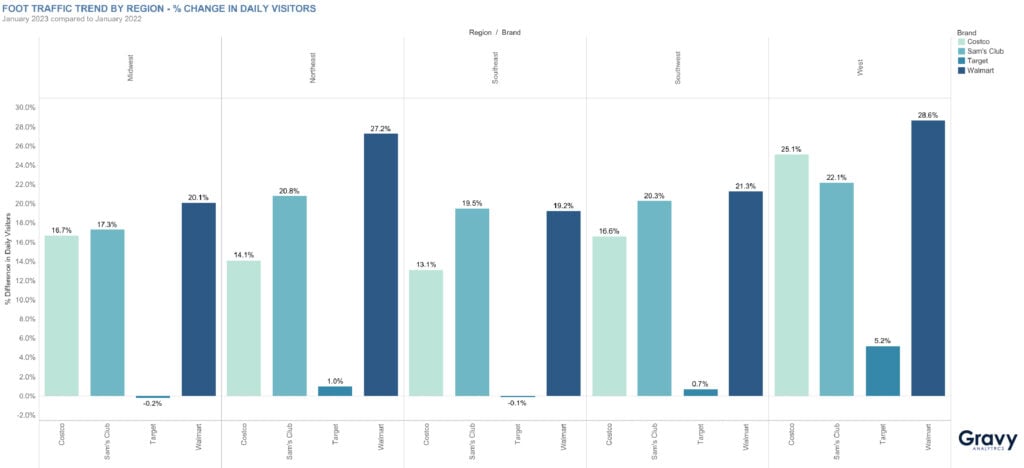

Target ended January 2023 with a year-over-year increase of 1.6% in foot traffic. Meanwhile, its competitors saw much greater year-over-year foot traffic growth. By January 2023, Walmart’s foot traffic increased 22.2% year-over-year—the largest increase in this category. Sam’s Club and Costco both showed increases of 19.5% and 20.1%, respectively, for the same time period. These trends were fairly consistent when comparing each company in various regions of the United States. Target saw a greater increase in daily visitors out west than in other regions, but that number was still significantly lower than its three competitors in the category. So why is it that Target’s foot traffic data has recently experienced a minimal increase?

Food Costs and Grocery Goods

Recently, two categories of retailers have experienced the most year-over-year foot traffic growth: home improvement and grocery. These recent trends in consumer interest are likely helping Walmart’s growth. these recent trends highlight Walmart’s wide selection of general merchandise, expansive grocery sections, and discount prices. So, it’s no wonder that Walmart showed the greatest growth in year-over-year foot traffic of the three companies analyzed. Of these companies, Walmart’s prices and access to underserved communities, such as rural communities, are proving effective.

As food costs soar, Walmart’s prices and selections may be attracting more cost-conscious consumers. In fact, over half of Walmart’s sales share is attributed to its grocery category, and that’s predicted to continue. Wholesalers, like Costco and Sam’s Club, are also seeing significant increases in year-over-year foot traffic, likely for the same reasons as Walmart. As more Americans are affected by rising food costs, consumers are likely putting more thought into how they spend their money.

Impulse Shopping Amid Economic Disruption

The fact that shoppers are more thoughtful about their purchases these days may be affecting Target as 21% of Target sales are unplanned purchases. This means Target relies on shoppers who impulsively pick up items or grocery products as they shop for other goods. With consumers becoming more thoughtful about their spending, Target may need to reevaluate its strategies to entice shoppers to make spontaneous purchases. As cost-conscious consumers opt for dollar and discount stores in the current climate, Target’s market share may shrink in the coming year. Conversely, Walmart and wholesale clubs may see an uptick in their market share as they continue to appeal to budget-minded shoppers.

Walmart shoppers—and wholesale club shoppers—are also more loyal than Target shoppers. Walmart customers spend about three times as much as Target shoppers each year. Because wholesale clubs are membership-based, their customers tend to be extremely loyal as well. For example, although there have been changes at Costco that challenged customer loyalty in the past, members continue visiting Costco’s warehouses, and increasingly so. The recent Target foot traffic data likely means Target is seeing less return shoppers than its discount and wholesale counterparts.

How Are Shopping Habits Changing?

The difference between Target and its three competitors we analyzed is that Target appeals to young, emotional shoppers often shopping for trendy items. This type of shopper is likely to be affected by economic disruptions, forcing shifts in their shopping habits. So, could Target customers become regulars at Walmart this year?

Other types of shoppers, like families, often place an emphasis on value. Value shopping is becoming a more common consumer behavior, and will likely continue affecting the retail landscape this year. Walmart, Costco, and Sam’s Club (a Walmart company) are likely to not only build customer loyalty in 2023, but attract new customers as the year progresses.

For more brand performance and foot traffic insights like these, join the Gravy Analytics newsletter today.