The Impact of COVID-19 on Clothing Stores

September 15, 2020

Like other sectors of retail, clothing stores such as Lord & Taylor and Men’s Warehouse have been significantly impacted by COVID-19. Apparel sales, especially for professional attire, have fallen in the past couple of months due to the coronavirus pandemic. Why is this the case? Many consumers who are working from home are less inclined to shop for work-related outfits or suits. Instead, consumers are purchasing more athleisure and casual clothes. We analyzed foot traffic at select clothing brands to determine how the coronavirus pandemic has affected their store foot traffic.

A Slow Recovery for Clothing Stores

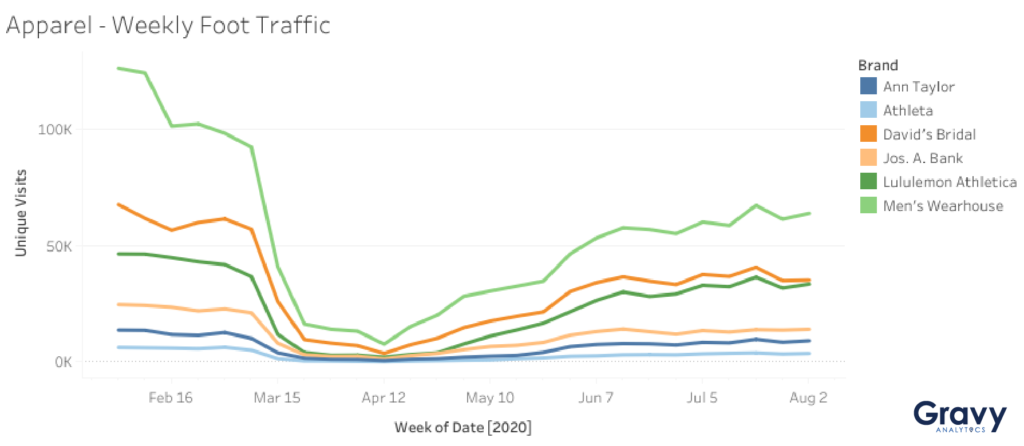

Foot traffic declined significantly the week of March 15, and remained low throughout April, due to retail store closures. It began to increase again in May as clothing stores slowly reopened. Foot traffic to apparel stores started to level off in June, with the exception of a high point in mid-July.Ready to start revamp your travel advertising strategy? Check out our latest advertising audiences below.

Athleisure Dominates Over Work and Formal Wear

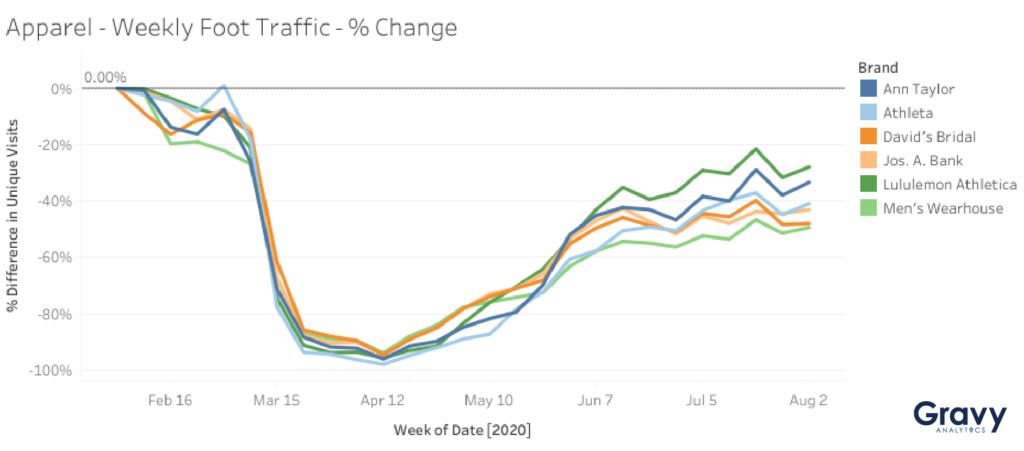

Lululemon and Athleta, major brands in the athletic wear industry, are recovering foot traffic faster than other apparel brands. Foot traffic at Lululemon and Athleta were 28% and 41% lower for the week of August 2, compared to the week of February 2. Ann Taylor is right behind Lululemon and Athleta in terms of recovery. For the week of August 2, Ann Taylor store foot traffic was just 33% lower than for the week of February 2. Ann Taylor is mostly known for women’s work outfits, but they also have a section of their stores devoted to casual clothing. Thus, they might be in a position to pivot towards bringing in customers looking for clothes to wear around the house.

With COVID-19 postponing or canceling formal events, many formal wear clothing stores are recovering slower than other apparel brands. Men’s Wearhouse, best known for its wedding suit rentals, continues to see the most foot traffic among the brands examined, possibly due to clearance sales as the company filed for bankruptcy. However, the brand is the slowest out of all the apparel companies to recover foot traffic. Foot traffic to Men’s Wearhouse stores for the week of August 2 remained 49% lower than for the week of Feb 2.

David’s Bridal, a leader in wedding and bridesmaid dresses, remained 48% lower than pre-COVID levels, which may be due to some brides pushing back their wedding days. Jos. A. Bank, known for their high-quality suits, is slightly ahead of Men’s Wearhouse and David’s Bridal in recovery; its store traffic was 43% lower than pre-COVID levels. This could be tied to customers going in-store due to announcements of store closures and clearance sales as they reduce inventory.

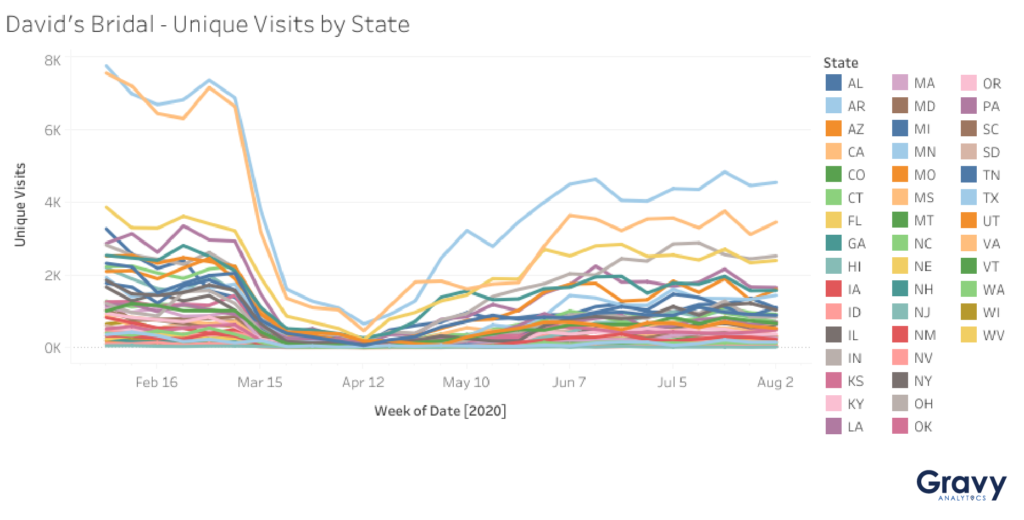

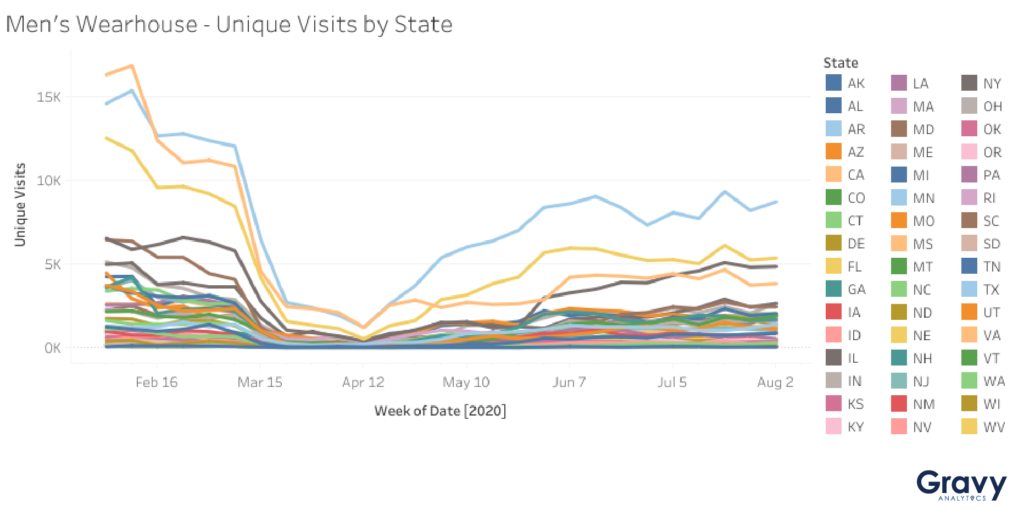

Regional Data Trends – David’s Bridal and Men’s Warehouse

Both David’s Bridal and Men’s Wearhouse are nationwide chains, but it seems that they are performing better in certain regions. Texas, California, and Ohio saw the most foot traffic at David’s Bridal stores. On the other hand, Men’s Wearhouse saw most of its in-store foot traffic in Texas, Florida, and Illinois. COVID-19 event restrictions vary by state, and this might be why these apparel brands associated with weddings are seeing more foot traffic in certain states.

Predicting Foot Traffic to Clothing Stores

The athleisure and casual clothing trend might be here to stay, and clothing stores must adapt their business models to meet customer demand. Customers are also more interested in convenience and safety when they are shopping now. To meet these expectations, clothing retailers must invest heavily in their online stores and integrate it with their in-store experience in the form of curbside pickup. Based on data from our economic activity dashboard, we predict that brands like Lululemon will continue to recover faster than other apparel retailers.