Consumer Insights Series: Dine-in Restaurant Trends

May 26, 2021

The coronavirus pandemic and lockdowns put a wrench in the dine-in restaurant industry. As the risk grew, people became averse to congregating with strangers, even if that meant forgoing their favorite dine-in hotspots. Many were also concerned with the economic hardships that the COVID-19 lockdowns would bring. Because of this, diners opted for fast food restaurants that offered lower prices or places that offered outside seating over traditional dine-in restaurants.

Now, we are heading towards a “new normal” here in the United States, and restaurants are again hosting sit-down diners at their tables. What does consumer foot traffic data tell us about dine-in restaurant recovery?

Overview: Sit-Down Foot Traffic Trends

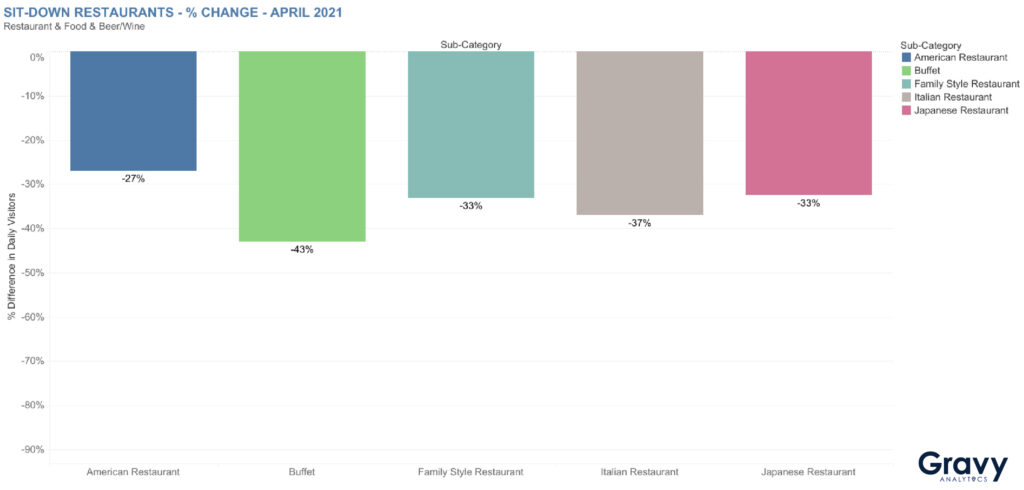

Before we take a closer look at how dine-in restaurants are performing in major cities, let’s see what was happening in the dine-in restaurant category in April 2021. Foot traffic at American restaurants remained 27% lower than pre-pandemic levels. Unsurprisingly, Buffet restaurants (-43%) aren’t recovering as fast as other sit-down restaurant categories, very likely due to the communal self-serve atmosphere.

While not quite as impacted as Buffet-style restaurants, foot traffic has been slower to return to Italian, Japanese, and Family Style restaurants, as well.

Sit Down Dining Trends by City

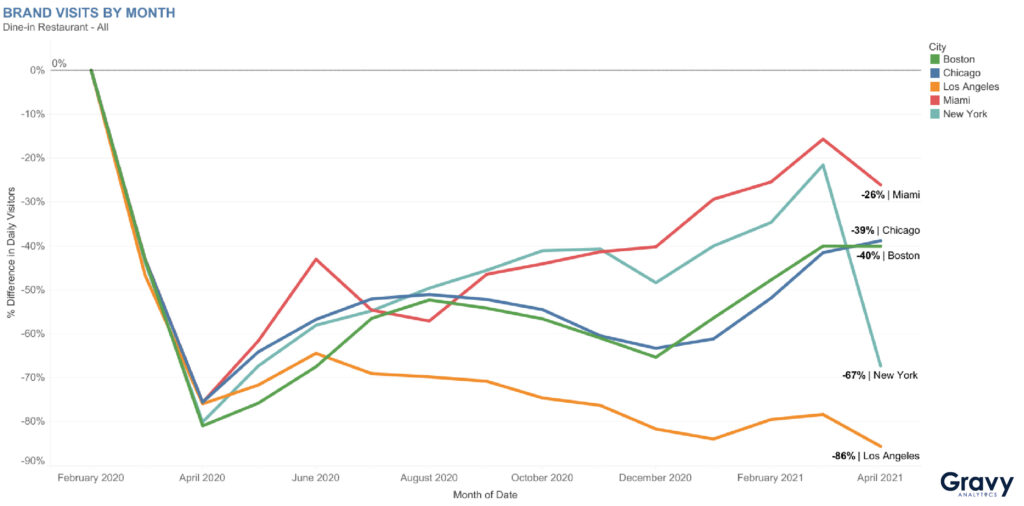

Given strict local dine-in capacity restrictions, it shouldn’t come as a surprise that April 2021 foot traffic to restaurants in New York (-67%) and L.A. (-86%) hasn’t recovered as much as in other cities. Compared to pre-pandemic numbers, foot traffic in Miami (-26%), followed closely by Chicago (-39%) and Boston (-40%), has picked up at a faster pace, but still has a way to go.

Why has Miami recovered more than many other major cities? It is possible that the city’s nightlife culture – coupled with looser dining guidelines – is encouraging diners to dine inside. Miami, with its consistently warm weather, is also a major tourist destination; seasonal tourists may have been another reason why Miami’s sit-down restaurants quickly recovered much of their foot traffic.

IHOP vs. Applebee’s

To get a better understanding of the dine-in restaurant economy, we also took a look at foot traffic for specific, popular dine-in restaurant chains.

IHOP Dine-In Trends

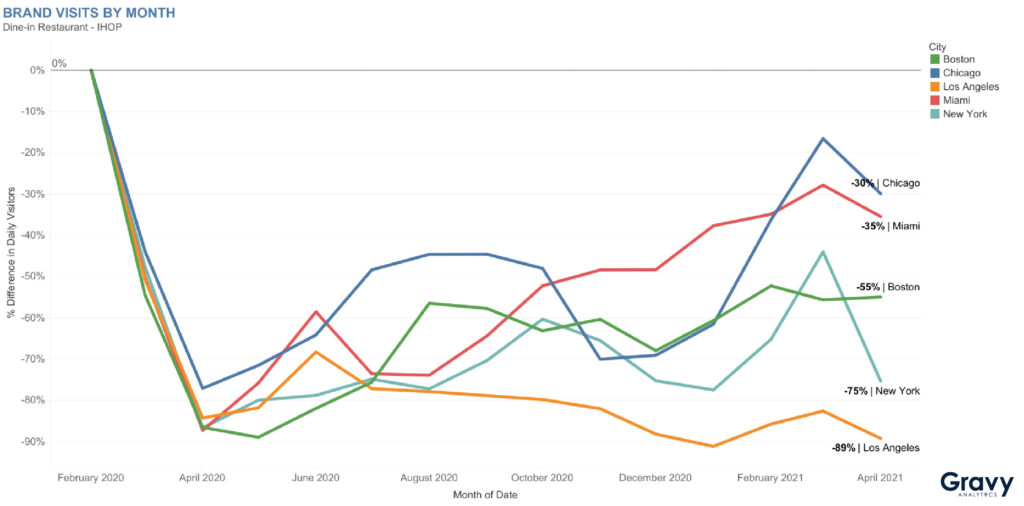

First up is America’s favorite pancake chain: IHOP. Looking at the rate of recovery for IHOPs in each city, we can see that the Chicago IHOP restaurants (-34%) have recovered faster, followed by Miami IHOPs (-35). IHOP restaurants in Los Angeles (-89%) and New York (-75%) have recovered far less foot traffic. Boston has fared better than (-55%) as New York and Los Angeles, but remains well below Miami and Chicago.

Some things to consider: not only are IHOP restaurants in New York and Los Angeles subject to these cities’ coronavirus restrictions, but nightlife venues are as well. As a restaurant that’s open 24-hours, it’s likely that IHOP restaurants in these cities have missed out on many lucrative late-night diners. This has not been the case in cities like Miami, where people have for the most part been able to stop at IHOP for pancakes after a night out.

Applebee’s Dine-In Trends

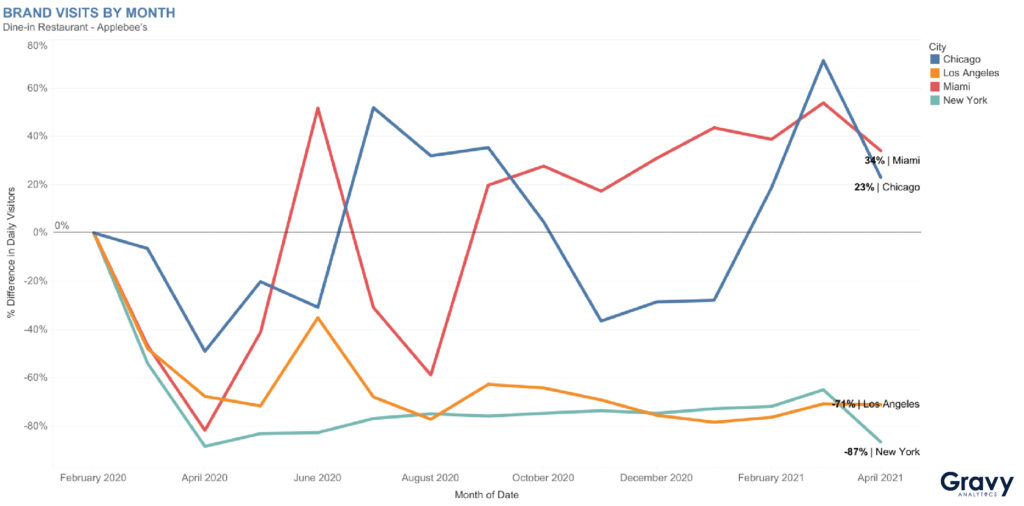

Another popular family restaurant is Applebee’s. This chain is one of the top spots for people looking for an affordable dine-in experience. Applebee’s has recovered much of its foot traffic in Chicago (+23%) and Miami (+34%), but hasn’t been as popular with diners in Los Angeles (-71%) and New York City (-87%). Note that New York and Los Angeles have only recently started raising their capacity limits for dine-in restaurants unlike some of the other major cities on this list.

Unlike IHOP, however, Applebee’s is not open for 24 hours, and they also serve alcoholic beverages. This may appeal to people looking for a bar-like atmosphere where it’s easier to socially distance. In some of the cities with higher foot traffic numbers, people could be opting to enjoy a drink at a dine-in restaurant.

The Future of Dine-In Restaurants

Outdoor dining has been a major trend for the past many months, but indoor dining is slowly making a comeback. Keep in mind that much of the United States has now lessened or entirely eliminated their coronavirus restrictions on restaurants. In Miami, for example, restaurants are no longer required to comply with occupancy restrictions while New York’s 75% capacity limit was just recently lifted. Los Angeles is still strict with its regulations, especially when diners and employees are not vaccinated.

As more consumers become vaccinated, indoor dining will become more appealing. However, some sit-down dining options, like buffets, will likely continue to see less foot traffic since many consumers will not want to contend with crowds just yet.

For more information on consumer foot traffic in your industry or area, contact us to speak with a location intelligence expert today.