Is Inflation Affecting Travel and Entertainment Foot Traffic?

June 8, 2022

Consumer demand for travel and entertainment is back, but has rising inflation shifted this demand? To understand how inflation is affecting consumer behavior, we analyzed travel and entertainment foot traffic to determine how select categories, including movie theaters and airports, did in Q1 2022 compared to 2021.

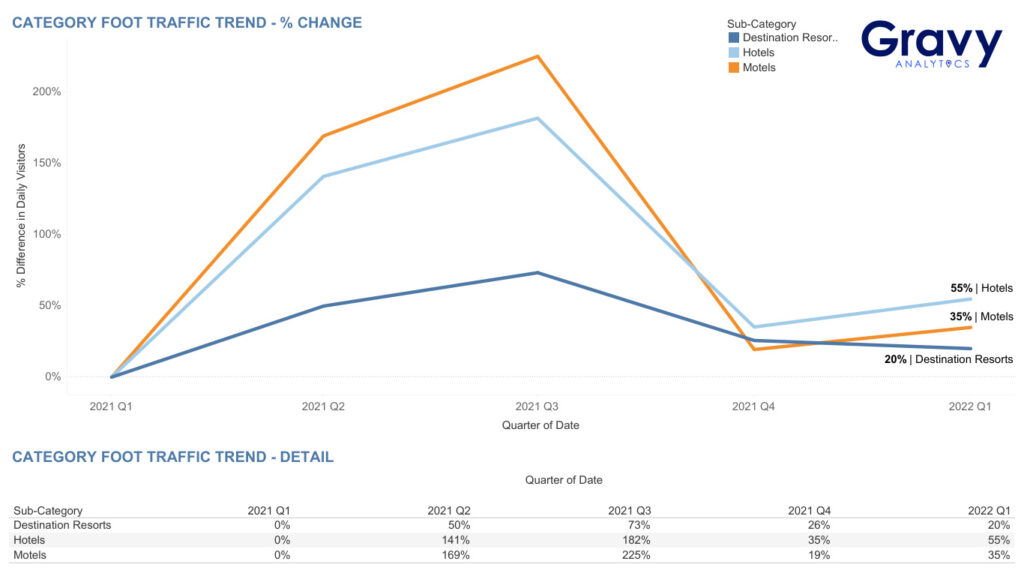

Hotels, Destination Resorts, & Motels

Foot traffic to resorts, hotels, and motels peaked in Q2 and Q3 2021. This is more than likely due to consumers taking spring and summer vacations. After Q3 2021, traffic declined significantly for hotels and motels. Destination resorts also saw a decline in foot traffic, but it was far less pronounced. By Q4 2021, foot traffic at hotels and destination resorts was 35% and 26% higher, respectively, compared to Q1 2021. In contrast, Q4 2021 foot traffic to motels was only 19% higher. During the 2021 holiday season, consumers spent more on hotels and airline tickets. This could explain why destination resorts and hotels, which usually cost more than motels, saw higher foot traffic during Q4 2021. After the holidays, motels and hotels both saw a slight increase in foot traffic, while destination resorts saw foot traffic remain flat from Q4 2021 to Q1 2022.

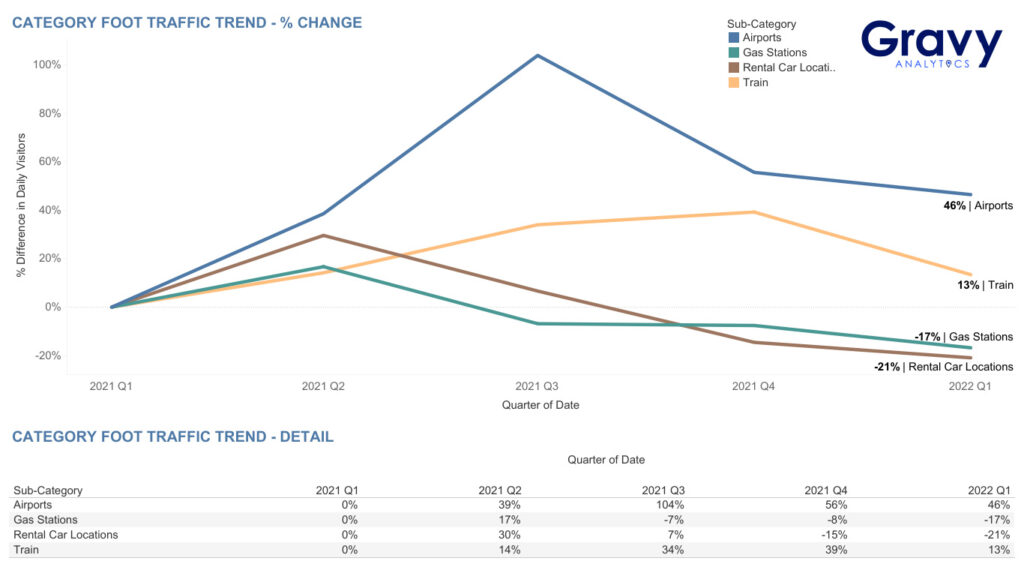

Transportation & Gas Stations

After Q2 2021, airports and train stations saw increases in foot traffic, more than likely due to summer travel. Airport foot traffic peaked in Q3 2021, but declined again slightly in Q4 and into Q1 2022. Foot traffic to train stations remained flat from Q3 to Q4 2021. Like airports, train stations saw a decline in foot traffic after Q4 2021. Declines in both train station and airport foot traffic could be due to seasonality; demand for travel is still high (despite high airplane tickets and fuel cost) and can be expected to peak again during the summer of 2022. By Q1 2022, foot traffic to train stations and airports was 13% and 46% higher, respectively, compared to the first quarter of the previous year.

Gas stations and rental car locations both saw slight peaks in Q2 2021. After Q2 2021, car rental locations saw a steady decrease in foot traffic, reaching its lowest point in Q1 2022. Traffic was 21% lower in Q1 2022, compared to the first quarter of 2021. Inflation has caused the price of cars to go up, and in turn, the cost of renting them. Besides the cost of rental cars, the price of gas also is rising. The Department of Labor found that gas and car rentals are two major areas that have seen a dramatic increase in price.

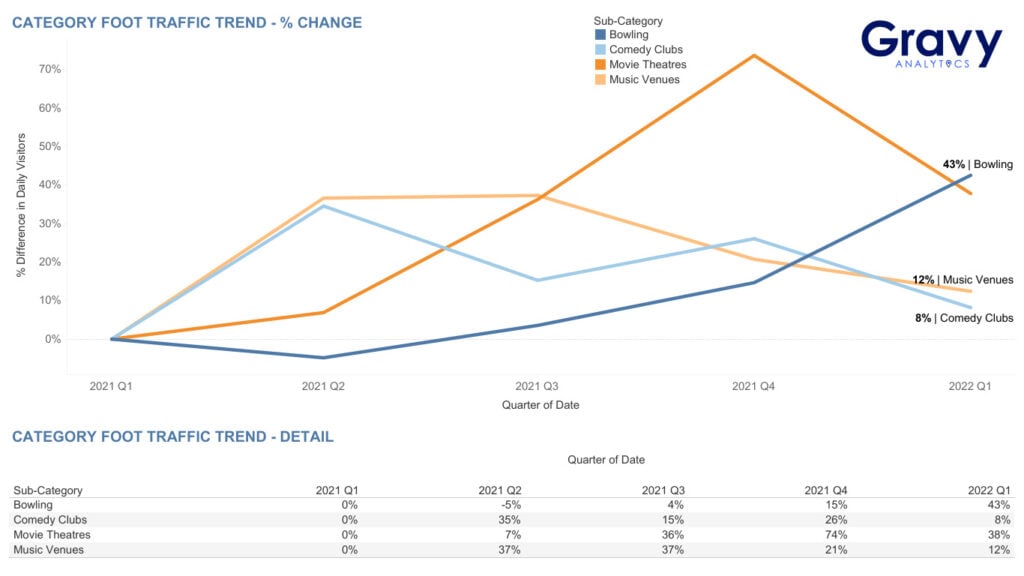

Movie Theaters, Music Venues, & Entertainment

Both comedy clubs and music venues saw significant increases in foot traffic in Q2 2021, which could possibly be due to tours starting up again. Comedy clubs declined after Q2 2021 while music venues saw flat traffic from Q2 to Q3 2021. Due to omicron and delta coronavirus variants, some artists had to cancel or/and postpone shows during the summer and early fall, which could explain these shifts in foot traffic. By Q1 2022, foot traffic to music venues and comedy clubs were 12% and 8% higher, respectively. Bowling alley foot traffic was 5% lower in Q2 2021, compared to the previous quarter. After Q2 2021, foot traffic to bowling alleys increased gradually and peaked in Q1 2022 (+43%). Movie theaters had its lowest point of foot traffic during Q2 2021. After Q2 2021, movie theater foot traffic increased significantly, peaking in Q4 2021. Many people enjoy going to the movies during the winter holidays, which could explain this spike in foot traffic.

The Future of Travel & Entertainment Foot Traffic in 2022

This year, summer travel can go two ways: consumers book trips no matter the cost or consumers put their travel money toward other expenses. An April 2022 survey by Longwoods International found that 53% of U.S. travelers say transportation costs will impact their future travel plans in the next 6 months. As inflation rates rise, consumers will have to choose which mode of transportation meets their budgets. Airport foot traffic will more than likely remain high as many travelers booked their summer vacations in advance of price hikes. As for entertainment, based on our data, it appears that movie goers are trading in some of their at-home streaming time for an in-person trip to the movie theater. We predict that movie theater foot traffic will continue to increase into the summer months. With more tours picking back up again, it can be expected that music venues and comedy clubs will see a significant increase in foot traffic this summer. For more information on how your business can understand travel and entertainment consumer trends, speak with an expert at Gravy Analytics today.