Lights, Camera, Amazon: Analyzing Post-Pandemic Foot Traffic to Movie Theaters Amid Amazon’s Potential AMC Deal

May 11, 2023

With rumors of Amazon’s potential acquisition of AMC Theatres, the entertainment industry is buzzing with anticipation. This move by Amazon could be part of its strategy to diversify its business ventures and strengthen its original content production division, leading to a reimagined movie theater experience.

However, the pandemic has brought lasting changes to the commercial landscape, particularly in-person entertainment. As consumers adjusted to spending more time at home, they had to bring the entertainment inside, leading to a surge in podcast subscriptions and electronics sales, as well as the growing popularity of streaming services for new movie releases. In this post-pandemic world, what does this mean for consumer foot traffic to movie theaters today? Could Amazon’s rumored interest in AMC be a sign of a resurgence for the movie theater industry? Or is the popularity of on-demand streaming continuing to cost major cinema chains in 2023?

To better understand current consumer interest in AMC locations and other cinema chains, we analyzed foot traffic to movie theaters from Q1 2022 to Q1 2023.

Foot Traffic to AMC Movie Theater Locations

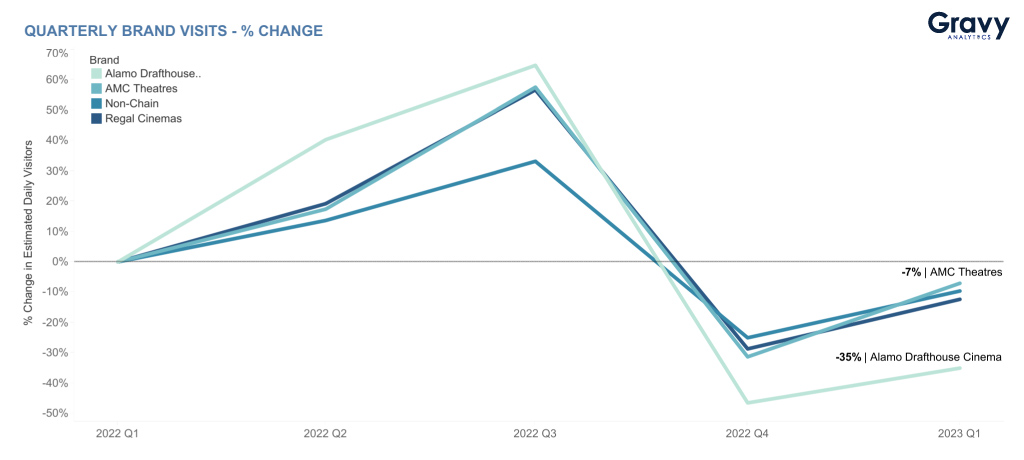

We analyzed consumer foot traffic to AMC Theatres along with Alamo Drafthouse Cinema, Regal Cinemas, and non-chain cinemas. Currently, all movie theater locations we analyzed are recovering from a significant decline in foot traffic in Q4 2022. During Q4, consumers were likely focusing their spending on essentials and gifts during the holidays, leaving less funds for entertainment expenses like moviegoing.

For the most part, all cinema brands analyzed followed a similar pattern in foot traffic. This suggests that there are likely shared factors impacting their performance such as consumer preferences, pricing, or overall demand for movie theater experiences. While all movie theater brands we analyzed are rebounding from their dip in Q4, foot traffic to movie theaters hasn’t grown year-over-year. In fact, all brands have experienced decreases in year-over-year foot traffic.

AMC saw a 7% decrease in foot traffic year-over-year, and while this is not ideal, AMC’s foot traffic decrease was relatively smaller than its competitors. Regal Cinemas saw a larger decline of 12%, while Alamo Drafthouse saw an even more substantial year-over-year decrease of35%. Non-chain movie theaters also saw a decrease in year-over-year foot traffic of 10%. Despite the year-over-year declines, there was a notable uptick in foot traffic during Q2 and Q3 of 2022. This suggests that consumer interest in cinemas is still alive, and Amazon could have the opportunity to capitalize on that interest if the company acquires AMC.

AMC Theatres & Consumer Interest

Although consumer interest in movie theaters remains, cinemas everywhere have suffered since the pandemic. During that time, movie theaters across the country shut down and online streaming took precedence. So, how has this major shift in the industry continued to affect foot traffic to movie theaters?

While about 85% of audiences are returning to theaters, streaming services are still widely available. Hollywood is making up for box office losses during the pandemic by producing less films than before, but focusing on summer blockbuster films that usually bring in surges of mass audiences. This could be why foot traffic to movie theaters increased during the summer months of 2022. However, it’s clear that the pandemic left its mark on the film industry, and moviegoing is not likely to return to the normal, pre-pandemic levels until 2025.

Many are calling Amazon’s possible acquisition of AMC Theatres unlikely, but low foot traffic to movie theaters isn’t the only reason.

The Entertainment Struggle

Mass, nationwide layoffs have made headlines in the last year, and Amazon isn’t immune. Amazon had multiple rounds of layoffs affecting tens of thousands of employees, and things aren’t looking optimistic for Amazon Studios and Prime Video, Amazon’s content production division and streaming service. The layoffs are continuing at Amazon Studios and Prime Video. Perhaps competing streaming services and production companies are capturing audiences’ attention, or perhaps consumer preferences have shifted due to the pandemic. Whatever the case may be, Amazon Studios and AMC Theatres are both struggling to recover from the lingering effects of the pandemic.

Amazon’s potential AMC acquisition could be a strategic move to help promote Amazon’s content and fuel new customer experiences at movie theaters. After Zoom partnered with AMC to allow conference calling from the big screen, there’s no telling how many more innovative uses there can be for the movie theater space. It will be interesting to see if the Amazon/AMC deal goes through, or if each company dreams up new ways to captivate audiences and recover from any losses.

For more foot traffic analyses and insights like this, subscribe to our email newsletter.