Music Festival Sponsorship: On Target or Off the Charts?

June 11, 2018

Pseudonymous event-based location data lets companies learn a lot about where different types of people go, what they do there, and the kinds of behaviors that signal purchase intent. Using these insights, marketers can more easily find the events that reach their target customers and make better sponsorship decisions.

Brand sponsorship is a big business: spending on music tours, festivals, and venues topped $1.54 billion last year according to the 2017 ESP Sponsorship Report. With music festivals being a big ticket item, leading automotive, beverage, fashion and hospitality brands line up to sponsor top events like Coachella, EDC, Firefly, and Bonnaroo.

While we aren’t sure what factors are considered during brands’ sponsorship planning sessions, we do know that event-based location data should play a role in their decision-making process.

To illustrate our point, we analyzed consumer attendance data from the 2018 Coachella festival alongside similar data from 2017 Bonnaroo, Firefly, and EDC to see whether each festival was a good match for its sponsors. Here is what we found:

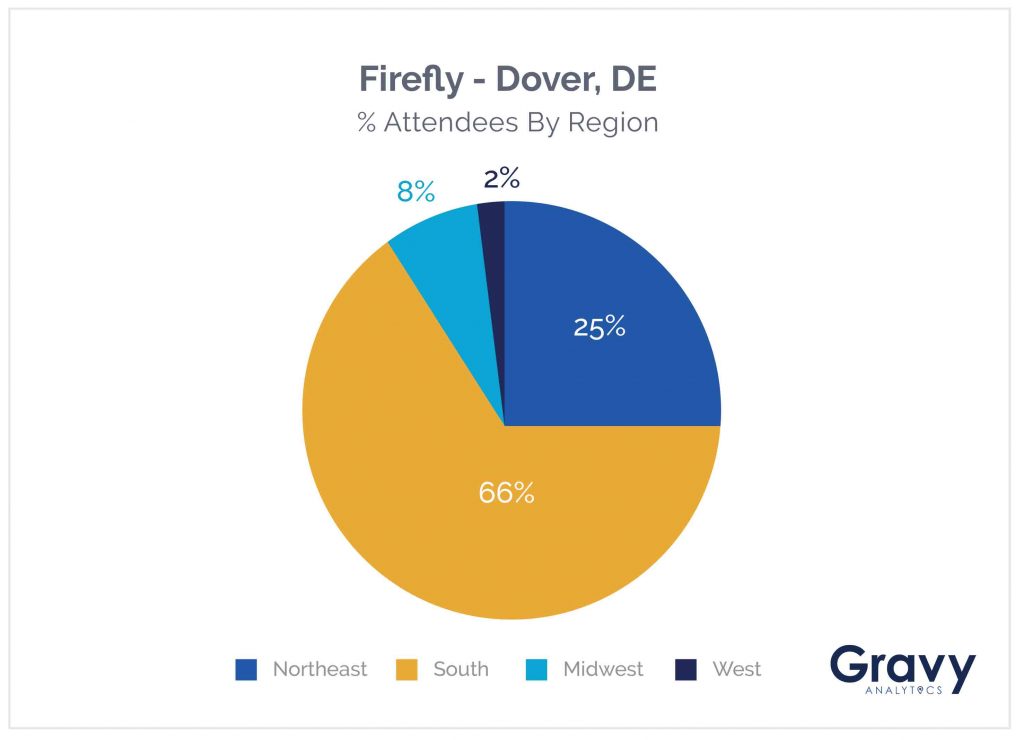

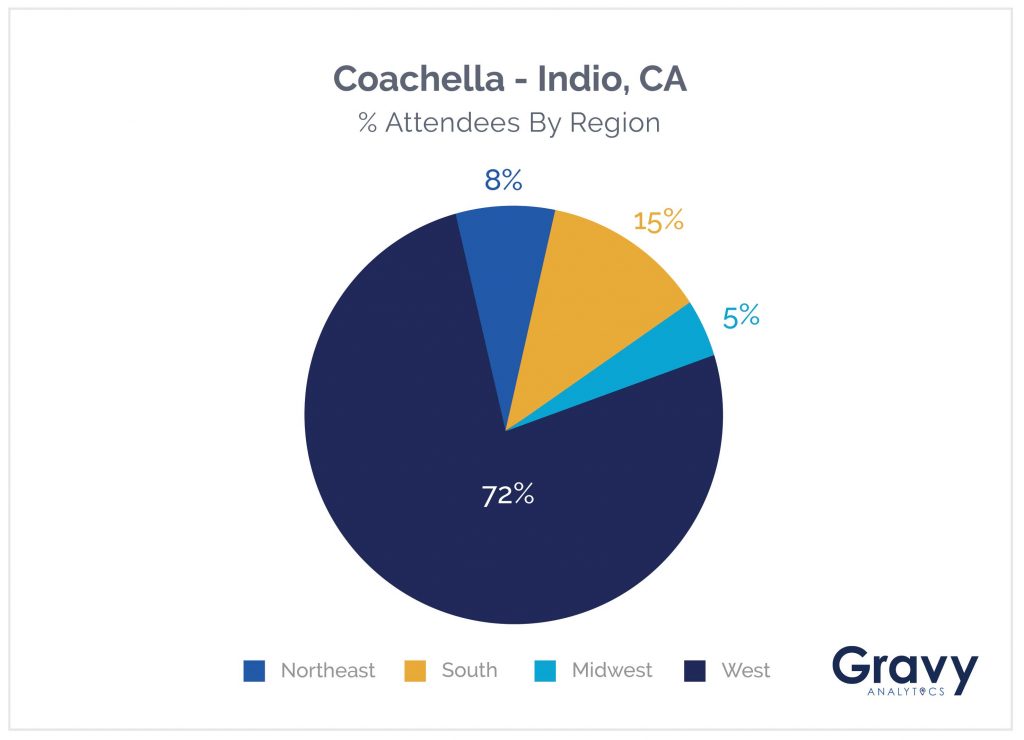

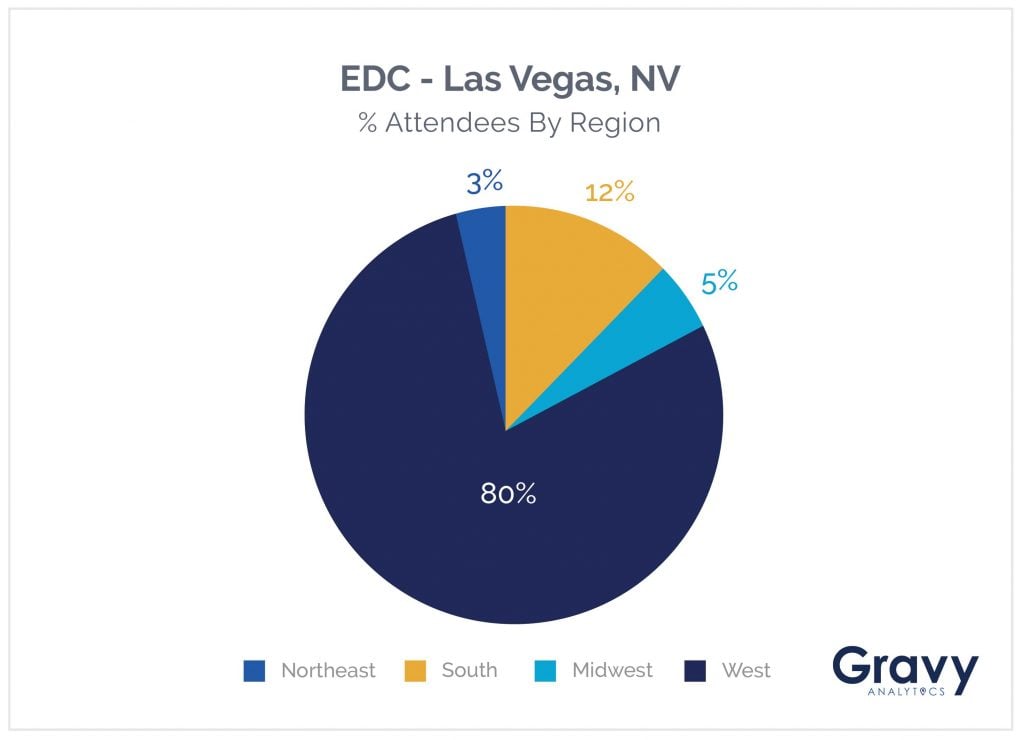

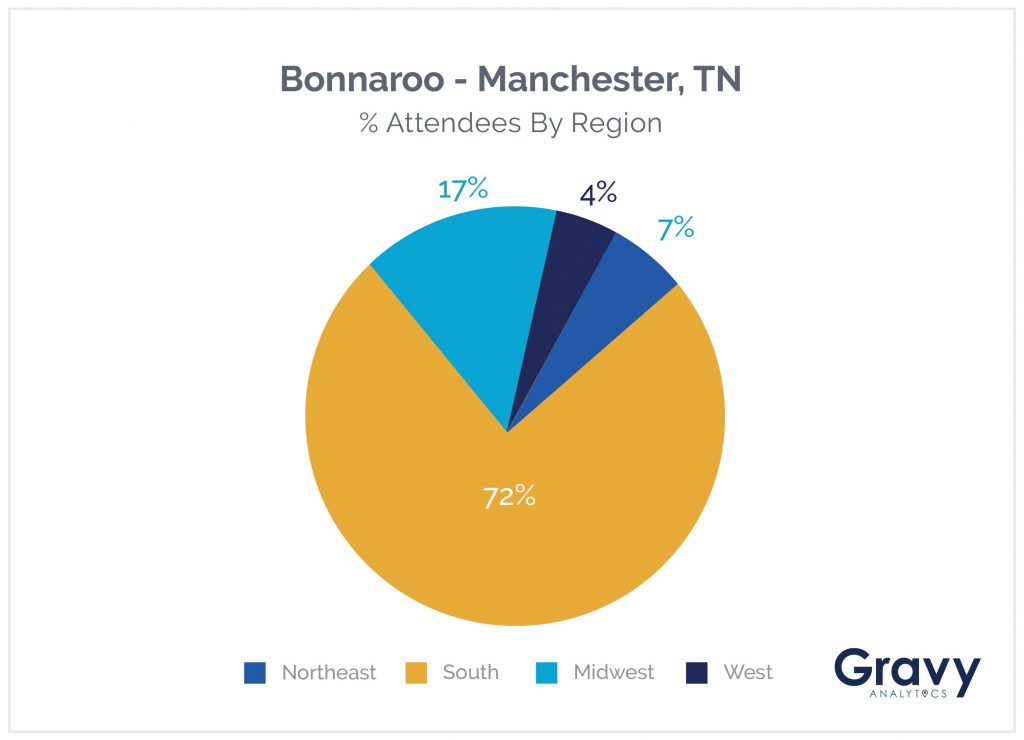

Regional Attraction

Our data shows that music festivals like Bonnaroo, Firefly, EDC, and Coachella are regional pilgrimages. A large majority of attendees at all four events live in the region where the event was held. And, just 0.25% of mobile devices were observed at more than one festival, indicating that very few people attend more than one of these events.

The takeaway? Companies with a nationwide footprint might consider sponsoring two or more festivals to reach an even larger audience. Festival organizers might also approach more regional brands about event sponsorship, knowing that event attendees most often live in the region where the event is hosted.

Alcohol Brands

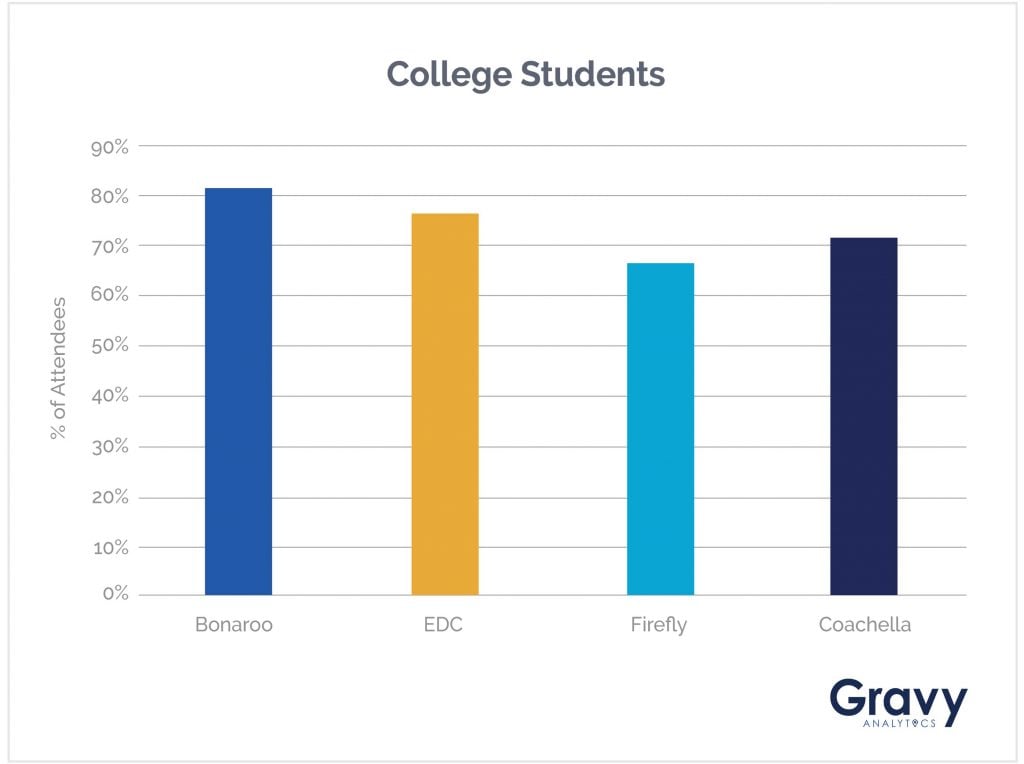

Per the 2017 ESP Sponsorship report, wine and spirits brands were five times more likely to sponsor live music events in 2017, followed by beer brands. All four music festivals attracted alcohol brands as sponsors, ranging from liquor brands Smirnoff and Bacardi, to wine brands Riunite and Cupcake Vineyards, to breweries like Miller Lite, Corona, Dogfish Head and Crazy Mountain. Yet, attendees are largely college students, and our audience analysis shows that less than 35 percent of festival attendees can be characterized as ‘beer lovers’, and less than 10 percent as ‘wine lovers’. So while the audience demographic and profile doesn’t exactly match up, we presume that alcohol brands consider music festival sponsorship an investment in the future.

Auto Brands

Location data provides some intriguing insights for automobile sponsors. For example, Toyota is a sponsor of the 2018 Firefly festival, but data from last year’s Firefly shows that attendees over indexed for visits to Acura dealerships. A missed opportunity, perhaps, for Acura to connect with people considering its cars? Meanwhile, BMW’s sponsorship of Coachella was a smart move: our data shows that Coachella attendees are far more likely to be observed at a BMW dealership than attendees of EDC, Bonnaroo or Firefly.

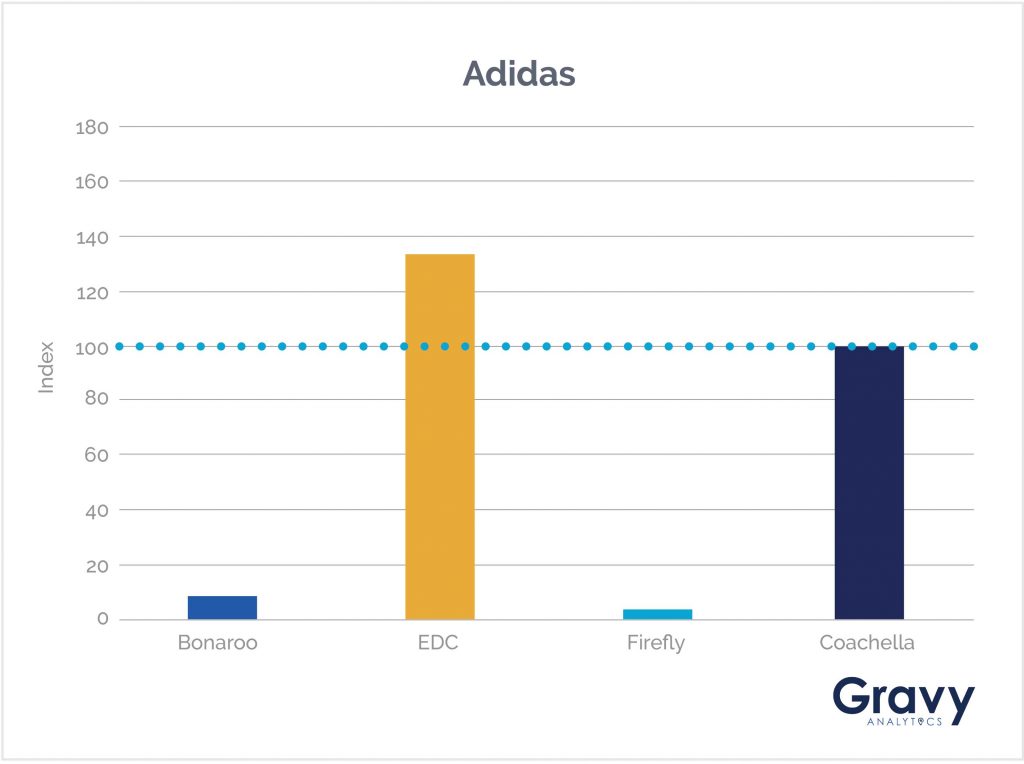

Clothing Brands

Adidas made a good decision sponsoring Coachella this year: location data shows that Coachella attendees make a strong showing at Adidas stores, making this investment a good fit. But, Adidas could get an even bigger return on its music festival sponsorship by adding EDC to its sponsorship plans. Adidas probably shouldn’t consider Firefly or Bonnaroo, however, since our data shows that their event attendees are much less likely to visit Adidas stores.

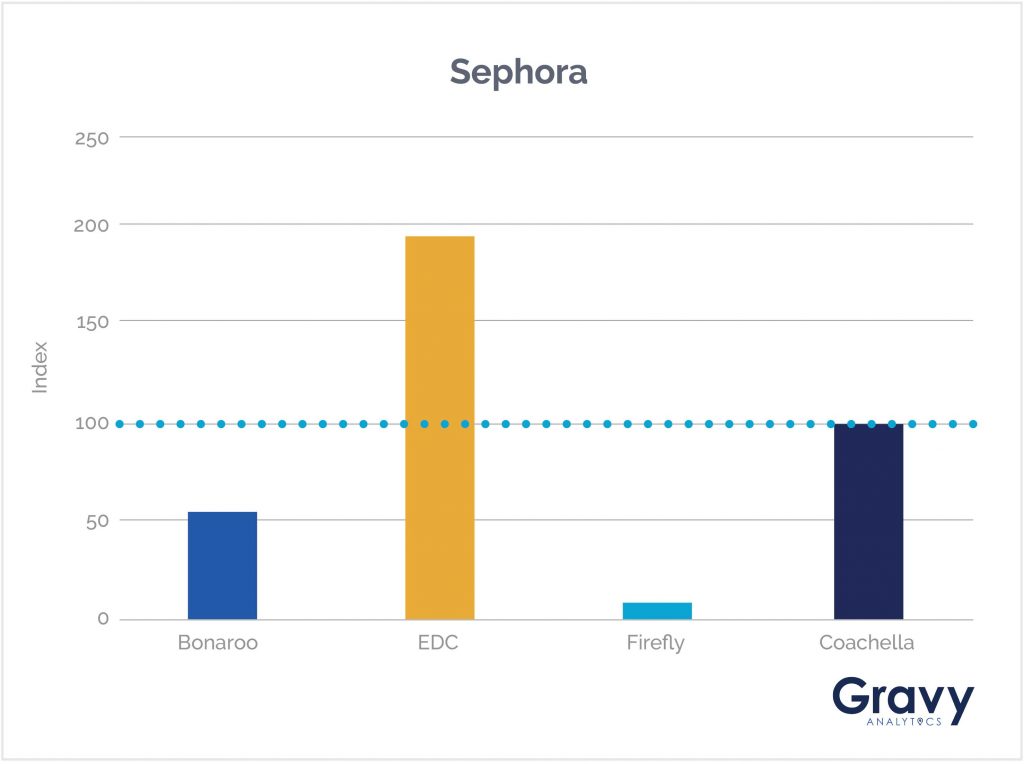

Beauty Brands

Sephora was a sponsor of this year’s Coachella, and that was a solid choice for the brand. Interestingly, our analysis shows that even more of their prospective customers can be found at EDC. For this reason, Sephora – and its competitors like Ulta or Blue Mercury – might consider sponsoring EDC in the future.

Hotel Brands

Music festival-goers often camp on site, but that didn’t stop higher-end hotel brands Ritz Carlton, Marriott, and Starwood from sponsoring Coachella 2018. It turns out that was a good decision: Coachella attendees over index for visits to both general and luxury hotels. But attendees at EDC also over indexed for hotel stays – meaning it might have been an even better sponsorship opportunity for these and other hotel chains.

Music Brands

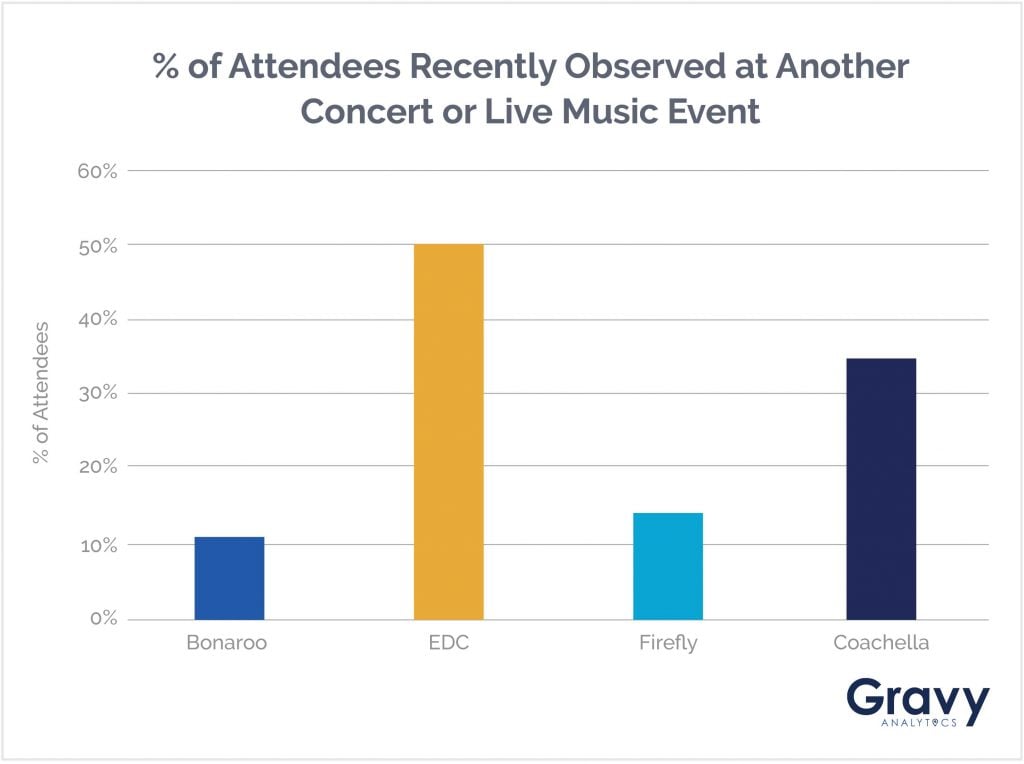

Live music brands, like Red Bull Music and JamBase, stood out for their sponsorship of Bonnaroo last season, but were largely missing from other summer festivals. Is that because Bonnaroo attracts the biggest music fans? Our analysis shows that the biggest live music fans are found at EDC and Coachella. These and other music brands may have engaged more fans elsewhere.

So, On Target – or Not?

In our opinion, it’s a mixed story. It’s clear that for some brands, music festival sponsorship was spot-on. For others, location data might have helped them get more from their spending. What’s clear is that companies of all kinds can benefit from using location-based data to choose their sponsorships – for music festivals, or for another event or venue – in the future.

Rock on.