Post-Pandemic Pharmacy Foot Traffic Trends

January 3, 2023

Amid heightened inflation, store closures, and increased theft, the nation’s pharmacies continue to compete for foot traffic and growth.

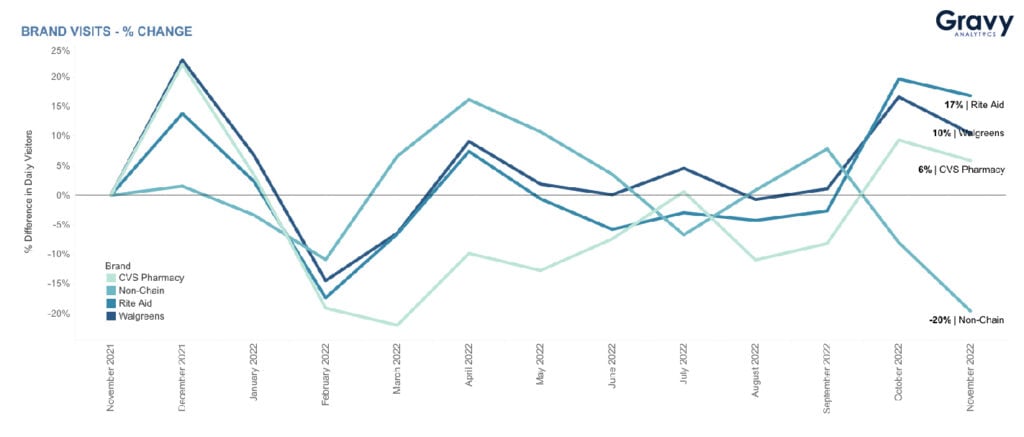

Health and wellness has been a societal theme for the last couple of years, so pharmacies have been a necessary consumer destination for medications, personal care products, and groceries. Now that the pandemic has calmed, are consumers doing away with pharmacy visits? We took a look at foot traffic patterns over the last year at some of the nation’s top pharmacies, including Walgreens, CVS, Rite Aid, and non-chain pharmacies. In short, consumers are still visiting top pharmacies, as foot traffic to the majority of pharmacy brands we analyzed has increased year-over-year, but non-chain pharmacies are feeling the effects of inflation the most.

Top Pharmacy Foot Traffic Trends

Our data shows that in November 2022 foot traffic to Walgreens, CVS, and Rite Aid had increased by 10%, 6%, and 17% respectively year-over-year. Similarly, in the previous year, each brand saw a spike in foot traffic in December 2021. This is likely due to an increased need consumers have for medication and health products to help them fight various illnesses, like COVID-19 and the flu, that typically surge during the holiday season.

However, when looking at foot traffic trends from October to November 2022, our data showed that Walgreens, CVS, and Rite Aid all saw declines in foot traffic. Even though foot traffic is up year-over-year, these companies are feeling the pressure of inflation and the slowing demand for COVID-19 tests and vaccines. As a result, Rite Aid is planning to close 145 unprofitable stores. In addition, both CVS and Walgreens have announced plans for store closures, with CVS planning to close 900 stores over three years, and Walgreens in the midst of closing 200 stores.

While these large pharmacy brands may be course-correcting in hopes of continuing to maintain and grow business in 2023, it’s local, non-chain pharmacies that are experiencing the biggest declines in foot traffic and may need to make significant changes to their business strategies. According to our data, non-chain pharmacies have seen a 20% decline in foot traffic year-over-year. As many consumers look to save money during this time of heightened inflation, big brand pharmacies may be drawing in customers with loyalty programs, sales, and coupons. These opportunities to save money could be the deciding factor for consumers to choose to shop at large national chains over independent pharmacies.

Is Theft Getting Out of Hand?

A challenge that all pharmacies will have to grapple with this year is increased theft, particularly in big city locations. In New York City, theft cost Rite Aid $5 million last quarter, and CVS has closed stores because of it. Inflation, unemployment, and overall post-pandemic desperation could be causing more shoplifting in drugstore chains, particularly in urban areas. Rite Aid, Walgreens, and CVS have all begun to see the consequences of theft in their stores. These stores are installing locked plexiglass cases over sought-after goods to prevent stealing—sometimes even for low-priced items like toiletries. These locked cases could mean less sales on those items, and even less returning customers who may equate locked up merchandise with increased risk of danger.

As top pharmacies continue to navigate post-COVID societal shifts, one thing’s for sure: the competition is strong as these brands strive to be the consumers’ pharmacy of choice amid ebbs and flows in foot traffic. Walgreens could see a rise in visits soon as they’ve just increased their investment in healthcare, but Rite Aid may be the top pharmacy chain to watch in 2023 as the brand has seen the highest increase in visitors year-over-year.

To learn more about our foot traffic data and services, contact an expert at Gravy Analytics today.