Q3 2021 Customer Loyalty Trends Part 1: Place Categories Analysis

December 21, 2021

Return visits are the true measure of customer loyalty. When customers return to a specific retail store time and time again, this indicates that they are interested in the products and services offered by that particular brand. In our Q3 2021 Consumer Trends Report, we analyzed return visits to leading brands. Now, we are taking a closer look at return visits to place categories—including Accommodations, Shopping, and Entertainment—to compare the percentage of visitors who return within 7 days, 30 days, 3 months, and 6 months, and to see how things have changed since 2019.

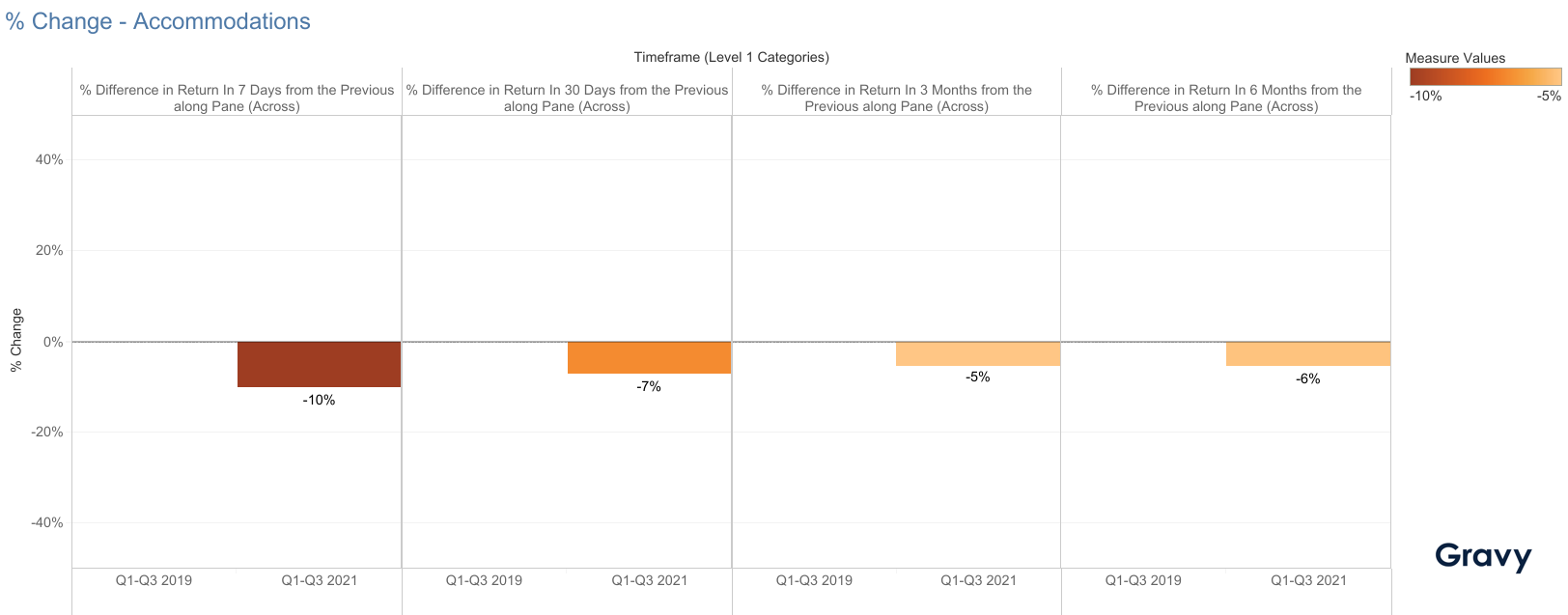

Accommodations

Overall, the hotel industry saw fewer return visitors in 2021 compared to 2019. Hotels had 10% fewer visitors return within 7 days—a bigger decrease than at 30 days, 3 months, or 6 months. The pandemic has changed how consumers travel for vacation and business. According to CFRA Research, business travel is down by 50% and airline traffic is now being driven by domestic leisure travel. While business events are starting up again and travel restrictions are gradually being eased, many are still putting off unnecessary travel in 2021.

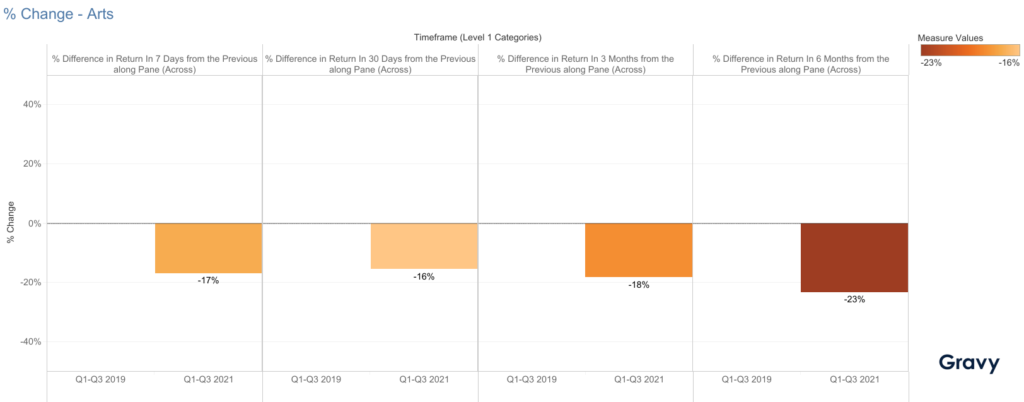

Art Venues

Art venues also saw fewer return visitors in 2021 than in 2019. Art venues saw 17% fewer visitors return within 7 days, and 23% fewer visitors return within 6 months. This could indicate that more people are attending art-related events infrequently, just a few times a year. Due to the pandemic, many arts venues continued to cancel or reschedule shows in 2021 for later in the year or early 2022.

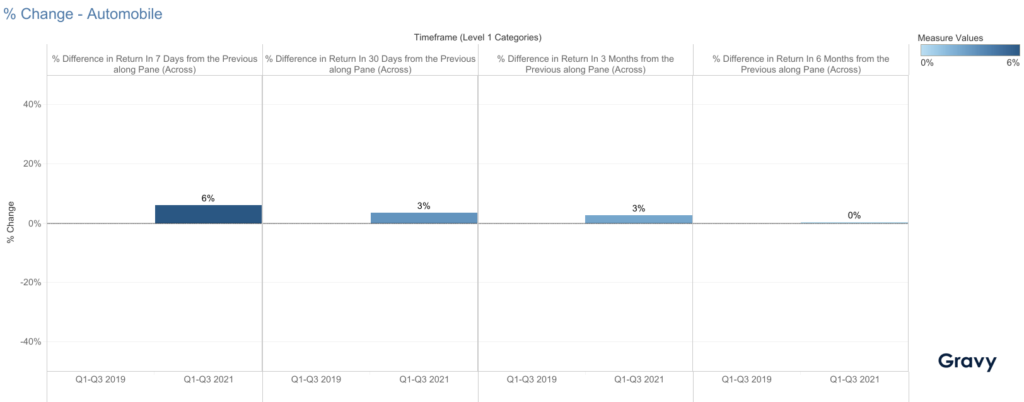

Automobile

The Automobile category, however, saw a higher number of return visitors in 2021 than in 2019. In 2021, car dealerships and auto repair shops saw a 6% change in visitors returning within 7 days, while at 6 months, returning visitors stayed flat. This could indicate that consumers who are interested in purchasing a car or getting a car repaired are making more frequent visits during the process.

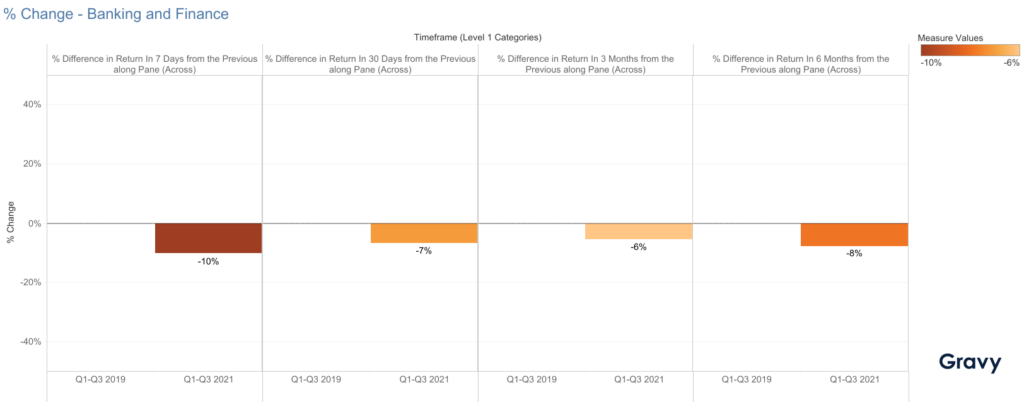

Banking and Finance

Banking and finance businesses saw fewer return visitors in 2021 than in 2019. In 2021, financial institutions had 10% and 8% fewer return visitors within 7 days and 6 months, respectively. During the COVID-19 lockdowns in 2020, many consumers opted for online and mobile banking. With online options, customers didn’t need to visit banks as often to withdraw or deposit money. In 2021, consumers might only visit a bank to meet with an associate or for services that must be conducted in-person.

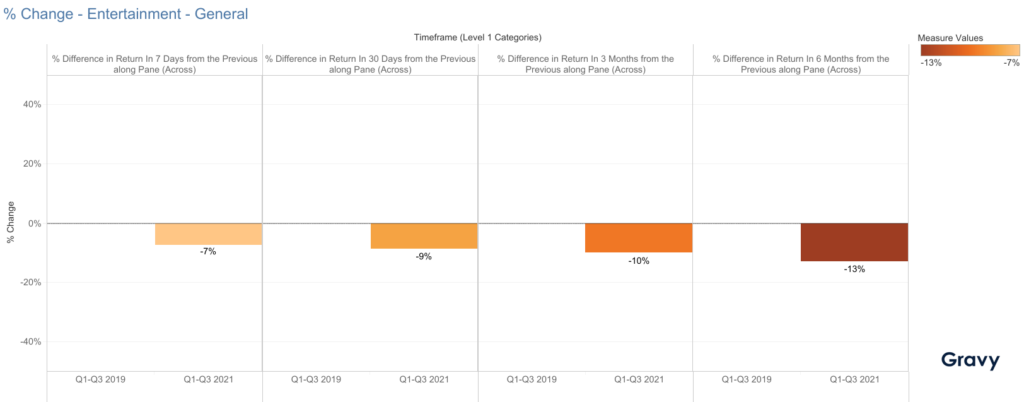

Entertainment Venues – General

In 2021, entertainment venues saw 13% fewer return visitors within 6 months than in 2019. When consumers go to Entertainment venues it is often a special occasion, such as to attend a specific event. Like art venues, entertainment venues also canceled or rescheduled many events throughout 2020 and 2021. Whether a football game or pop music concert, going to events in person seems to be a less frequent indulgence in a post-COVID world.

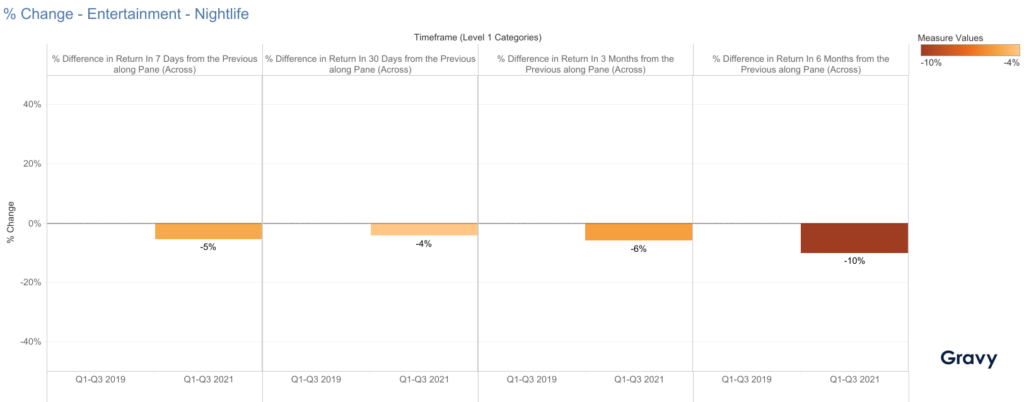

Entertainment Venues – Nightlife

Nightlife venues exhibit trends similar to the Entertainment – General category. In 2021, nightlife venues saw 5% fewer visitors return within 7 days and 10% fewer visitors return within 6 months compared to 2019. Again, consumers are probably less inclined to return to comedy clubs, nightclubs and other nightlife venues due to the need for continued social distancing and new habits developed over the course of the pandemic.

The Rise of Occasional Customers

Based on our data, it’s apparent that many venue categories are seeing more occasional customers. With the notable exception of visitors to Automobile venues, consumers simply aren’t returning as frequently to places in the entertainment, travel, or banking sectors in 2021. In part two, we will examine even more place categories to see what other emerging trends we can uncover. For more information on how your business can use consumer loyalty data to improve the customer experience, contact a location intelligence expert at Gravy Analytics today.