Q4 2022 Consumer Trends Report: Grocery Shopping Trends & Predictions

February 23, 2023

Our Q4 2022 Consumer Trends Report makes one thing clear: necessity and value are what people are shopping for these days. Our report found that, of all the shopping destinations in our database, food stores saw some of the highest growth in year-over-year foot traffic. With significant growth in this category, it appears that grocery shopping trends are shifting, but how?

Grocery Shopping Trends in Foot Traffic

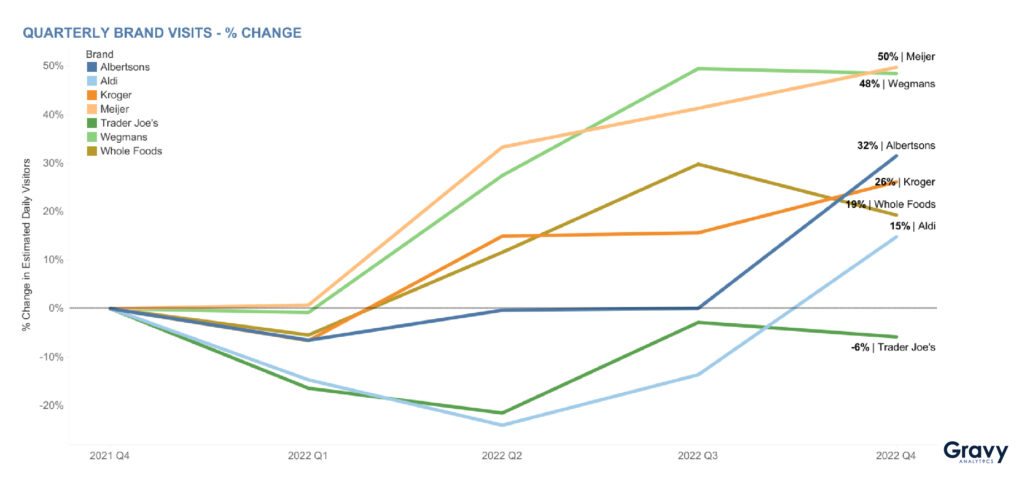

In our recent report, Gravy analyzed foot traffic trends at top food stores from Q4 2021 to Q4 2022. Overall, the food stores category as a whole saw a 22% increase in foot traffic year-over-year. This happened as pandemic restrictions lifted and consumers adjusted to a new normal. So, more and more Americans likely began returning to in-person shopping, especially for necessities such as groceries.

We analyzed the following grocery chains: Meijer, Wegmans, Albertsons, Kroger, Whole Foods, Aldi, and Trader Joe’s. From Q4 2021 to Q4 2022, all of these companies experienced growth in year-over-year foot traffic except one: Trader Joe’s. Trader Joe’s saw a decrease in foot traffic by -6% year-over-year. This is likely due to a variety of factors, such as crowded stores and the lack of self-checkout options.

These limitations could have made the shopping experience less efficient or less appealing for some customers. Moreover, Trader Joe’s does not offer curbside pickup or delivery, and it does not work with third-party delivery services. This makes it less convenient for customers who prefer pickup or delivery options that skyrocketed in popularity during the pandemic.

Conversely, all the other brands in the grocery store category saw significant year-over-year foot traffic growth. Meijer, this category’s top performer, experienced an increase of 50% in year-over-year foot traffic, and is likely to continue attracting customers in 2023. Being as Meijer is one of the top 10 brands to watch for foot traffic growth this year, it makes sense that it would be the category’s leading brand. So, why are companies like Meijer attracting the most growth in foot traffic recently?

Meijer: Continuing to Take the Lead

Meijer, a family-owned midwestern supercenter chain, has a few initiatives underway that may be contributing to its growth. In 2023, the company is expanding not only in store locations, and owned brands, but also in store formats. Meijer currently has four small-store format locations, offering shoppers a quick, convenient shopping experience. These small stores focus on local goods and necessities, likely attracting new and returning customers. Meijer plans to introduce a mid-sized store format larger than its small stores. It also plans to continue emphasizing store formatting to meet unique community needs or interests. This store formatting strategy could lead to new grocery shopping trends and habits this year, and it may be the perfect way to increase foot traffic.

On top of that, the local, fresh goods at Meijer stores, along with the company’s support of farming education and environmental initiatives, may appeal to consumers looking to support companies that align with their morals and values.

Meijer, along with a number of other grocery stores, has been focusing on improving their loyalty program as well. With more customer rewards, these programs have become a popular strategy for enhancing customer satisfaction and loyalty. As Americans continue to grapple with economic disruptions post pandemic, the value and benefits of these loyalty programs have only become more important.

What Sets Competitors Apart?

As many food stores continue improving loyalty programs to attract more visitors, they may also emphasize appealing to consumers’ needs and preferences. For example, in this category, Trader Joe’s saw a decrease in year-over-year foot traffic. Although the company is fairly well-known and popular, other competitors could be swaying Trader Joe’s customers. Convenience is a major selling point in the grocery market, and Trader Joe’s lack of emphasis on convenience may be why shoppers are choosing other brands like Aldi.

Offering many specialty food items, low prices, and locally-sourced produce, Aldi checks many boxes that Trader Joe’s does, plus one: convenience. Aldi’s delivery, pickup, and money-back guarantee is likely why the company saw a 15% increase in year-over-year foot traffic. As more companies adapt to the changing needs and habits of their communities, they will likely see more foot traffic as the year progresses.

Future Predicted Trends

Groceries are some of the top necessities shopped across the country, so it’s no wonder food stores have seen substantial growth. As more brands appeal to the values and preferences of consumers, food stores could see a surge in foot traffic, as well as competition, this year. For example, companies like Whole Foods are planning to incorporate eco-friendly initiatives and sustainability as they look to grow. Whole Foods is also emphasizing convenience, like its integration with Amazon’s Dash Cart service, allowing customers to skip the line entirely.

All of the grocery chains we analyzed that are currently seeing foot traffic growth are expanding digitally. This could lead to continued success for these brands in 2023. Not only do digital shopping options appeal to new generations of shoppers, but they are more convenient. They also allow customers to gain loyalty rewards and discounts.

This year, grocery shopping trends will likely continue shifting with the ever-evolving needs and interests of shoppers. Food stores that cater to a wide range of consumer preferences are likely to see an increase in foot traffic. As shoppers become more discerning in their purchasing decisions, food stores that are able to provide an efficient and personalized shopping experience are more likely to succeed.

For more insight into current consumer trends across a variety of place categories and brands, download the full Q4 Consumer Trends Report today.