A Summertime Foot Traffic Boost for Subway, Arby’s, and Cousins Subs

April 27, 2022

Fast-food sandwich chains like Subway are dealing with a shift in consumer dining habits. Consumers are once again going out to eat more, but are they still visiting sandwich shops? Restaurant food delivery services have grown by 40% in the past five years. This could indicate that more consumers are opting for delivery rather than pickup at their favorite sandwich chains. We analyzed foot traffic to Subway, Arby’s, and Cousins Subs to determine how consumer dining choices at fast-food sandwich chains in 2021 will shape those in 2022.

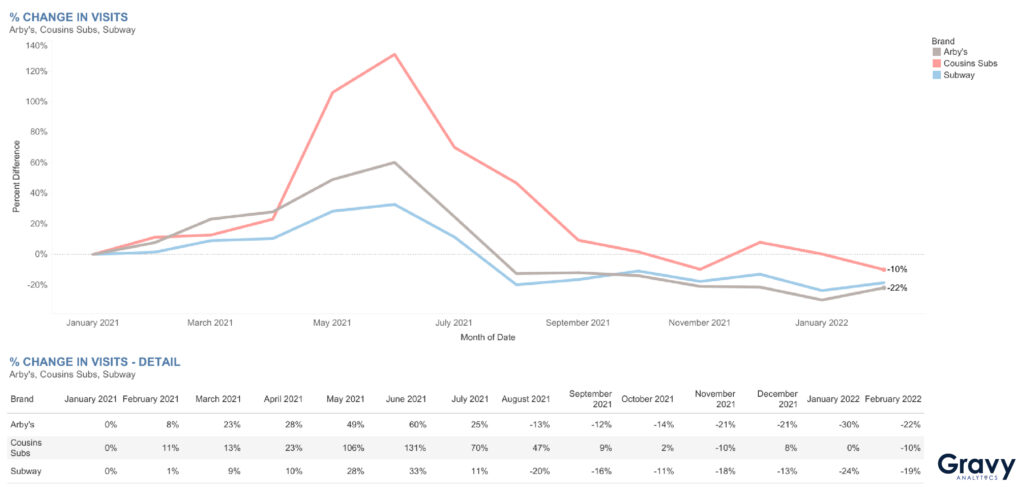

Starting in April 2021, foot traffic to sandwich shops increased, compared to January 2021 levels, and peaked in June 2021. This could reflect consumers purchasing sandwiches to take with them on summer adventures to parks and beaches. After June 2021, all sandwich shops that we analyzed saw sharp declines in foot traffic, perhaps an effect of sandwiches being eaten at home as people returned to their routines after the summer. This decrease in foot traffic might not be seasonal consumer behavior, but instead a result of the overall consumer shift to at-home dining, which has become much more common in a post-COVID world.

Beginning in August 2021, foot traffic to Subway restaurants remained relatively flat but continued to stay below January 2021 levels into the first two months of Q1 2022. By February 2022, Subway’s foot traffic was 19% lower than January 2021. Arby’s saw a slight decline in foot traffic after August 2021; February 2022 foot traffic was 22% lower, compared to January 2021. Cousins Subs sustained its foot traffic above January 2021 levels, except in November 2021 and February 2022. Unlike national brands Subway and Arby’s, Cousins Subs is a smaller, regional brand with stores in Wisconsin and Illinois. Regional differences in consumer dining behavior could explain why, as of February 2022, its foot traffic was only 10% lower compared to January 2021, whereas Subway and Arby’s experienced greater decreases in foot traffic.

The Future of Subway and Fast-Food Sandwich Chains

Based on our data, it can be concluded that sandwich-focused chains should continue to invest in takeout and delivery options to keep consumers coming back. While we do expect sandwich shop foot traffic to increase again in the spring and summer of 2022, at-home dining lets sandwich shops potentially serve even more customers without expanding dining room size. For more information on using foot traffic to predict brand performance, contact one of our location intelligence experts today.