Top Consumer Trends 2020: Arts & Crafts Supplies

February 4, 2021

There were many top consumer trends in 2020: sourdough bread starters, curbside pickup, and athleisure wear. One consumer trend of 2020, which didn’t get as much attention, was arts and crafts supplies. As more consumers stayed at home due to the coronavirus pandemic, there was a surge in demand for craft projects for both children and adults. Arts and crafts stores saw sales increase significantly, possibly due to consumers working DIY home improvement projects and parents looking for non-digital activities to keep their kids busy.

We analyzed 2020 data for Hobby Lobby, Michaels, and mom-and-pop arts and crafts retailers to see if consumer demand is reflected by in-store foot traffic, and which states saw the most interest in this consumer trend. (Keep in mind that this data analysis focuses on comparing foot traffic to February 2020.)

The Swift Recovery of Hobby Lobby

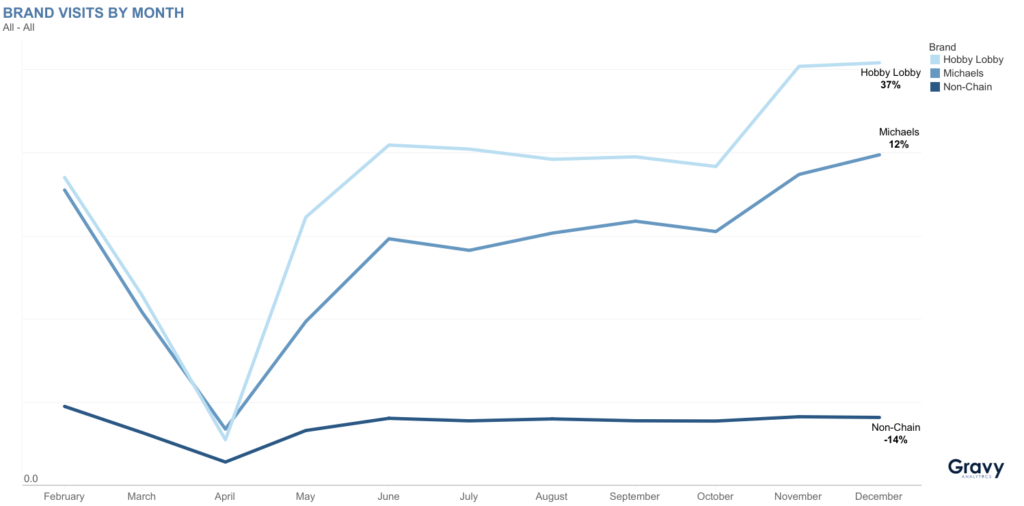

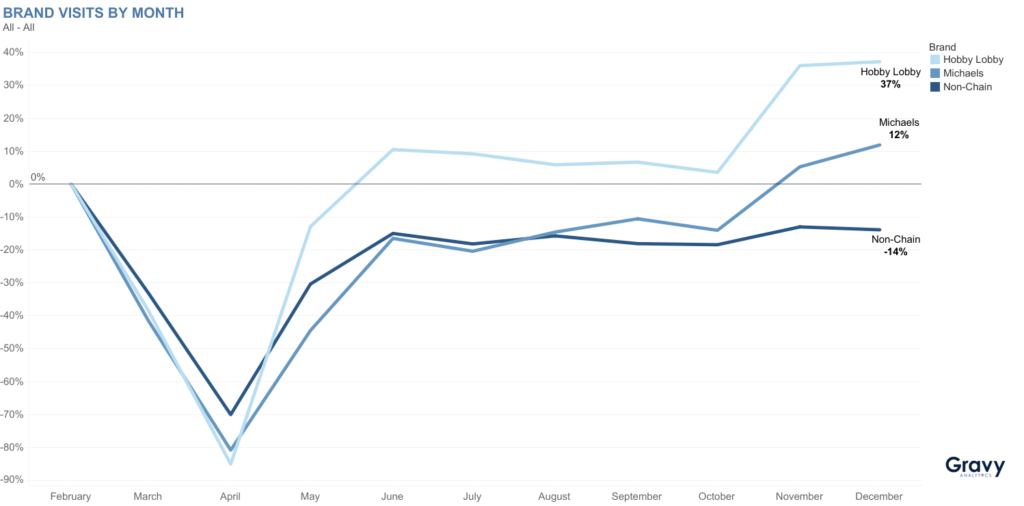

Overall, Hobby Lobby stores had more visitors than Michaels or mom-and-pop craft retailers in 2020. Of course, April was a challenge for all of these retailers. During April 2020, non-essential stores closed, and this included arts and crafts retailers such as Hobby Lobby, Michaels, and mom-and-pop stores. It isn’t much of a surprise that foot traffic was at its lowest points across the board for these retailers during this period of time. Interestingly enough, Hobby Lobby was the most impacted compared to Michaels and non-chains; foot traffic was 85% lower than pre-COVID levels. Hobby Lobby recovered foot traffic faster than Michaels, starting in May once stores reopened again. It’s important to note that mom-and-pop stores seemed to be less impacted by the closures in April.

Hobby Lobby continued its recovery in foot traffic throughout much of the summer and early fall, but it saw a boost in foot traffic around November and December. Michaels saw this same boost as well during the holiday season. Let’s take a closer look at the December holiday rush trends for arts and crafts retailers.

A Holiday Rush for Arts and Craft Supplies in December

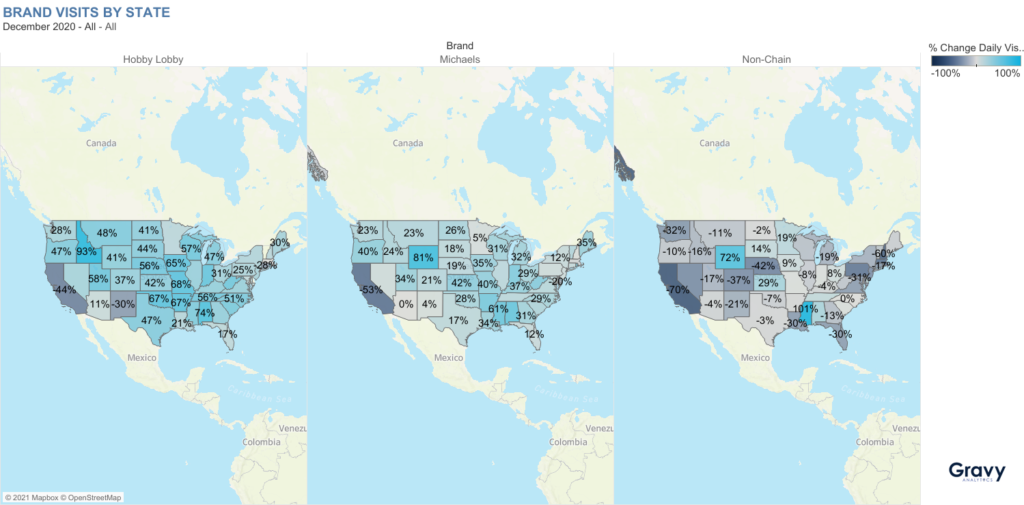

In December, consumers across the U.S. flocked to Hobby Lobby stores, with the exception of California, New Mexico, and Connecticut. In contrast, Michaels also saw foot traffic during the month of December severely impacted in California. Foot traffic to Hobby Lobby stores was 37% higher while Michaels was 12% higher compared to February 2020. This could be due to consumers going out to find supplies to create homemade gifts for family and friends. Mom-and-pop craft retailers were impacted the most compared to Hobby Lobby and Michaels but they saw bright spots in certain states, including Mississippi, Wyoming, and Kansas. Foot traffic to non-chains in Mississippi was 101% above pre-COVID levels.

The Future of Arts and Crafts Retailers

Why are U.S. consumers preferring Hobby Lobby over other arts and crafts supply retailers? One possibility is there are more Hobby Lobby stores than Michaels in certain parts of the U.S. Even before the pandemic, some Michaels’ stores closed, which might have led to more consumers having to go to Hobby Lobby or local stores for their craft supplies. Despite this initial setback, Michaels has recovered foot traffic above pre-pandemic levels.

As consumers are spending more time at home, the demand for arts and crafts supplies is going to continue to increase well into 2021. Based on the trajectory of this top 2020 consumer trend, we predict that Hobby Lobby and Michaels will continue to recover faster than mom-and-pop stores. However, to meet the demand, Hobby Lobby and Michaels will have to make sure they create a seamless shopping experience from online to in-store for their customers.