Retail Analysis: Are Department Stores Recovering Foot Traffic?

August 6, 2020

For the past couple of months, department stores have been adapting their customer experience and inventory to meet new customer expectations. They are also having to reassess and adapt their marketing and advertising strategies to a new economy. Retailers are determined to drive foot traffic back to their stores, and retail industry recovery will only come with continued innovation and adaptability.

In April, we analyzed select retail stores to see how they had been impacted by the coronavirus pandemic. Now, we are taking an in-depth look at four leading department stores, Kohl’s, Macy’s, Nordstrom, and Sears, to see how their foot traffic has changed through June 2020.

Is Foot Traffic at Department Stores Recovering from COVID-19?

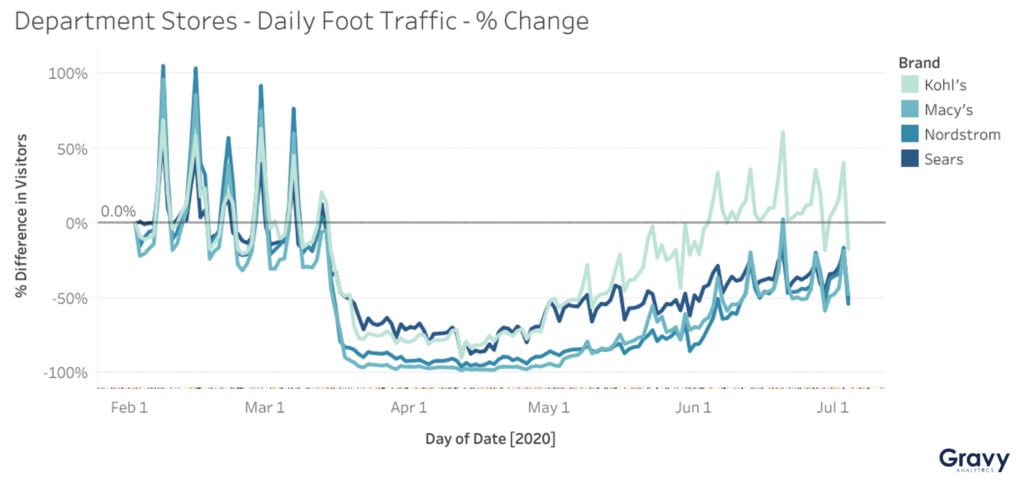

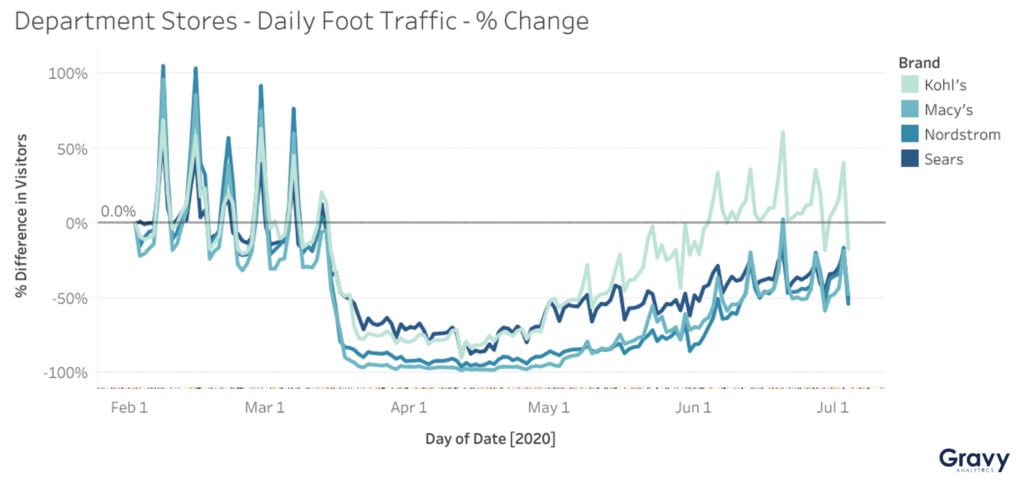

Foot traffic to department stores remained normal throughout February, significantly declined starting mid-March, and reached its lowest point in April, most likely due to social distancing measures that required retail store closures. Foot traffic began to gradually recover in late April and throughout May as stores began to reopen. In June, most department stores saw their foot traffic begin to level off, with the notable exception of Kohl’s.

Do Holidays Still Drive Department Store Foot Traffic?

Holidays, like Black Friday, have always been a major driver of foot traffic to department stores. Department stores saw spikes in foot traffic on Valentine’s Day, Mother’s Day, and Father’s Day. However, foot traffic to these brands was significantly impacted for holidays in March (St. Patrick’s Day) and April (Easter and Passover), which was probably due to store closures and consumers re-prioritizing their spending habits early on in the coronavirus pandemic.

Which Department Store is Recovering the Most Foot Traffic?

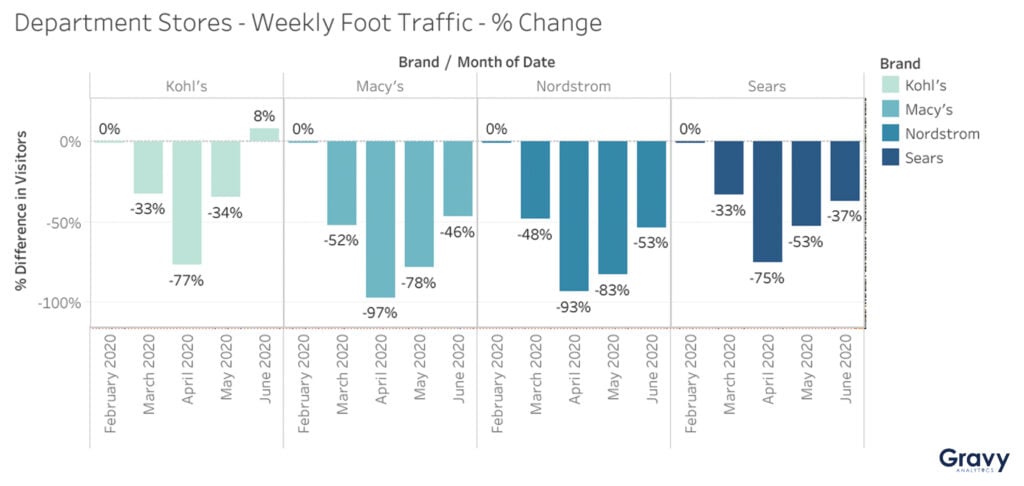

While all department stores are seeing foot traffic recover, Kohl’s is rebounding faster than others. For the month of June, foot traffic to Kohl’s was 8% higher compared to the week of February 2. In contrast, foot traffic at Macy’s and Nordstrom remained 46% and 53% lower, respectively, than the week of February 2. Kohl’s online presence, partnership with Amazon, and contactless drive-up service, may be a few of the reasons behind its more rapid recovery.

While Macy’s and Nordstrom do have an online presence, they are known for selling more expensive items and have had to recently downsize their stores. Sears hasn’t been as impacted as Macy’s and Nordstrom, but still lags behind Kohl’s in its recovery. During the month of June, Sears foot traffic remained 37% lower compared to the week of February 2. Unlike the other department stores we examined, Sears sells large appliances and mattresses, which may be appealing to customers who are looking to spruce up their living spaces.

The Future of Department Stores

Kohl’s appears to have the ideal business model for department stores. According to our economic activity dashboard, Kohl’s foot traffic continues to surpass other department stores, with July foot traffic 1% higher than in February. But, will Kohl’s foot traffic continue to hold against other stores now evolving their own best practices? With back-to-school and holiday shopping quickly approaching, we expect that Kohl’s foot traffic will remain higher than its competitors. To keep up with Kohl’s, major department stores are going to have to adjust their product and service offerings to meet the needs of customers concerned with safety, convenience, and cost.