How to Improve Staffing Strategies with Location Intelligence

January 18, 2021

The Great Resignation has caused a wave in the working world. Job openings in the U.S. increased by 431,000 to about 11 million in October 2021. With the emergence of the omicron and delta COVID-19 variants, the labor market in 2022 is expected to look a lot like 2021.

With labor shortages across industries putting a strain on employees and business operations, companies are going to need real-world data to make informed staffing decisions. What exactly is real-world data? It is data that measures consumer behavior based on the actions consumers take in the physical world. We call this real-world dataset location intelligence.

Let’s discuss one potential use case: determining the percentage of a business’s visitors who are employees vs. customers. This type of data can provide a business with insight into how its staffing compares to its competitors, and how its staffing strategy might make or break the customer experience. Let’s take a look at the percentage of employees at major brands in the hotel, restaurant, and retail sectors.

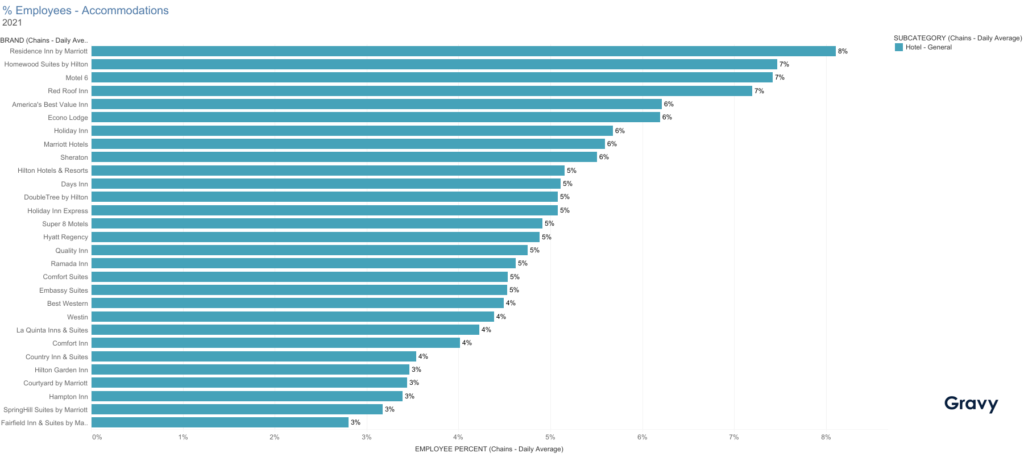

Hotel Employees

The hotel industry, in particular, has had to adapt to many shifts in consumer travel behavior during the pandemic. Many consumers canceled travel plans early on in the pandemic, and hotel brands adjusted staffing accordingly. However, in October 2021, hotel job growth began to recover as leisure travel took off again. Which hospitality brands had the highest percentages of employees in 2021? Oddly, budget hotels, like Red Roof Inn and Motel 6, had a higher percentage of employees on-site than many premium hotel brands. Residence Inn by Marriott had the highest percentage of employees among the hotels we examined, and more than any other Marriott-branded hotel.

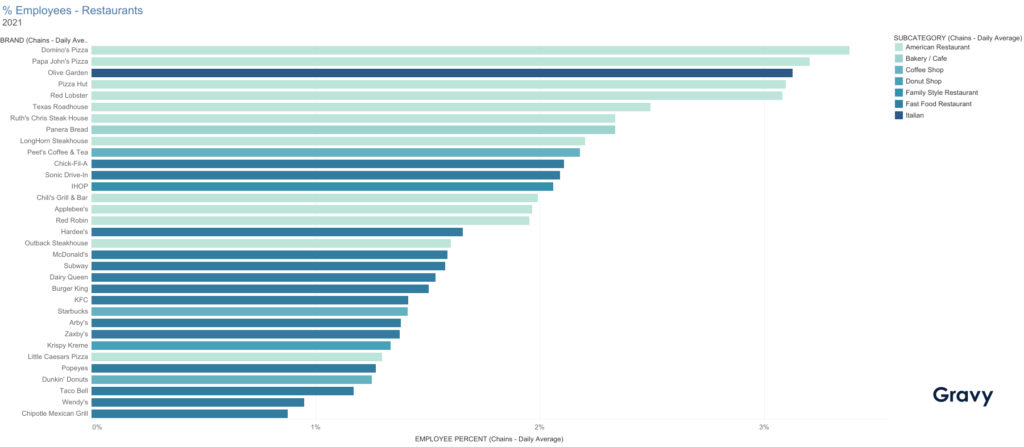

Restaurant Employees

Which restaurant brands had the highest percentage of employees in 2021? Domino’s Pizza and Papa John’s Pizza. These popular pizza chains have business models that are designed around delivery–the more drivers, the better. Because many customers prefer to have their pizza delivered rather than picking it up in-person, this could explain why both pizza chains have a high percentage of employees at their locations.

Our data also shows that most sit-down restaurants have higher ratios of employees to customers, while fast-food brands are the opposite. The notable exceptions? Chick-fil-A and Sonic.

Chick-fil-A is known for its high customer service standards, which impacts how the company hires. Chick-fil-A only hires 0.4% of job applicants, and the company is very selective about its franchise owners. Sonic is known for its drive-in model where customers are served food in their cars. This business model thrived during the pandemic and, as a result, Sonic is investing in technology to further enhance its customer experience without taking away from the high-quality service provided by carhops.

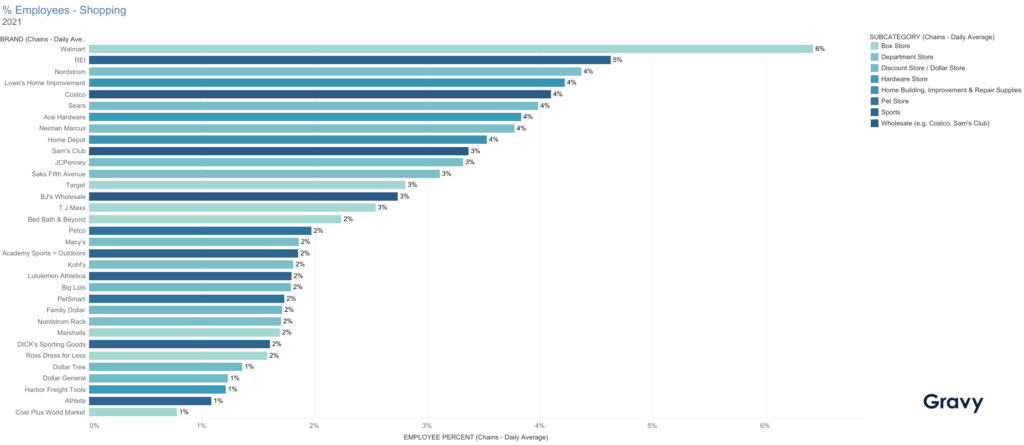

Retail Employees

In the retail sector, hiring slowed significantly in 2021. Some major retailers started massive hiring campaigns while others adjusted their business models to account for a smaller workforce. Surprisingly, Walmart had the highest percentage of store employees, followed by REI and Nordstrom. Walmart’s push to hire more employees in 2021, especially during the holiday season, may be why the big-box retailer made the top of our list. Increased consumer interest in outdoor activities might have caused REI to hire more employees to assist customers shopping for sports equipment.

Nordstrom, a luxury retailer known for its customer service, launched a strategy in 2021 that leveraged the company’s physical locations and digital assets to elevate services, merchandise, and delivery in its top 20 markets. This growth strategy could account for the high percentage of employees in Nordstrom’s stores. It is interesting to note that other high-end department stores, like Neiman Marcus and Saks Fifth Avenue, have a lower percentage of employees than Sears. Less surprising are discount stores, such as Dollar Tree and Dollar General, near the bottom of our list. This reflects Dollar Tree’s and Dollar General’s strategy to keep operating costs low.

Staffing for Improved Customer Experience

A better customer experience is a win-win for businesses, employees, and ultimately, customers. Companies need data they can rely on to better understand how their staffing strategies compare to others in the category and impact their customer experience. For more information on how your business can create a data-driven staffing plan with location intelligence, contact an expert at Gravy Analytics today.