Who is Whole Foods Market’s Biggest Competitor?

May 9, 2022

Consumer grocery shopping habits are shifting due to high inflation rates. A recent survey by American Consumer Credit Counseling (ACCC) found that 19% of Americans are cutting back on grocery spending. Supply chain challenges, inflation, and other factors have caused many grocery retailers to switch up their strategies to drive customers to stores. Some grocers chose to focus on advertising store brand essentials. Others chose to close underperforming locations and focus on where their brand is thriving the most.

For example, Whole Foods Market, which specializes in organic groceries, announced the closure of a few of its stores in certain locations. It can be expected that some other grocery retailers might follow (or have already followed) in Whole Foods Market’s steps to reduce brick-and-mortar stores to focus on other areas of growth such as grocery delivery. This shift could possibly result in consumers going to discount/dollar stores, wholesalers, and other types of food stores (think convenience stores) instead of traditional grocery stores for essentials. This will more than likely result in more competition for grocery stores, especially specialty ones like Whole Foods.

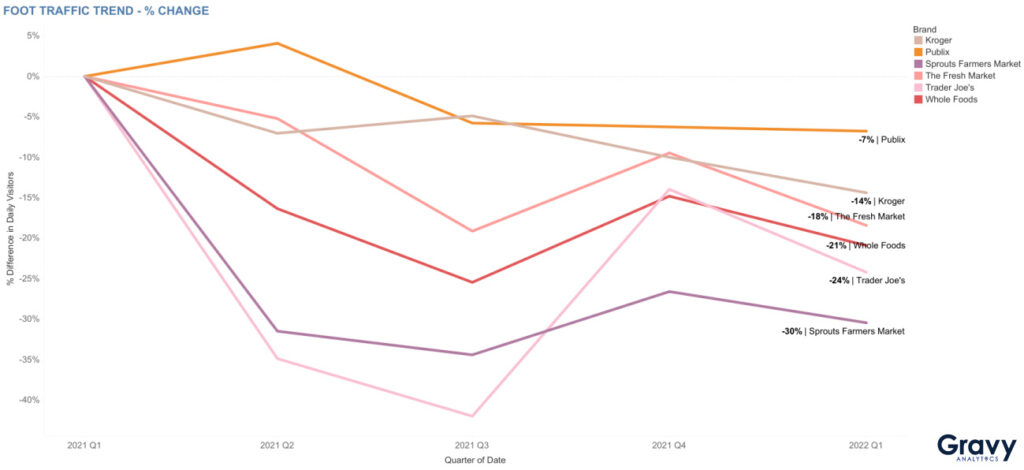

How is Whole Foods doing in comparison to its competitors? We analyzed foot traffic data to Whole Foods locations, as well as Kroger, Publix, The Fresh Market, Sprouts Farmers Market, and Trader Joe’s, to see how the Amazon-owned grocery brand performed amongst its competitors in Q1 2022, compared to 2021.

Food Stores vs. Discount Stores and Wholesalers

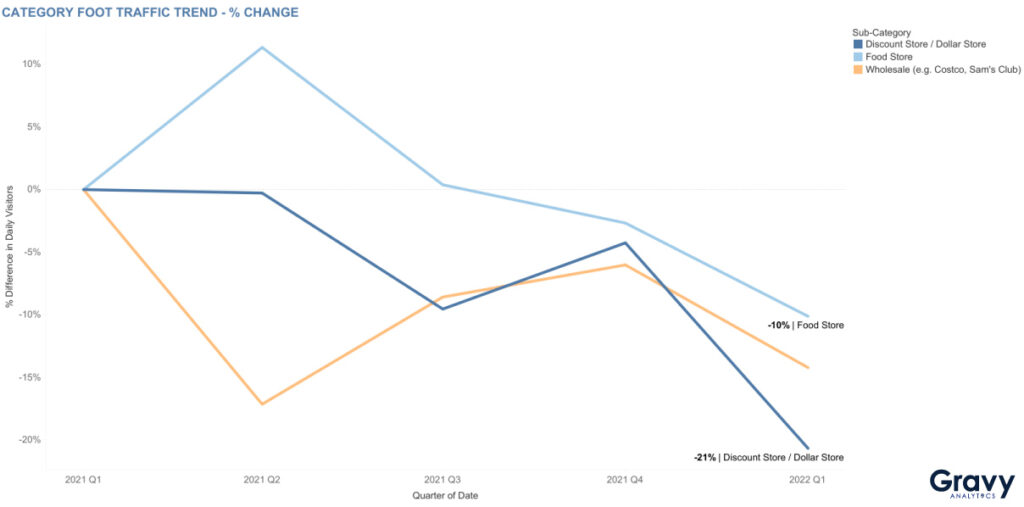

First off, we need to take a look at the overall market landscape before we start to understand how Whole Foods did against its competitors in Q1 2022. Food stores (which include convenience stores and grocery stores) saw a peak (+11%) in Q2 2021. But by Q1 2022, foot traffic to food stores had decreased and was 10% lower, compared to Q1 2021. The sharp decline in foot traffic to food stores could be a result of inflation and the increase in use of grocery delivery services. Discount and dollar store foot traffic declined after Q2 2021, but traffic increased again after Q3, peaking in Q4 2021. However, by Q1 2022, foot traffic to discount and dollar stores was 21% lower, compared to the first quarter of 2021.

Wholesale foot traffic was at its lowest point in Q2 2021, but saw a gradual increase before declining again after Q4 2022. Q1 2022 foot traffic to wholesalers was 14% lower than Q1 2021. Wholesale retailers sell products in bulk, and while this often means a lower cost per item, buying in bulk is typically more costly upfront, compared to buying items in smaller quantities at grocery stores. With inflation making wholesale prices even higher, this could explain why foot traffic remained below Q1 2021 levels.

Whole Foods Market’s Latest Competitors: Publix, Kroger, & The Fresh Market

Similar to some of its competitors, Whole Foods Market saw foot traffic decrease starting in Q2 2021, and then increase slightly after Q3 2021. Whole Foods, Trader Joe’s, Sprouts Farmers Market, and The Fresh Market all saw peaks in foot traffic around Q4 2021, during the height of the holiday meal prepping season. Interestingly, Kroger’s peak in foot traffic came in Q3 2021, followed by a decline in foot traffic. By Q1 2022, Kroger was 14% lower, compared to the first quarter of the previous year. Publix’s foot traffic peaked in Q2 2021, but then declined and remained flat into 2022. By Q1 2022, foot traffic to Publix stores was 7% lower than Q1 2021. Both Kroger and Publix aren’t specialty stores like Whole Foods and are known for low prices. The Fresh Market’s prices are similar to Whole Foods, but the Greensboro-based supermarket’s advantage may be its focus on having only 159 locations in the U.S. vs. Whole Foods’ 500-plus locations. Based on our consumer foot traffic data, the competitors that Whole Foods will have to watch out for in the coming months are Kroger, The Fresh Market, and Publix.

Driving Grocery Store Foot Traffic During High Inflation

Inflation rates aren’t expected to decrease anytime soon. To stay competitive, grocery stores like Whole Foods must determine how to drive foot traffic back to their stores. Discounts are one way for grocery stores to get customers back. Alternatives to discounts like memberships or rewards programs for customers could also allow shoppers to receive benefits for in-store shopping. Some grocery stores like Publix already have this type of program in place, but many stores do not, such as Whole Foods, which should consider moving beyond discounts for Amazon Prime members. For more information on how brands can use foot traffic data to better understand how they compare to competitors in the marketplace, speak to a location intelligence expert today.