2021 Car Rental & Parking Industry Analysis

March 9, 2022

Consumers aren’t taking public transportation as much as they used to. It has become the norm to only take the train or bus when absolutely necessary. Although an increase in vaccination rates and decline in coronavirus cases led to a slight recovery for public transportation, mass transit systems still saw a significant decrease in ridership in 2020. Many consumers still in social distancing mode contributed to an increase in car sales in 2021. Over 15 million cars were sold in 2021, and sales were 3.4% higher than in 2020. We analyzed foot traffic to car rental locations and public car parking locations to understand consumer demand for cars in 2021.

State of the Car Rental Market

The high demand for used cars drove many car rental locations to sell their inventory. This caused a car rental shortage, but it didn’t stop consumers from renting cars.

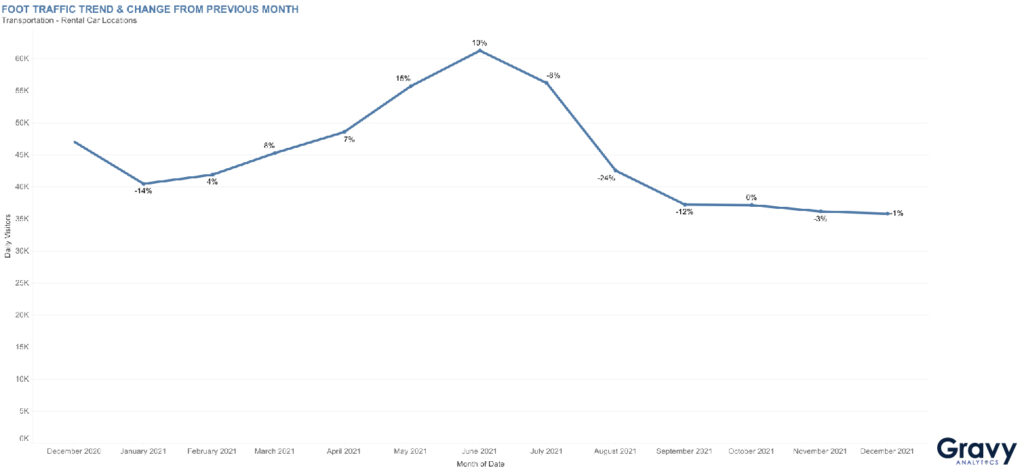

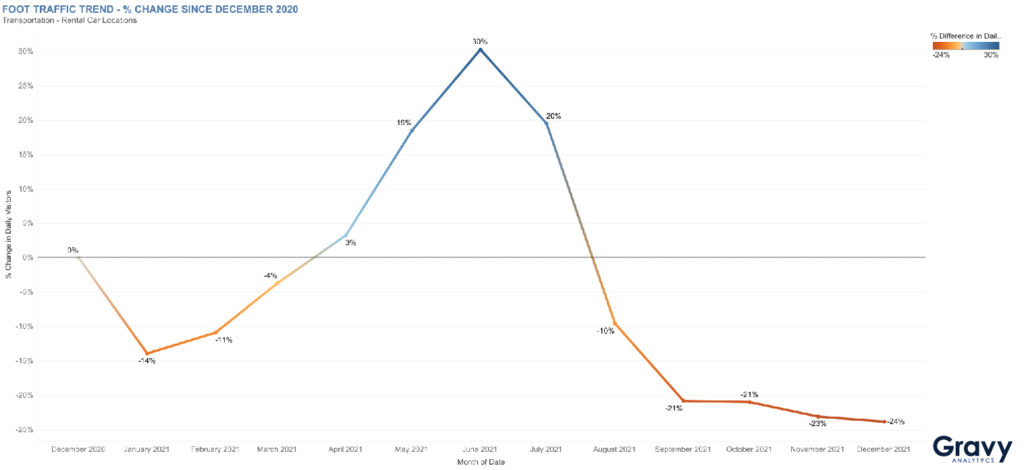

Foot traffic to car rental locations dipped in January before gradually increasing through the spring of 2021. Visits to car rental locations peaked in June and July, possibly due to summer vacation travel. As people headed back to work and school in the late summer and fall, foot traffic dropped dramatically. Foot traffic remained low throughout the fall and flat during the holiday season as many consumers reacted to the increase in coronavirus cases by canceling trips to visit family or friends. Foot traffic to car rental locations reached its lowest point in December 2021.

Visits to car rental locations were down at the start of 2021. However, a busy spring and summer travel season may have helped foot traffic to recover. Beginning in May, foot traffic to car rental locations jumped significantly. At its peak in June, foot traffic to car rental locations was 30% higher than in December 2020. After July, foot traffic decreased sharply, possibly because of the spread of the Delta variant, and remained flat through the holiday season, possibly due to Omicron. In December 2021, foot traffic to car rental locations was 24% lower, compared to the previous December.

Hertz, Enterprise, & Non-Chain Car Rental Companies

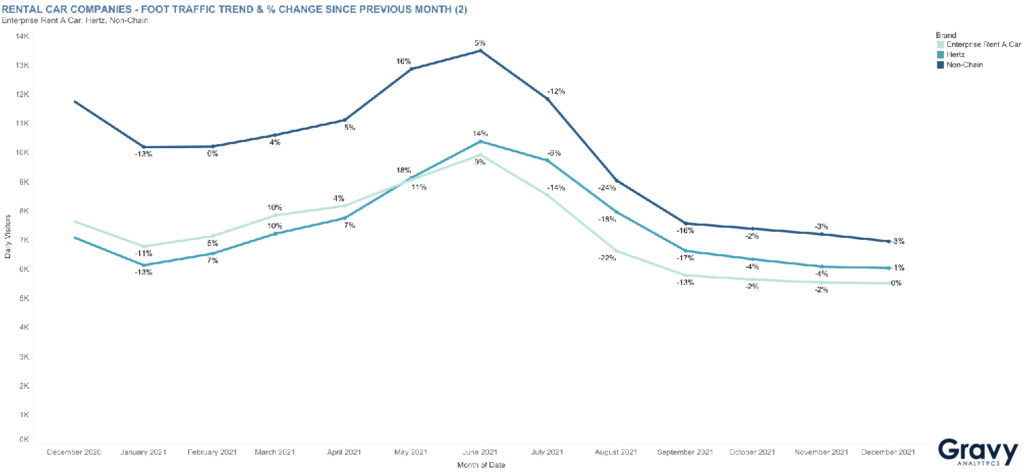

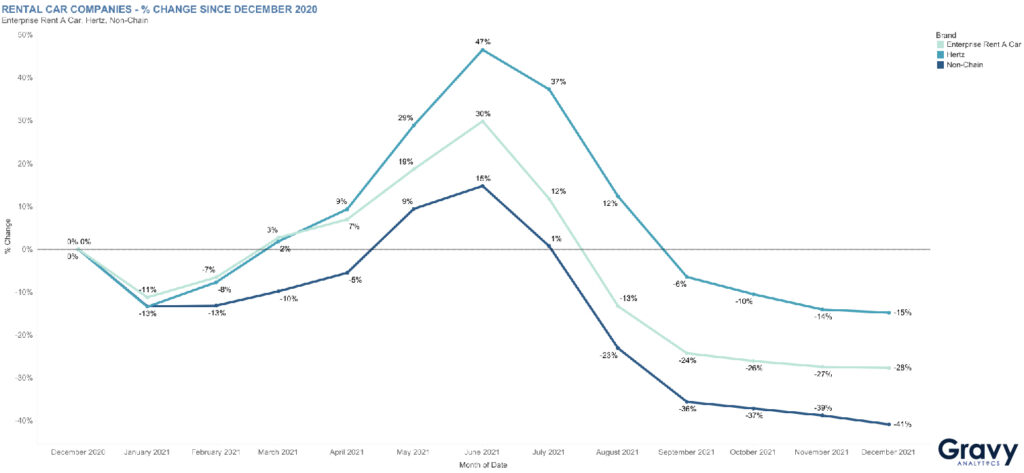

Non-chain car rental businesses saw more consumer visits than both Hertz and Enterprise in 2021. All car rental brands saw foot traffic gradually increase as spring progressed. Similar to the overall category, foot traffic peaked for all car rental brands in June. By August, consumer foot traffic dropped again, and remained flat through the rest of the year. This may have been due to lower consumer demand for rental cars as a part of business travel.

Hertz saw its foot traffic increase more dramatically during 2021 than Enterprise and non-chain car rental companies. Even though non-chain car rental locations had the most consumer visits, they saw more modest growth in foot traffic during the summer months. Across all brands, foot traffic grew significantly in the late spring and summer before falling again in late summer and fall; all brands ended the year below December 2020 foot traffic levels.

Public Parking Lots & Garages

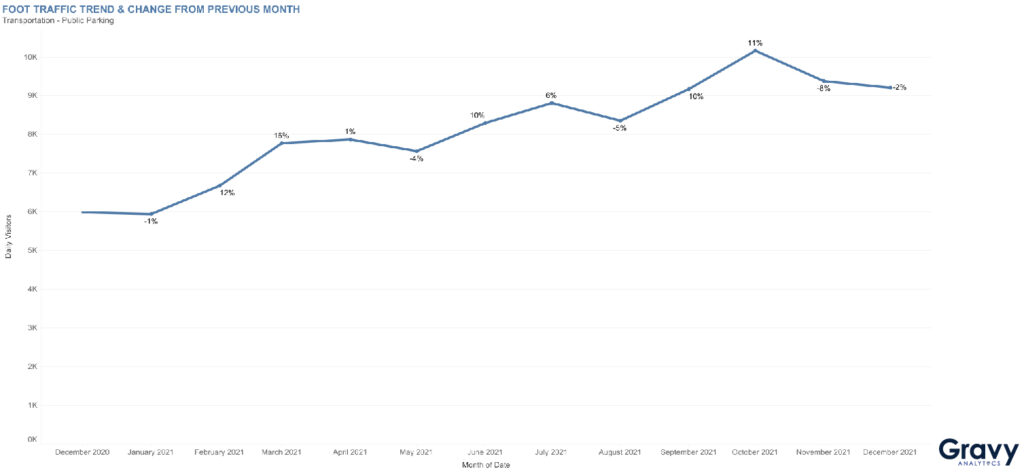

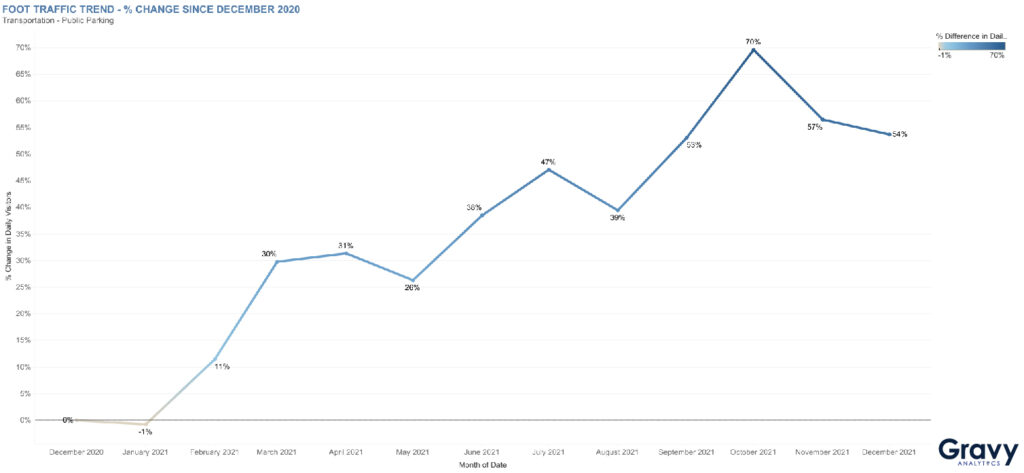

Public parking locations saw an increase in foot traffic starting in February 2021. This trend may reflect the increase in people going out more and the rise in reliance on cars rather than public transportation. Foot traffic to parking garages and lots continued to grow throughout most of the year, reaching a peak in October 2021.

Foot traffic to public parking lots began to trend up starting in February 2021. By October, foot traffic was 70% higher compared to December 2020. This trend might echo more people driving because of COVID-19 and cold weather, as well as increased trips as people returned to the office.

The Future of Car Rental and Parking Industries

With the increase in car demand and recovery of travel, car rental brands shouldn’t find it challenging to get consumers interested in renting a car. Our data suggest that demand for parking and car rentals will continue to rise in 2022, especially as more people begin to travel again. To learn more about how location analytics can be used by the car rental and parking industry to predict customer demand, speak with one of our location intelligence experts today.