7 New Consumer Trends for 2022

August 4, 2022

It’s becoming increasingly clear that there won’t be a “return to normal” for U.S. consumers. COVID-19 ushered in a host of innovations to meet new customer expectations that show no sign of dissipating. Customer experiences that seemed far-fetched just a few years ago are now de rigueur across industries — from touchless check-in at hotels, to mobile payments in restaurants, to curbside pickup and delivery of almost anything. Consumer expectations keep on changing and it’s important for businesses to understand emerging trends to stay ahead of shifting expectations. To learn more about new consumer trends, we looked at Gravy Visitations data across more than 3MM venues and 125 place categories, and compared total foot traffic in Q2 2022 with Q2 2021 to see which places are resonating with consumers right now.

Here are seven important consumer trends we’re seeing in 2022.

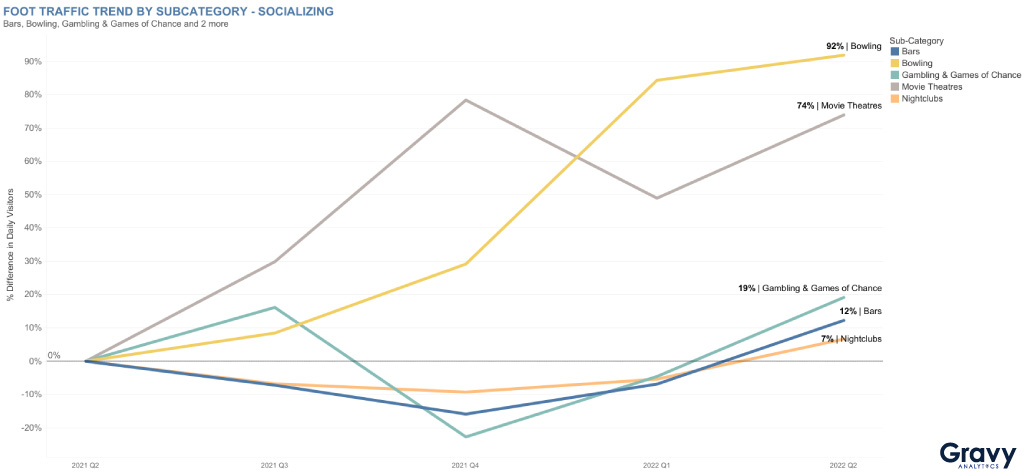

1. Socializing in Person Again

After two solid years of mask-wearing and social distancing, U.S. consumers are ready to get back out there. Across the board, visits to entertainment-related venues where people can meet and mingle, like bars (+12%) and nightclubs (+7%), are up year-over-year. Despite rising inflation, visits to casinos were still up a healthy 19% in Q2 2022, while visits to more budget-friendly entertainment destinations, like movie theaters and bowling alleys, increased a whopping 74% and 92%, respectively, compared to the same time last year.

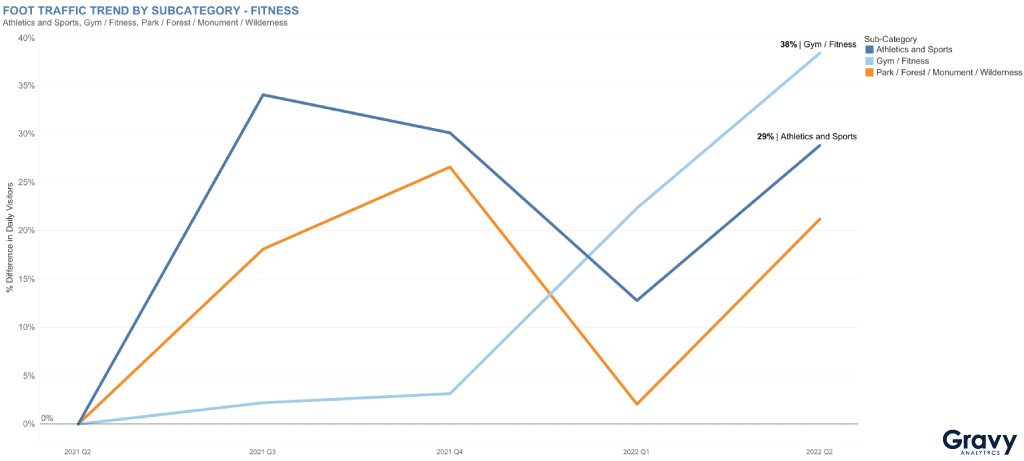

2. We’re Headed Back to the Gym

Working from home keeps a lot of us at our desks all day. What’s a person to do when it’s 5PM and you haven’t yet gotten your steps in? For a lot of consumers, it now means hitting the gym instead of starting the long commute home. While consumers’ focus on health and wellness isn’t anything new, it’s how they work out that has changed. For the first time in months, more consumers are heading back to the gym: gym visits in Q2 2022 were 38% higher than in Q2 2021. Visits to athletic and sports venues were also up by nearly 30%. What does this mean for the various fitness equipment and online workouts that popped up during the pandemic? Only time will tell.

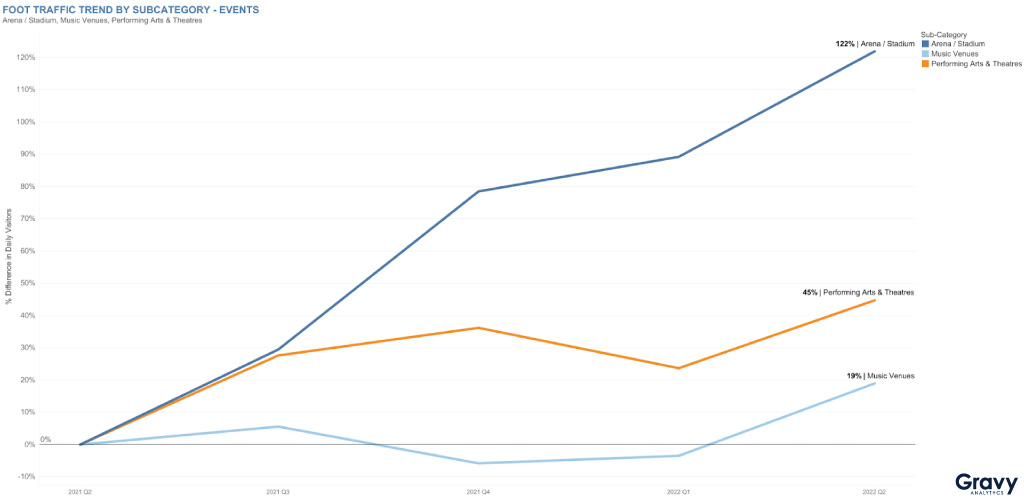

3. Big Events are Back – in a Big Way

If there’s one thing we missed during COVID, it was the thrill of seeing our favorite sports teams and music artists play live. Our foot traffic data shows that the summer concert season is off to a rocking start: visits to music venues were up by 19% in Q2 2021 compared to the year prior, while visits to performing arts centers increased by a remarkable 45%. Arenas and stadiums host some of the largest sports and music events around, and visits to both increased a whopping 122% for the same period. We can almost hear the fans cheering in the stands from here.

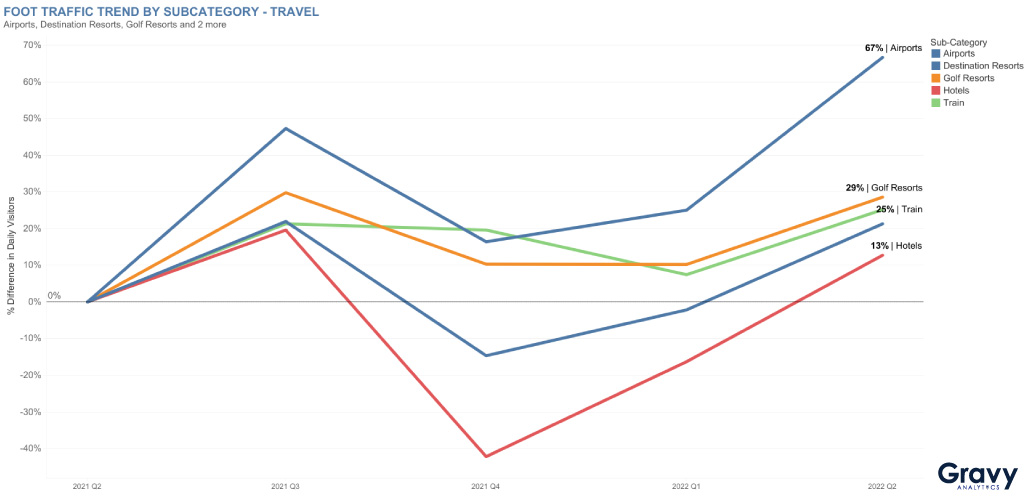

4. Travel is Once Again a Priority

COVID-19 caused many of us to cancel our vacation plans in 2020 and 2021–but travel is definitely back on our schedules for 2022. If you’ve been in an airport lately, it’s probably no surprise that foot traffic in Q2 2022 was 67% higher than in Q2 2021. Train stations also saw considerably more visitors year-over-year, with foot traffic up by 25%. At the same time, vacation-oriented accommodations, like golf resorts (+29%), destination resorts (21%), and hotels (13%), all saw solid growth in consumer visits. Despite rising airfare and gas prices, consumers are still willing to spend on travel this year.

5. It’s Time for a Leisurely Meal

Foot traffic at sit-down restaurants is also up year-over-year. What do these venues have in common? They are all casual and reasonably priced restaurant options for those evenings when you just don’t want to cook at home. Bistros and grills saw the most marked improvements, with 14% and 15% higher foot traffic in Q2 2022 than in the same quarter a year prior, while Mexican restaurants were flat to slightly up. Although Q2 foot traffic was not as strong as in Q4 2021, Italian restaurants saw a few more visitors, too. Which restaurant categories didn’t fare so well? Fast food restaurants, for example, saw strong foot traffic throughout much of the pandemic due to their drive-thru options and takeout-friendly fare, but foot traffic has slowed in recent months.

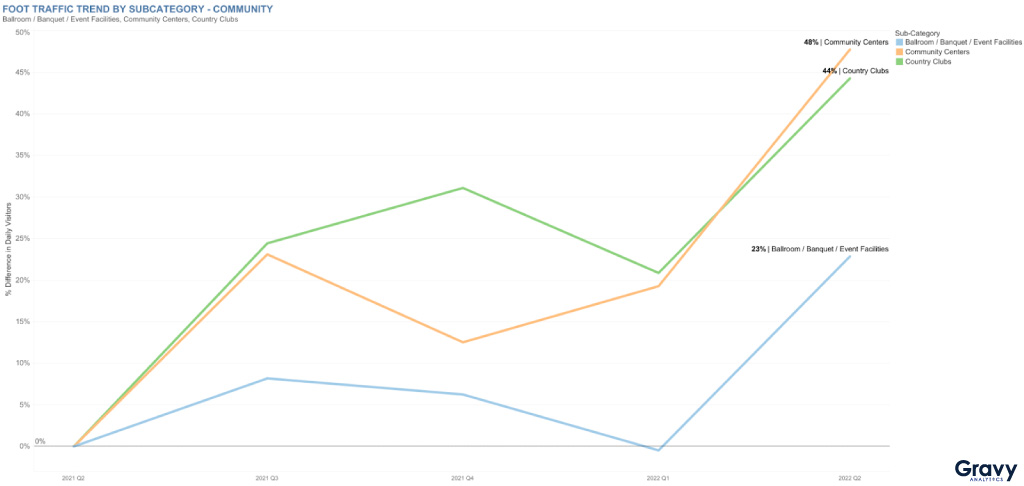

6. A Sense of Community

For the last couple of years, casual get-togethers and community events have been few and far between. Weddings, parties, and other social events were either scaled back or postponed until further notice. Gravy’s latest foot traffic data shows that people are getting back together in person for celebrations and community events. Compared to Q2 2021, foot traffic at event facilities increased by 23% in Q2 2022, while visits to country clubs and community centers jumped by 44% and 48%, respectively. After two years of keeping our social circles small, consumers are ready to engage with friends, neighbors, and the larger community.

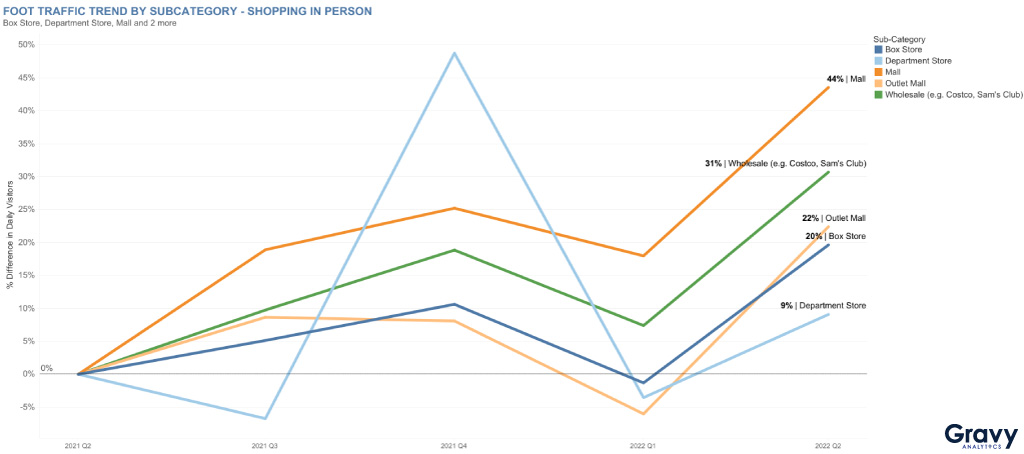

7. Shopping In Person

Believe it or not, consumers are starting to shop in person again. After two years of curbside pickup and Amazon delivery, consumers are once again visiting stores and malls to do their shopping. Department stores saw a huge spike in foot traffic over the holidays before declining in Q1 2022, but still ended Q2 with 9% more foot traffic than in Q2 2021. As consumers continue to shop for value, foot traffic to outlet malls and wholesalers has also increased: outlet malls saw a 22% jump in foot traffic, while wholesalers, like Costco and Sam’s Club, saw visits increase by 31%. In an era of 80s nostalgia, shopping malls saw their foot traffic increase by a radical 44%. Maybe the shopping mall isn’t dying, after all.

Foot Traffic Data Highlights New Consumer Trends

Foot traffic data as measured by location intelligence can deliver key insights about consumers and our society. What interests today’s consumers? Which places and events are they visiting? Can emerging consumer trends be found? For more information on how location analytics can help you with consumer insights and market research, get in touch today.