Are Consumers Traveling Less in 2023?

May 23, 2023

After Q4 2022’s mass travel disruptions, Spring Break 2023 was projected to be a season of increased travel, with consumers making up for lost travel time. Travelers were predicted to visit new locations and even vacation overseas in Q1 2023. So, as consumers become more adventurous and discretionary spending increases, how might this affect foot traffic to places in the travel industry? Is consumer foot traffic to hotels and other accommodations still on the rise?

To learn more about current consumer travel behaviors, we analyzed year-over-year foot traffic to accommodations for our recent Q1 2023 Consumer Trends Report.

Foot Traffic to Hotels & More

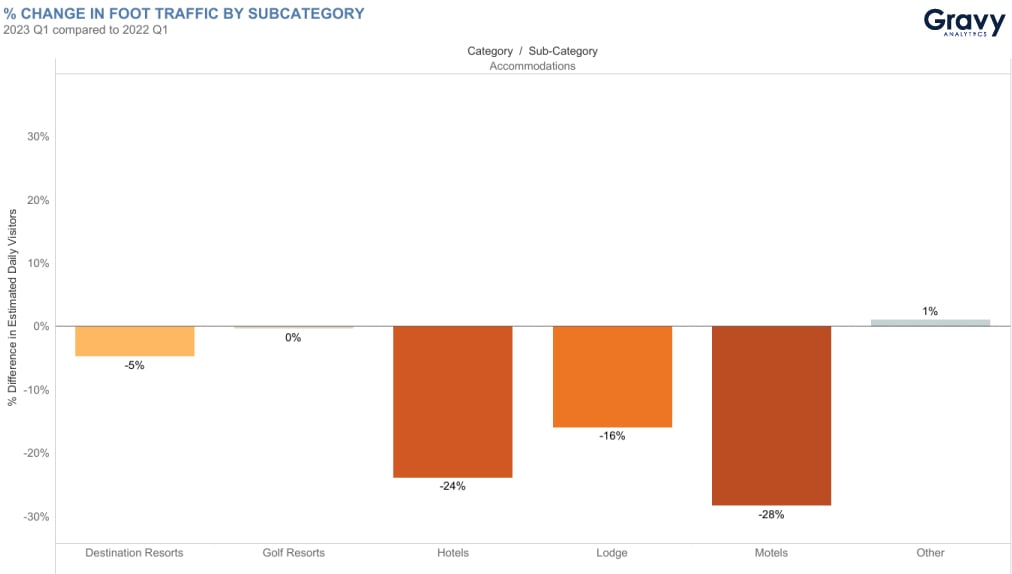

In our report, places in the category of Accommodations performed the lowest in terms of foot traffic. Overall, Accommodations saw a year-over-year decrease in foot traffic of -22%.

In this category, hotels and motels experienced the largest decreases in foot traffic for the time period analyzed. Foot traffic to hotels was down -24% year-over-year, and foot traffic to motels was down -28%. While these were the two largest decreases, foot traffic to lodge locations was also down by -16% year-over-year. With these being among the most popular types of accommodations for tourists, why might consumer foot traffic be decreasing at these locations? Are consumers actually traveling as much as they were projected to in Q1 2023?

Hotels in 2023

Recently, we’ve seen foot traffic increase at pricey coffee shops and mid-priced retailers like Target, suggesting that consumers are willing to spend a bit more freely in 2023. However, this doesn’t mean that consumers are more willing to spend on higher ticket items like travel. While Americans may be more open to affordable luxuries like coffee, they could still be concerned about job security and the overall economy, which may be affecting their interest in travel.

At the same time, price hikes and labor shortages have left many consumers feeling that travel just doesn’t provide the same value that it once did. In Q1 2023, U.S. hotel prices were up by an average 54% year-over-year, as the industry continued to struggle with supply and demand imbalances. Although nightly rates for Airbnbs were the highest they had ever been in the first quarter of 2022, the company recently warned that rates would decrease slightly in 2023 as demand for longer-term rentals dropped and more consumers returned to the office. The cost to fly is also sky-high this year, adding to the discontent many are feeling when traveling. Our takeaway? High prices and a return to more traditional work schedules could be key reasons why foot traffic to hotels and other accommodations is currently on the decline.

Although consumers believe the value of traveling is shrinking, they remain enthusiastic about travel in general. So, what does this mean for the travel industry for the rest of 2023?

Traveling Reshaped

2023 was expected to be the year that the travel industry would almost fully rebound from its pandemic slump. However, as the summer travel season sets in, hotels and resorts in some usually-popular destinations, many in Florida, are already seeing fewer bookings. So with destinations like Fort Lauderdale and Orlando welcoming fewer tourists, and foot traffic to hotels on the decline, consumers may be opting to travel a bit differently in 2023.

We expect that consumers will continue to prioritize leisure travel this season, but with post-pandemic economic disruptions like inflation and supply chain issues still affecting the cost of accommodations and flights, long-distance travel may be less common. Day or weekend trips, staying with family, or camping at a campground are all alternative lodging options that are far less expensive than a week-long stay at a traditional hotel. We also expect that smaller, local tourist destinations may get a boost in visitors as tourists seek out less-known destinations that are both more cost effective and more likely to meet their travel expectations for value and experience.

For more consumer foot traffic insights like this, subscribe to the Gravy Analytics email newsletter.