Banking Trends: A Consumer Foot Traffic Analysis

April 14, 2021

Online banking has become very popular among consumers, especially during the COVID-19 pandemic. This push towards digital transformation isn’t going away. Mobile banking’s rise in popularity has changed how consumers interact with banks but, according to a survey by Novantas, 40% of consumers are still planning on returning to banking branches post-COVID. In the future, banks will have to shift their business models to balance the demand for both in-person and online banking. However, they shouldn’t start changing business models without analyzing real-world consumer intelligence.

Foot traffic data can provide banks with a glimpse into current consumer trends based on where customers are going in the real world.

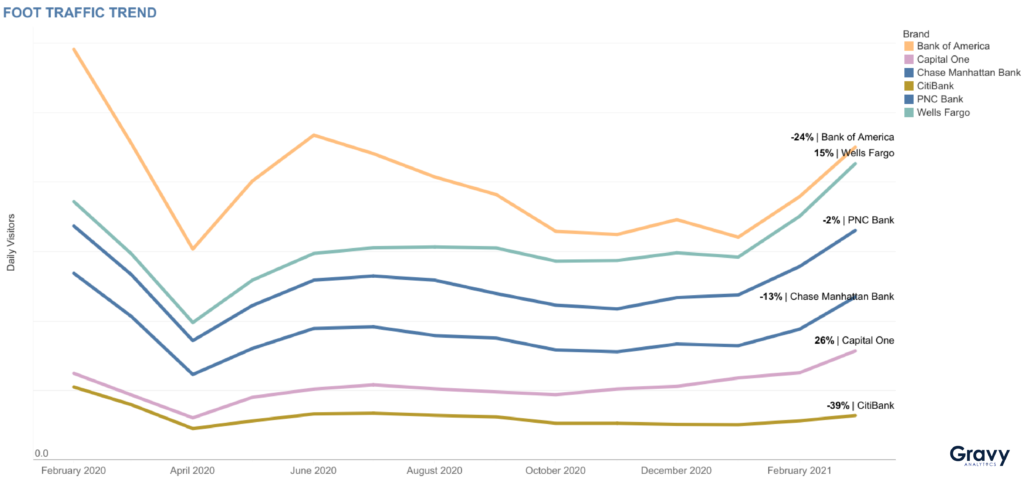

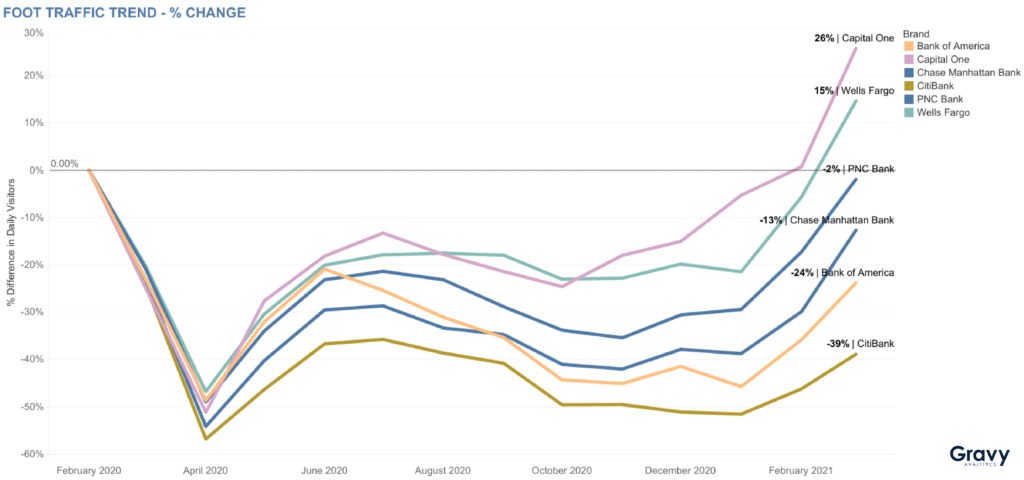

To understand how banking trends have changed due to the pandemic, we examined consumer foot traffic at several U.S. bank chains, including Capital One, Bank of America, Chase, and Wells Fargo, from February 2020 through March 2021.

Bank of America: Leader in Consumer Visits

Let’s take a look at overall bank visit trends. All bank visits were impacted significantly in April 2020, despite banks being essential businesses. Bank foot traffic began to recover in May and June 2020, then leveled off for much of the rest of the year. In Q1 2021, banks again saw an uptick in consumer visits, with Capital One and Wells Fargo receiving more visits in March 2021 than pre-COVID. While Bank of America locations saw the most foot traffic overall, this doesn’t necessarily mean that they recovered faster.

Capital One’s Quick Recovery

Capital One recovered faster than other banks that we included in our analysis; foot traffic for March 2021 was 26% higher compared to pre-pandemic levels. This might not be a shock to those who keep tabs on the banking world as Capital One is known for investing in digital transformation. Wells Fargo’s recovery (+15% as of March 2021) is close behind Capital One. Like Capital One, Wells Fargo has embraced contactless payments and created a virtual wallet for their customers. The investment in the customer experience via digital transformation is more than likely the reason why customers continue to even choose to bank in-person at both Capital One and Wells Fargo. Citibank isn’t recovering consumer foot traffic as fast as other banks, possibly due to the temporary closure of a few of its bank lounges early in the pandemic and reduced hours of operation.

A New Age for Banking

Neobanks, banks without physical branches, are on the rise and are expected to be worth 722.60 billion by 2028, according to data from Grand View Research’s recent report on the neobanking market. Traditional banks should continue to innovate and think about using real-world data like location intelligence to stay competitive with neobanks.

What can banks with physical locations do to drive customer traffic? Besides investing in digital transformation, they’ll need to redefine spaces built for in-person banking and understand which consumers are visiting banks, how far they are traveling, and the duration of visits. With this information, banks can adjust their customer offerings at branches to improve the customer experience. Based on actionable data insights, major bank chains may decide to add more drive-through lanes, increase access to ATMs, or integrate virtual wallets into the traditional banking experience.