Chicken Sandwich War 2.0: Data Analysis of Chick-fil-A, KFC, and Popeyes

March 10, 2021

Did you know that each American ate 48.8 kg of chicken in 2017 alone? That makes chicken the most popular meat in the United States. Just looking at the numbers tells you that fast food chicken restaurants are a hot commodity in the U.S. KFC, Chick-Fil-A, and Popeyes are all household names; these fast food restaurants serve not only great chicken but also a seamless buying experience that keeps Americans coming back for more.

That’s why we decided to take a closer look at their foot traffic, and how each of these giants fared during the most unusual year of our lifetime and into February 2021. Let’s take a look at the data to find out how they did.

The State of Fast Food

Before we get to the details, it’s important to understand what was happening in the fast food industry in 2020, and what dining behavior looked like for most consumers. As lockdowns swept across the United States, restaurants were forced to close their dining rooms and had to innovate quickly to accommodate increased delivery demands. This is where fast food restaurants had an advantage over the rest of the restaurant industry. With existing drive-throughs, a reputation for quickness, and no delivery fees, it’s not surprising that many consumers chose drive-through over delivery (if only to get out of the house for a little while).

According to data from our economic activity by state and category dashboard, foot traffic to fast food restaurants was 14% lower in February 2021 compared to February 2020.

Is the Chicken Sandwich War Still Going?

If we were to ask America which fast food restaurants serve the best chicken, they would give you different answers, but Popeyes, Chick-Fil-A, and KFC would be mentioned often. KFC popularized the bucket of fried chicken, Popeyes made popcorn chicken a thing, and Chick-Fil-A was able to make a name for itself by offering healthier chicken with a giant helping of customer service.

KFC and Popeyes’ foot traffic was on a similar trajectory in April 2020 but Chick-Fil-A’s traffic was nearly 65% lower than pre-COVID. Popeyes and KFC may have had more retail locations in less-affected markets than Chick-Fil-A, giving them an edge at a time when people weren’t straying too far from home. All three brands began to recover foot traffic in May and June, but while Chick-Fil-A’s continued to recover foot traffic through the fall, foot traffic at both KFC and Popeyes stalled. Chick-Fil-A eventually caught up to Popeyes and KFC in November and as of February 2021, foot traffic was just 12% lower compared to pre-COVID levels.

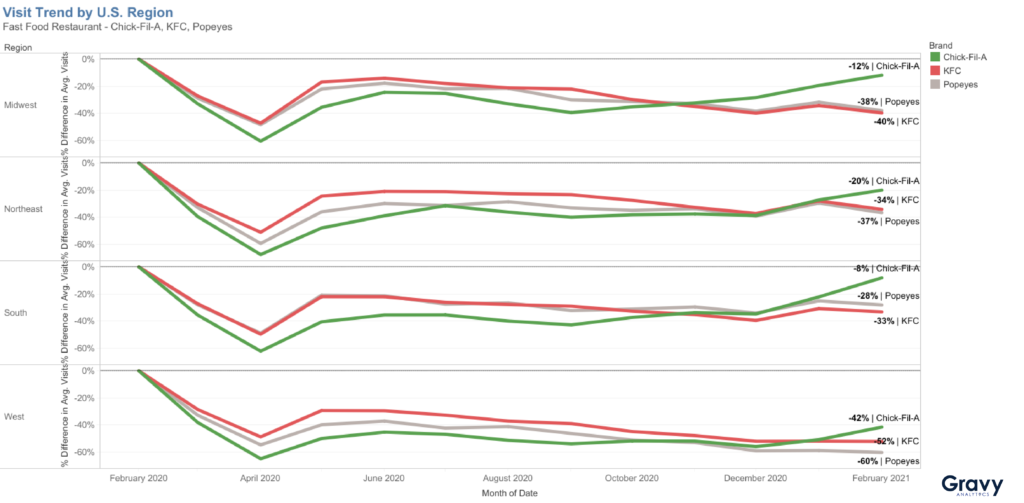

Regional Trends

Chick-Fil-A was the most impacted of the 3 chains in every region, but then overtook both Popeyes and KFC starting (in the Midwest) in November 2020. For all chains, foot traffic was least impacted at restaurant locations in the South, while those in the West were the most impacted. In both the Northeast and the Midwest, Popeyes and KFC performed similarly.

As of February 2021, Chick-Fil-A was outperforming both Popeyes and KFC in terms of foot traffic in every region. Customers in the Midwest and South seemed to choose Popeyes over KFC, while those in the Northeast and West favored KFC over Popeyes. Foot traffic recovery for all 3 restaurant chains was at its lowest in the West.

Based on regional trends, people are returning to Chick-Fil-A more quickly than they are to Popeyes or KFC.

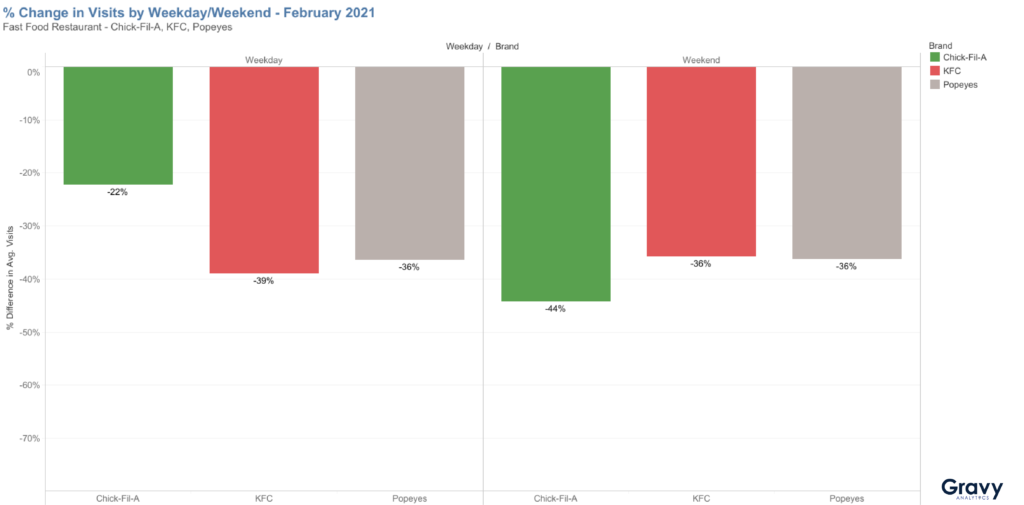

Weekday vs. Weekends

Weekday and weekend foot traffic follow similar patterns for both Popeyes and KFC. Chick-fil-A, however, retained far more of its weekday foot traffic than its weekend traffic. Chick-fil-A has also recovered its weekday foot traffic much more quickly. Although Chick-Fil-A has managed to bring back more of its overall foot traffic than KFC and Popeyes, it still lags behind both in terms of weekend foot traffic recovery.

With its tradition of being closed on Sundays, Chick-Fil-A has always been busier on weekdays than on weekends — unlike most other fast food chains. Would that change if Chick-fil-A were to open on Sundays? It’s possible, but it would mean a big change to Chick-fil-A’s business model.

The Verdict: Customer Experience Wins

Based on our data, Chick-fil-A stands out in terms of foot traffic recovery. One thing that consistently puts Chick-Fil-A in the lead is their unparalleled customer service. According to the American Customer Satisfaction Index, Chick-Fil-A scored the highest among all fast-food chains with a score of 84, where the space as a whole scored a 78. Their marketing efforts are also top-notch.

Steve Robinson, Chick-Fil-A’s head of marketing said, “…why are we doing the same promotion as every other fast food brand?” This is a fundamental question that is important in a post-COVID world: how do fast food chains promote their brand in a way that doesn’t make them look like every other restaurant?

With Chick-Fil-A now winning America’s chicken sandwich war, Popeyes and KFC should consider taking a page out of the Chick-fil-A playbook and start investing in their own customer and dining experiences. Sometimes, the overall experience is every bit as important as the actual meal.

The Road Ahead for Fast Food

Fast food is clearly still winning over consumers. Many Americans are still wary of dining in a restaurant, and fast food is often more economical than paying delivery fees or dining in. The fast food industry continues to evolve with the times, offering up more healthy options while still keeping the “fast” part of the equation in check.

We predict that Chick-Fil-A’s customer experience is going to be more important than ever before. Fast and cheap just won’t cut it anymore. It’s time for fast food restaurants to take it a step further and listen to what their customers want — and actually act on the feedback.

For more information on location intelligence, contact us to speak with an expert today.