How Does Dollar General’s Foot Traffic Compare to Its Discount and Dollar Store Competitors?

November 30, 2022

In the mid-20th century, discount and dollar stores emerged and became a staple for underserved communities and folks looking for a deal. Dollar General, a leading dollar store chain, was one of the first of its kind. Now with over 18,000 stores nationwide, Dollar General is the largest dollar store chain in the country. But, how does Dollar General’s foot traffic compare to its top discount and dollar store competitors, especially now when discount shopping is in high demand due to inflation?

We took a look at foot traffic to Dollar General as well as its top competitors, including Dollar Tree, Family Dollar, and Walmart, to find out what recent foot traffic patterns reveal about these companies and the latest consumer trends.

Dollar General’s Foot Traffic Comparison

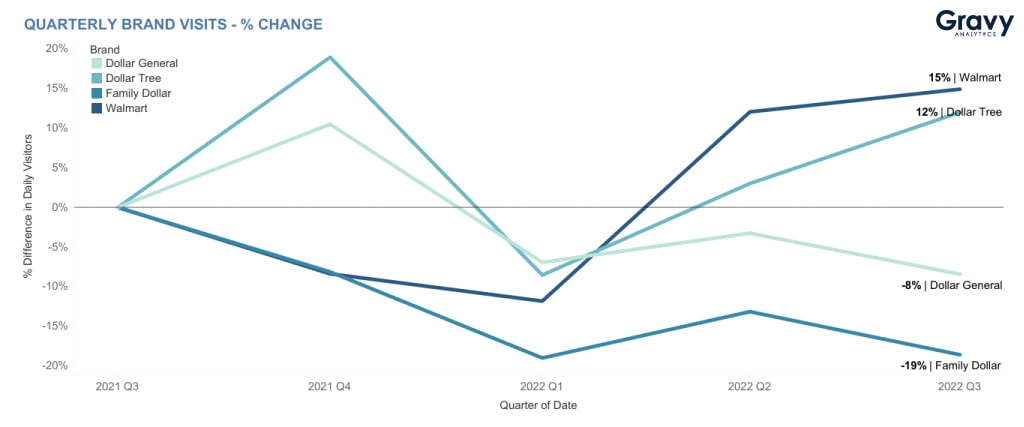

We analyzed foot traffic data at four of the nation’s top dollar and discount stores from Q3 2021 to Q3 2022. Over the last year, Dollar General’s foot traffic trends mirror, in different ways, the quarterly patterns seen with Family Dollar, Dollar Tree, and Walmart. Dollar General’s foot traffic peaked in Q4 2021 and has been on a downslope since then—with a slight increase in Q2 this year. According to our data, foot traffic to Dollar General now sits at a negative 8% change YoY. While families may have prioritized Dollar General during the late summer and back-to-school season last year, consumer foot traffic didn’t reach the same levels in Q3 this year. Family Dollar followed suit and saw a small spike in visits in Q2, but ultimately, the company saw 19% less foot traffic in Q3 2022, compared to the previous year.

On the other hand, since Q1 2022, foot traffic to Walmart and Dollar Tree has been on a steep incline. Dollar Tree has had a 12% increase while Walmart has had a 15% increase YoY. It seems as prices for rent, gas, and food inflate, people are focused on Dollar Tree’s especially low, $1.25 per item prices and Walmart’s well-rounded selection of goods with greater value. As the holidays approach, we expect more visitors at all four chain stores, although we expect substantial growth for Walmart and Dollar Tree. Dollar General is not only seeing some of the least amount of traffic, but that number could continue to drop this quarter.

Controversy and Closures

In spite of Dollar General’s large number of locations, expansion of grocery goods, and plans for growth, store closures may be on the horizon.

Dollar General has recently been the subject of controversy regarding health and safety. According to the U.S. Department of Labor, there have been repeated OSHA violations by Dollar General stores, resulting in $15 million in proposed penalties. This caused temporary closures of some Dollar General stores, along with the voluntary, permanent store closures happening as of late. Although all four discount stores we’ve analyzed have shut stores down this year, Dollar General is at risk of forced closure of up to 200 stores next year. Closures, safety risks, and post-pandemic inflation seem to be causing a shift away from Dollar General. As fierce competition with Walmart and Dollar Tree increases, Dollar General may continue seeing low foot traffic throughout Q4.

Value Shopping: the Overall Trend

Overall, dollar and discount stores have become more important as inflation persists. Consumer trends are pointing toward cost-conscious shopping, so discount stores are likely to continue seeing foot traffic. Even though Dollar General’s foot traffic has decreased YoY, and competition is looking tough, discount store shoppers are more frequent this year, and more wealthy. These stores are attracting a wider variety of customers now, which could mean more opportunity for growth in 2023. Discount and dollar stores are still navigating the post-pandemic market, but we think foot traffic will begin to level out in 2023 as company growth initiatives—and inflation—continue to rock the boat.

To learn more about how you can use our enterprise location intelligence to gain more insight into your business, contact us to connect with one of our experts today.