How Far will Consumers Travel for Shopping, Entertainment, and Dining?

November 3, 2021

The COVID-19 pandemic has changed many of the ways people shop, dine, and entertain themselves, which in turn has significantly affected consumer travel. For example, to minimize the risk of becoming infected, many consumers opted to shop online or to use curbside pickup throughout the pandemic. In 2021, these habits still remain prominent among many consumers, especially with the emergence of coronavirus variants.

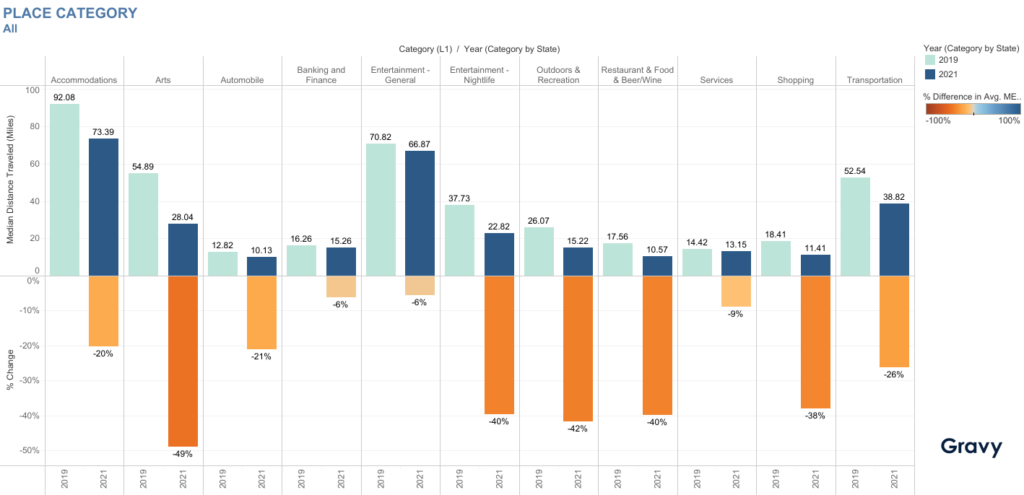

We selected a few place categories to understand how far consumers travel to various destinations, including accommodations, parks, restaurants, and retail stores. Which categories saw the biggest shifts between Q2 2019 and Q2 2021? Let’s take a look at the data to see which have been impacted the most (and least).

Which Place Categories Have Been Impacted the Most?

Arts venues are the most impacted place category. In 2021, the median distance traveled was 49% lower compared to 2019. Many arts venues had to close down in 2020 and have only recently reopened their doors to ticket holders. The second most impacted category is Outdoors and Recreation (-42%), which is a surprise given the increase in consumer interest in outdoor activities. However, this significant change could have been due to people opting to take advantage of their local parks and hiking trails rather than those farther away from home.

Consumers also traveled farther to nightlife venues in 2019. In 2021, the median distance traveled by consumers to nightlife venues was 40% lower than in 2019. This may indicate that consumers are opting for local bars or clubs that are closer to them rather than traveling to clubs in cities. As more DJ and music events start happening again, more people may decide to travel longer distances to watch highly anticipated sets at nightclubs and bars.

In 2019, consumers were traveling farther to stay at hotels, but this changed in 2021. The median distance traveled by consumers to accomodations was 20% lower than in 2019. One explanation for this could be that consumers may have put their big vacations on hold in 2020 and instead opted for “staycations” at local hotels in 2021.

Consumers usually don’t travel very far to shop for essentials like groceries, and the coronavirus pandemic seems to have amplified this trend. In 2021, people didn’t travel as far to shop as they did in 2019. With the popularity of two-day delivery, it seems that many consumers prefer to shop online despite occasional delays or product backorders due to supply chain issues caused by the pandemic.

Which Place Categories Have Been Impacted the Least?

Banking and Finance, Entertainment – General, and Services (e.g., housing services, organizations, appearance & beauty) were the least impacted compared to other categories. Between 2019 and 2021, there were only slight decreases in the median distance traveled by consumers to these venues. Banking and Finance and Services are considered to be essential and remained open during the initial COVID-19 lockdowns. Many venues under the Entertainment – General category, which include zoos and aquariums, are now open with social distancing practices in place. These venues are often destinations during vacations and day trips, which may explain why consumers travel farther to visit places categorized as Entertainment – General than to those in the categories of Banking and Finance or Services.

Consumer Travel in 2021: Unique Customer Experiences

The customer journey is constantly changing, especially in 2021. By analyzing consumer travel trends, businesses can understand consumer interests, which industries (e.g., restaurants, nightlife, shopping, etc.) are being disrupted by changes in consumer behavior, and which ones remain largely unaffected (e.g.,banks and services). With the rise of convenience as a consumer value, we predict that in 2022, people will continue to only travel to places that provide unique customer experiences and stick to shopping for essentials closer to home.

For more information on how to measure consumer travel trends, contact Gravy Analytics to speak with an expert today.