Foot Traffic at Home Improvement Brands Gets a Summertime Boost

March 16, 2022

In 2020, we analyzed foot traffic to Lowe’s and Home Depot stores, just as consumer interest in home improvement was increasing at the start of the coronavirus pandemic. One year later, analysts noted that a decrease in demand might impact Lowe’s and Home Depot’s 2022 sales. Although many consumers may be finished with their home improvement projects, this doesn’t mean less foot traffic for these brands.

As people continue to work from home, they can expect wear and tear on everything from appliances to floors, and big chains like Home Depot can anticipate consumers returning to its stores for maintenance purposes. We analyzed foot traffic to Home Depot, Lowe’s, and Menards to determine what home improvement retailers can expect in 2022.

Summertime Growth for Home Improvement Chains

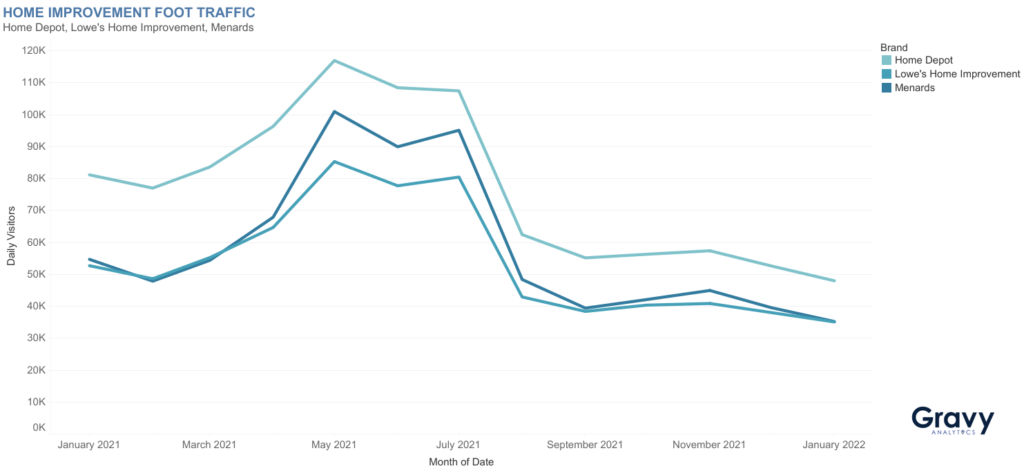

Home Depot saw more consumer visits to its stores than Lowe’s and Menards. Lowe’s and Menards showed similar foot traffic patterns until April 2021. During the spring and summer, visits to Menards rose past Lowe’s, but didn’t reach the number of visits that Home Depot had at its stores. Visits to home improvement chains peaked in both May and July 2021, possibly because of consumers getting their homes and gardens ready for the summer season. After July 2021, foot traffic declined dramatically for all three home improvement brands.

A Decline in Holiday Foot Traffic for Home Improvement Retailers

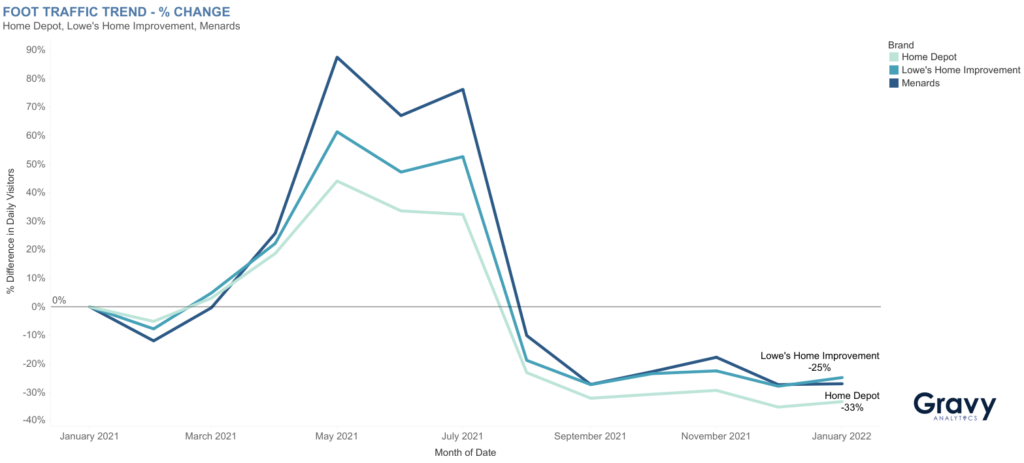

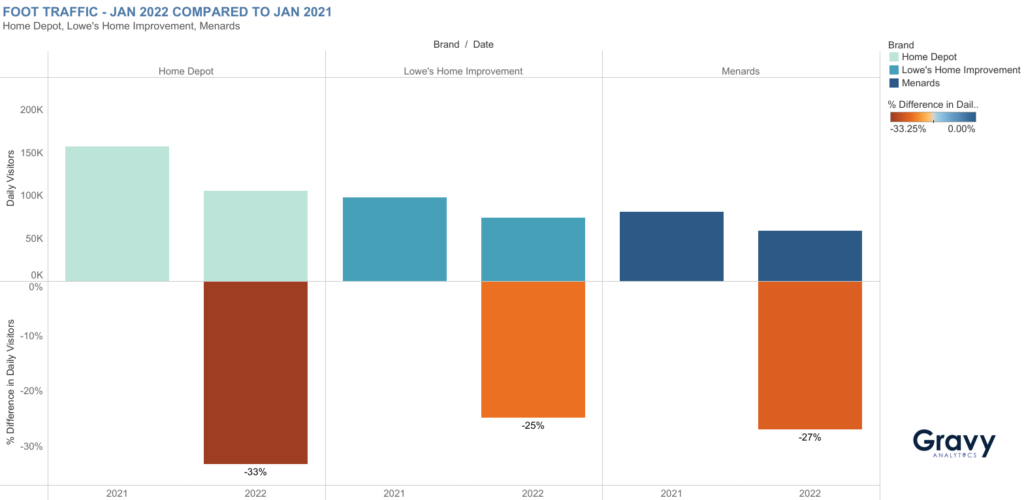

Starting in March 2021, foot traffic to Home Depot, Lowe’s, and Menards increased significantly. Menards’ foot traffic growth skyrocketed past Home Depot and Lowe’s in the spring and summer months. However, all home improvement retailers that we analyzed saw foot traffic drop below January 2021 levels starting in August 2021. By January 2022, foot traffic to Lowe’s was 25% lower compared to the previous January; Menards’ foot traffic was only slightly lower than Lowe’s. Home Depot was the most affected as its foot traffic was 33% lower, compared to January 2021. This slump in Q3 and Q4 foot traffic to Lowe’s, Menards, and Home Depot may show that consumer interest in home improvement is slowing down.

What to Expect in 2022: Going Beyond Home Improvement

Although foot traffic to these retailers is highly seasonal, home improvement stores will have some work to do in order to bring foot traffic back to 2021 summer levels. We predict that regional home improvement brands can expect more foot traffic than big brands, such as Home Depot and Lowe’s. How can bigger home improvement chains get customers to shop in-store? They should consider emulating the in-store customer experience of regional and local home improvement stores.

Smaller home improvement brands often have a more diverse business model that goes beyond only offering home improvement goods and services. For example, Menards offers its customers access to pet supplies, home decor, and grocery departments along with construction and home improvement supplies. Therefore, it’s not too surprising that Lowe’s is partnering with Petco to offer pet supplies and services in its stores.

To learn how your business can use foot traffic analytics to analyze company performance, contact one of our location intelligence experts today.