Is Inflation Affecting Gym Foot Traffic?

June 14, 2022

The pandemic changed the way people work out as gyms around the country temporarily closed their doors during the COVID-19 lockdowns. Before gyms reopened, many exercise enthusiasts invested in at-home workout equipment or simply chose to exercise outdoors. Even as gyms gradually reopened, a 2020 survey found that 49% of respondents were uncomfortable with returning to the gym.

With the increase in vaccination rates and ease of coronavirus restrictions, gyms eventually opened back up at full capacity. This shift caused many consumers to reconsider at-home gym equipment purchases and restart gym memberships. However, some people are still hesitant to return to the gym for a variety of reasons, including rising prices due to inflation.

If consumers aren’t planning to return to the gym anytime soon, then where are they working out? Are consumers going to gyms more now or are they continuing to workout at public parks? To understand shifts in consumer behavior related to exercise, we analyzed foot traffic to gyms, parks, and recreation centers to determine where consumers are working out in 2022.

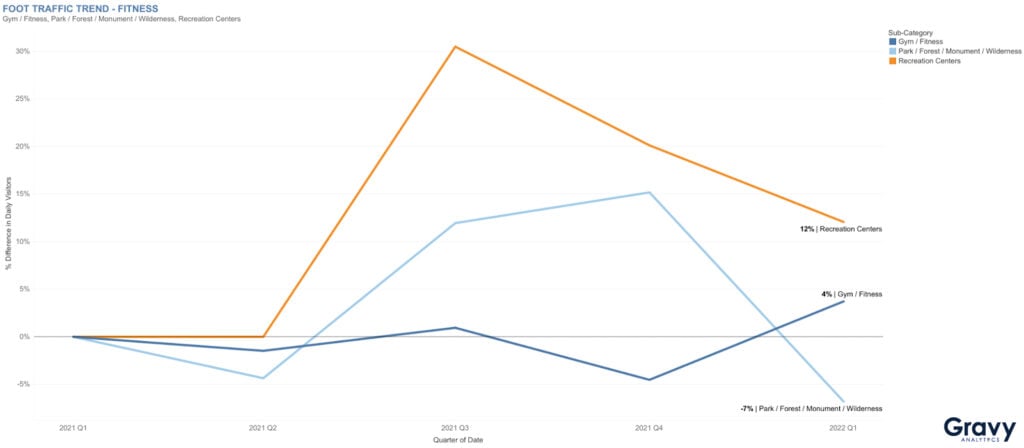

Consumers Workout at Recreation Centers

Foot traffic to recreation centers increased significantly after Q2 2021, and peaked in Q3. Although recreation centers saw foot traffic decline into the first quarter of 2022, foot traffic was still 12% higher than during the first quarter of the previous year. Similar to recreation centers, parks saw an increase in visits after Q2 2021. However, foot traffic continued to rise between Q3 and Q4 2021 before declining sharply in the new year. By Q1 2022, foot traffic to parks was 7% lower compared to Q1 2021. The winter isn’t an ideal season for outdoor activities in most areas of the U.S., which could explain why park visits declined during Q1 2022. The increase in foot traffic to parks in Q4 2021 is likely due to the many holiday-related events that take place in parks during this timeframe, such as pumpkin patches and Christmas light shows.

Gym foot traffic remained at or below Q1 2021 levels throughout 2021 before increasing slightly at the start of 2022. In Q1 2022, gym foot traffic was 4% higher than in the first quarter of 2021. In 2021, the emergence of the omicron and delta coronavirus variants caused many consumers to continue to avoid the gym. Possible reasons for the Q1 2022 increase in gym foot traffic include New Year’s resolutions, discounted gym memberships, and consumers becoming more comfortable going to the gym due to increased vaccination rates.

Regional Fitness Trends in Q1 2022 vs. Q1 2021

Visits to gyms in the Midwest and Northeast were lower in Q1 2022, compared to the same quarter of the previous year. Gym foot traffic remained relatively flat (2%) in the South. Gyms in the West, however, saw a significant increase in foot traffic; Q1 2022 traffic was 28% higher than in Q1 2021. A possible explanation for this resurgence in gym foot traffic could be California’s reopening of gyms at full capacity in June 2021. Recreation center visits were up for the Northeast, West, and South, but this wasn’t the case in the Midwest where foot traffic to recreation facilities remained flat. Park visits were down across all regions. This may be a trend related to seasonality; consumer interest in outdoor activities more than likely declines during the winter months.

More Recreation and Park Visits, Less Gym Time

For the foreseeable future, we predict that recreation centers and parks will continue to see more foot traffic compared to gyms. Why are consumers visiting recreation centers? Recreation centers offer a wider range of activities to choose from than gyms, and these activities might not always be related to exercise. Given the onset of warmer weather, we also don’t anticipate that park visitations will slow down anytime soon. For more information on predicting consumer trends with foot traffic data, contact one of our location intelligence experts today.