Low Gas Prices Cause Consumers to Return to Gas Stations

August 24, 2022

Gas prices are as much of an economic indicator as the stock market and consumer sentiment. As we have seen in the past couple of years, there are many factors that have affected the cost of gas — from the cyberattack on the Colonial Pipeline to the war in Ukraine. Over the past several months, gas prices increased because of inflation, but now, they are going down again. Could a decline in gas prices be a sign that the U.S. economy might be able to avoid a recession? It’s a possibility. We analyzed foot traffic data to gas stations in relation to the average price of gas across the U.S. (sourced from EIA’s Weekly Retail Gasoline and Diesel Prices) to find out how the recent increases in gas prices have affected foot traffic to gas stations.

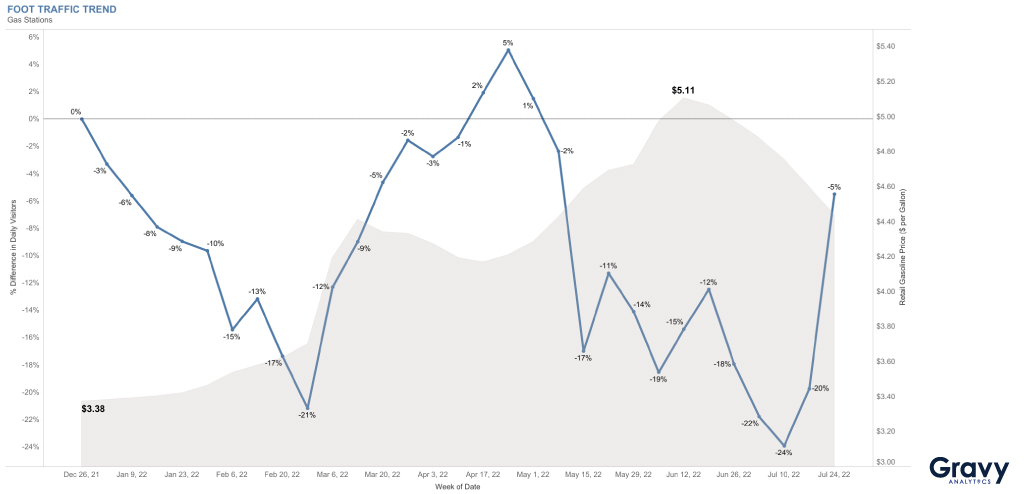

High U.S. Gas Prices Equals Less Consumers at the Pump

Following the busy holiday travel season, foot traffic to gas stations decreased in January and February, but then increased again in March with spring break travel, as gas prices also began to rise. As gas prices started to flatten and decrease slightly in April, more consumers visited gas stations to take advantage of the perceived price drop. By the week of April 17, 2022, gas station foot traffic was 5% higher than during the week of December 26, 2021. As of mid-May, however, foot traffic to gas stations had dropped again, and remained well below early 2022 levels as gas prices continued to rise. The average price of gas peaked at $5.11 per gallon during the week of June 12th. However, by the last week of July, gas prices had dropped to an average $4.44 per gallon and foot traffic to gas stations jumped, indicating pent-up consumer demand for lower-priced fuel.

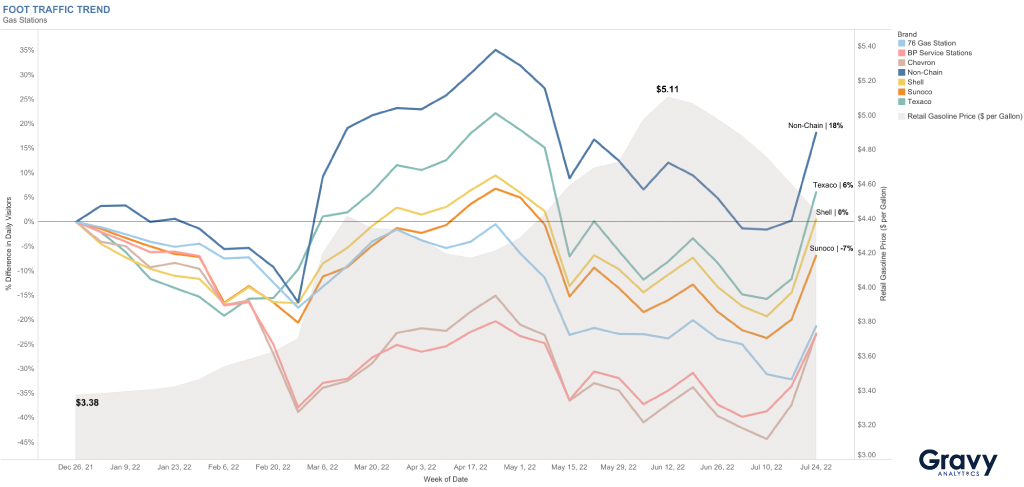

Mom-and-Pop Gas Stations Win Over Consumers

Texaco locations outperformed all other gas station chains, except for mom-and-pop gas stations. Compared to the first week of 2022, foot traffic to Texaco gas stations was 6% higher during the week of July 24th. In contrast, for that same week, visits to Shell locations were flat compared to the start of the year. Visits to BP, 76 Gas Station, Chevron, and Sunoco locations have all trended down in 2022 and remained well-below foot traffic levels for the week of December 26, 2021. Big gas station brands often sell gas from large oil refineries, which can cause prices to be higher compared to those who distribute unbranded gasoline.

Mom-and-pop gas stations performed comparatively well, compared to their big name competitors. What’s the biggest reason for the success of mom-and-pop gas brands during a time of inflation? Mom-and-pop gas stations frequently have lower gas prices than larger chains because they sell unbranded gas and have more control over pricing, which gives them an advantage over their competitors. It’s also possible that consumers are staying closer to home and are more likely to fill up at big gas station chains when they are traveling or closer to highways.

Will Gas Station Visits Return to Pre-Pandemic Levels?

Gas prices are continuing to fall, and some consumers are filling up their tanks in anticipation of the big “Return to Work” and a busy school year. The return of some office workers to their commutes plus school traffic could also contribute to more visits to gas stations. Assuming that gas prices continue to fall, we predict that gas station foot traffic will rebound to pre-pandemic levels this year, especially with more consumers going out again for work, school, and fun. For more information, contact one of our location intelligence experts today.