Target’s Foot Traffic Outperforms Walmart’s in Q2 2022

September 14, 2022

In Q2 2022, big-box stores saw 20% higher foot traffic, compared to the second quarter of the previous year. Perhaps, the most popular big-box stores are Target and Walmart. Walmart is known for its low prices while Target has a loyal following of fans. On August 16, 2022, Walmart reported that its earnings were up 8.4% in Q2 2022. In contrast, Target’s profits dropped by 90% during the second quarter, despite the Minneapolis-based chain cutting back prices in response to inflation. With both companies ending Q2 2022 on different notes, we decided to take a look at our data to determine which company performed the best in terms of foot traffic.

Target vs. Walmart Foot Traffic

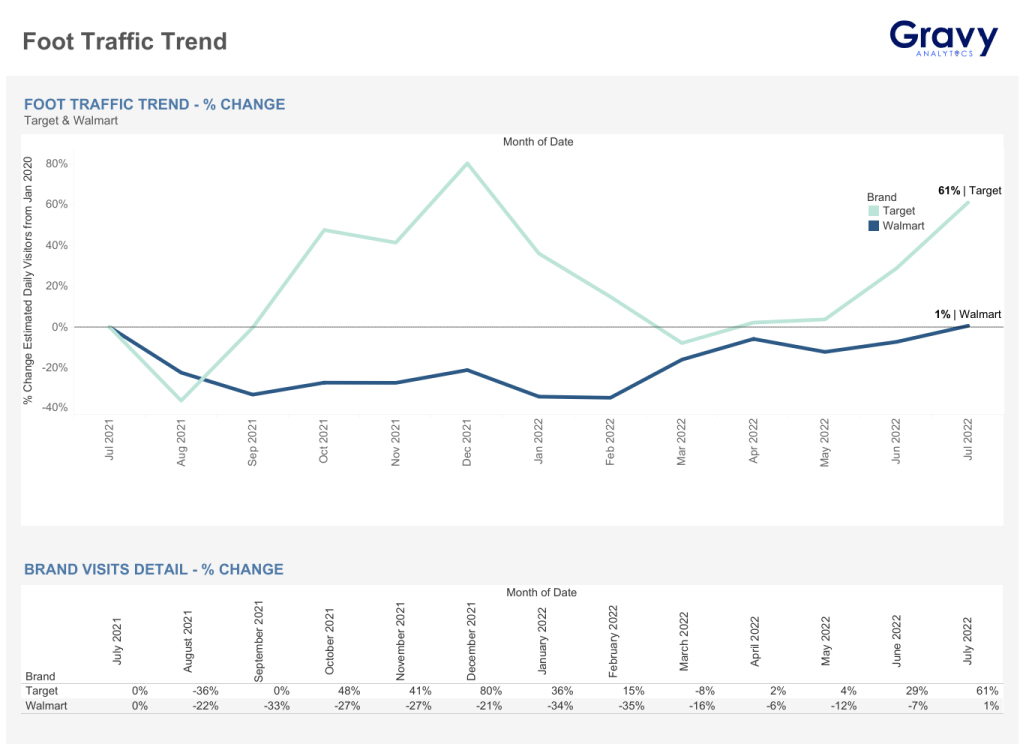

Within the last quarter, which included May, June, and July 2022, Target experienced a significant increase in foot traffic. Meanwhile, during this same time period, Walmart also saw an increase, but it was much more gradual. Both brands experienced a decrease in foot traffic from July 2021 to August 2021, perhaps due to increases in COVID-19 cases caused by the delta variant. However, starting in September 2021, Target’s foot traffic began to rise, ultimately peaking in December 2021, most likely due to holiday shopping. Following this peak, foot traffic at Target declined until it increased once again starting in April 2022, perhaps as customers shopped for spring and summer essentials. This increase continued through the end of this quarter. Following August 2021, Walmart’s foot traffic continued to decline into September. From October 2021 to February 2022, foot traffic increased and decreased slightly, but remained mostly steady overall. In March 2022, foot traffic to Walmart began to increase, and this continued through the end of this quarter. By the end of July 2022, each brand’s foot traffic was above the levels each experienced in July 2021. Year over year, Target saw a 61% increase, while Walmart saw only a 1% increase.

Total Estimated Visitors for Walmart and Target

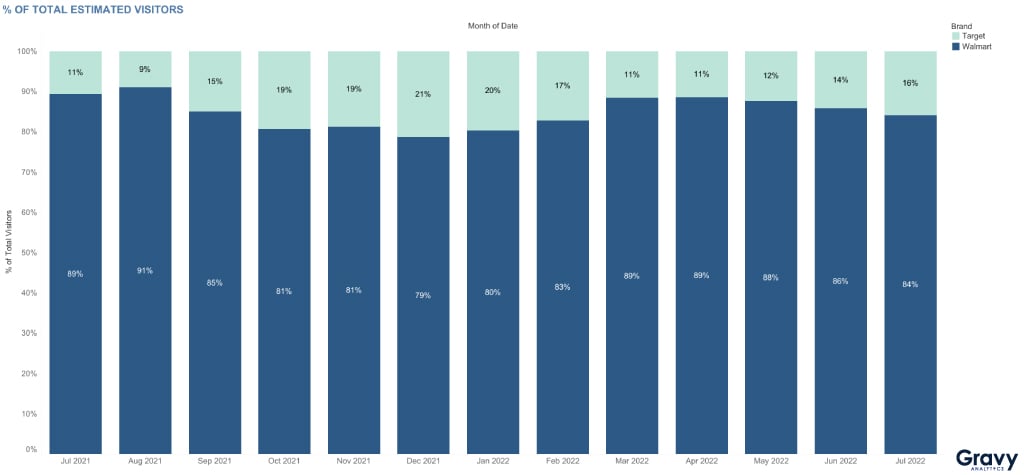

Year-round, Walmart receives a much larger share of total estimated visitors, compared to Target. August is Walmart’s biggest month for visitors, possibly due to back-to-school shopping. December isn’t as big of a month for Walmart, which could indicate that its customers rely more on Walmart for daily needs rather than for holiday shopping. Target saw a larger percentage of visitors during October, November, and December 2021 and January 2022. During those months, consumers are shopping for the holiday season, which might explain the higher share of visitors at Target stores.

Best Days to Go Shopping at Target and Walmart

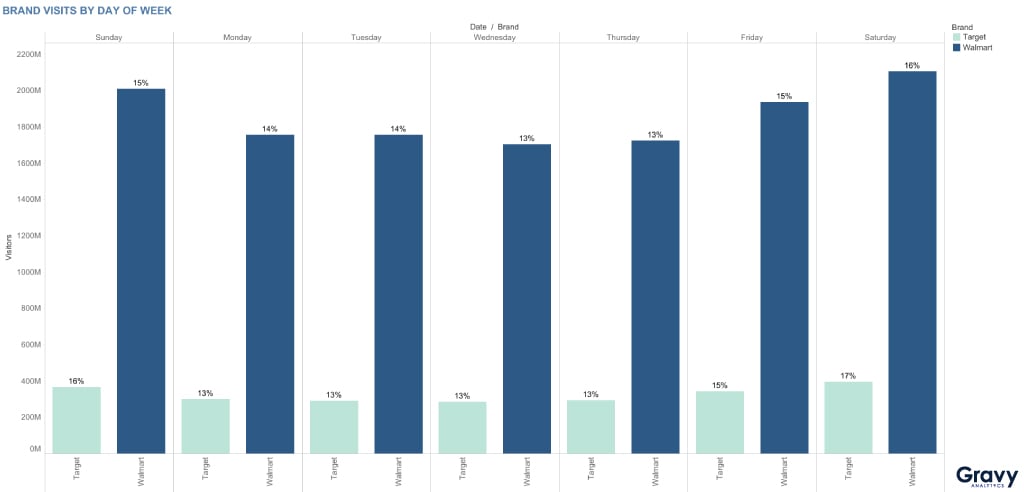

Both brands see similar foot traffic patterns by day of week. Target gets slightly more of its visitors on Saturday and Sunday than Walmart. In contrast, Walmart sees more of its visitors on Mondays and Tuesdays than Target. If you’re a Target shopper, then you might want to shop during a weekday to avoid crowds. Walmart gets most of its visitors on Fridays, Saturdays, and Sundays, so the best days to shop at Walmart are Wednesdays and Thursdays.

Share of Walmart and Target Visits by State

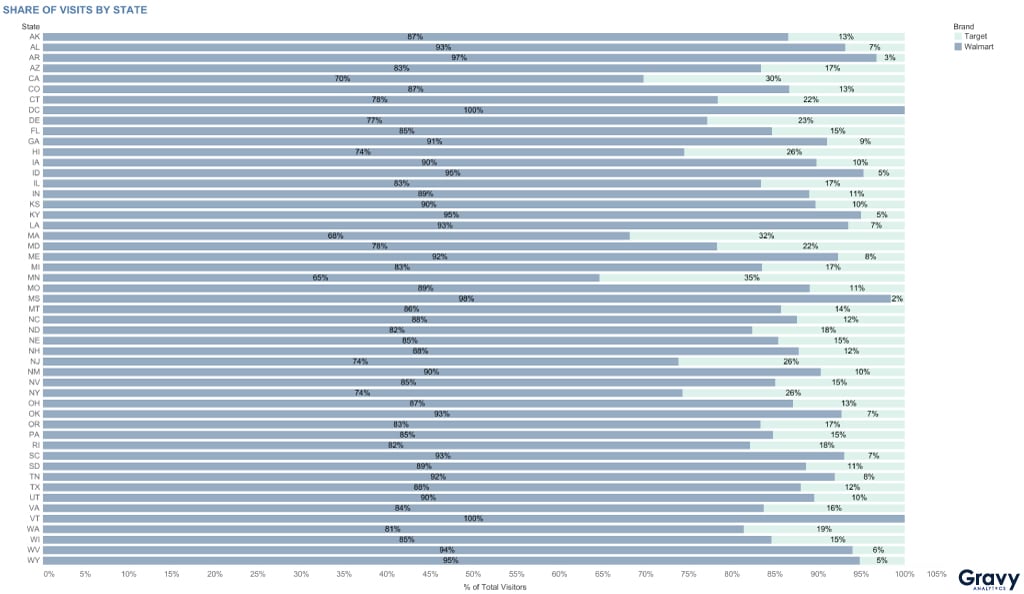

With more than 4,700 stores compared to Target’s 1,900 stores, Walmart receives a larger share of consumer visits than Target in every state. Walmart saw the largest share of visits in Vermont, Washington, D.C., and Mississippi. Walmart also receives more than 95% of visits in states including Arkansas, Iowa, Kentucky, and Wyoming. In which states does Target bring in more visitors? In California, Massachusetts, and Minnesota, where Target’s headquarters is based, Target accounts for more than 30% of consumer visits. Target also attracts its fair share of visitors in states like Hawaii, New Jersey, and New York.

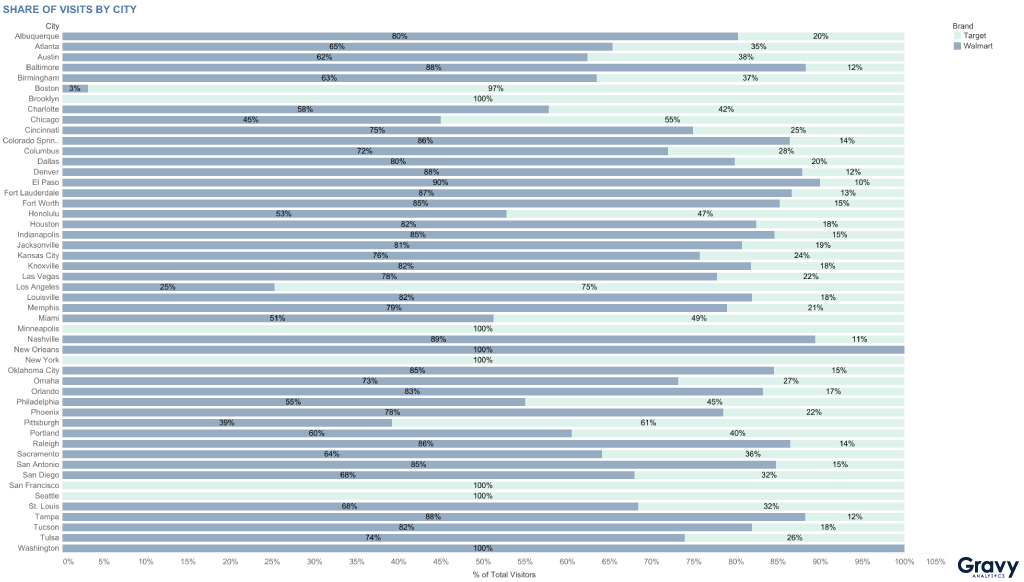

Share of Target and Walmart Visits by City

Target has a much larger presence in metropolitan areas like New York City, Seattle, and San Francisco. It’s also no surprise that Target is popular among shoppers in Minneapolis, as the chain’s headquarters is located in the city. Meanwhile, Walmart’s presence is more concentrated in rural areas and smaller metropolitan areas like New Orleans, Washington, D.C., and El Paso. In these cities, as well as in Nashville, Baltimore, Denver, and Tampa, Target has the lowest percentages of visits to its stores.

Why Target is Performing Better than Walmart

Year-over-year, Target has seen a significantly greater increase in foot traffic, compared to Walmart. Despite posting lower profits, this suggests that Target’s cost-cutting strategies not only kept their current customers coming back, but also attracted additional shoppers as well. This data could also suggest that Walmart shoppers were more affected by inflation than Target customers and shopped less in-person as a result. Last quarter, Walmart’s e-commerce earnings saw a 12% increase year-over-year. It’s possible that the majority of Walmart’s customers are shopping online rather than in-person, which could explain why Walmart’s foot traffic isn’t as high in comparison to Target’s traffic. For more information on using location analytics to understand how consumers interact with brands, contact one of our location intelligence experts today.