Why Is Foot Traffic to Barnes & Noble Stores on the Rise?

June 22, 2023

Over the years, with the advancement of the digital age, there has been a decline in the popularity of reading books. However, during the pandemic, there was a resurgence in reading as consumers were spending much more time at home with ample free time for hobbies. Now, consumers are reading 25% more than they were just a few years ago.

So, how has this revival of reading affected foot traffic levels for the well-known book store chain Barnes & Noble? Moreover, as discretionary spending continues to increase this year, will more consumers prioritize their hobbies and shop at stores like Barnes & Noble? To learn more about how Barnes & Noble’s foot traffic levels are being affected by these recent shifts in consumer interest, we analyzed consumer foot traffic trends over the last 12 months. Here’s what we found.

Foot Traffic to Barnes & Noble Stores

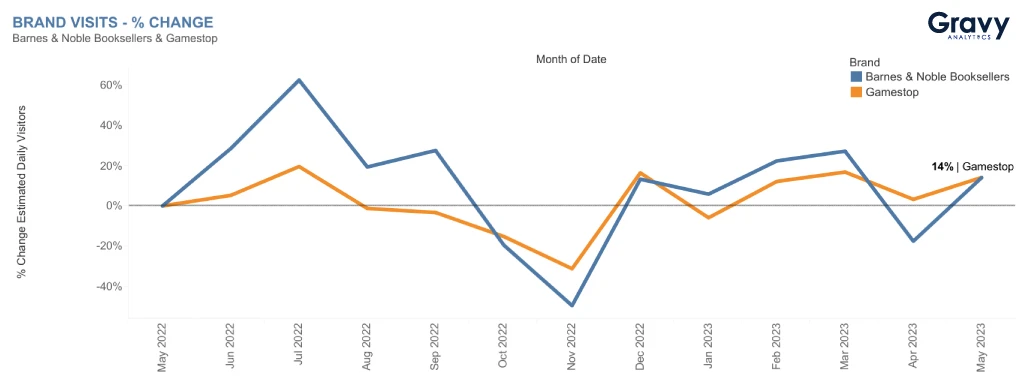

We analyzed foot traffic to Barnes & Noble stores over the past 12 months compared to GameStop’s foot traffic over the same time period to better understand current consumer interest in hobby-based products. For the most part, Barnes & Noble and GameStop experienced similar trends in foot traffic. As of May 2023, both companies saw year-over-year foot traffic increase by 14%. However, this notable growth in foot traffic didn’t come without some sizable fluctuations over the last 12 months.

In July 2022, Barnes & Noble saw a dramatic spike in foot traffic, increasing 62% compared to May 2022. However, later in the year, foot traffic fell by 49% in November. Similarly, GameStop saw a 20% increase in foot traffic in July 2022 and a decrease of 31% in November. Even though both brands saw similar foot traffic patterns, Barnes & Noble saw a much greater surge in foot traffic last summer, compared to GameStop, suggesting there is a strong consumer demand for reading in the summer. However, because both companies are currently experiencing foot traffic growth, both brands could see additional spikes in foot traffic in the coming months.

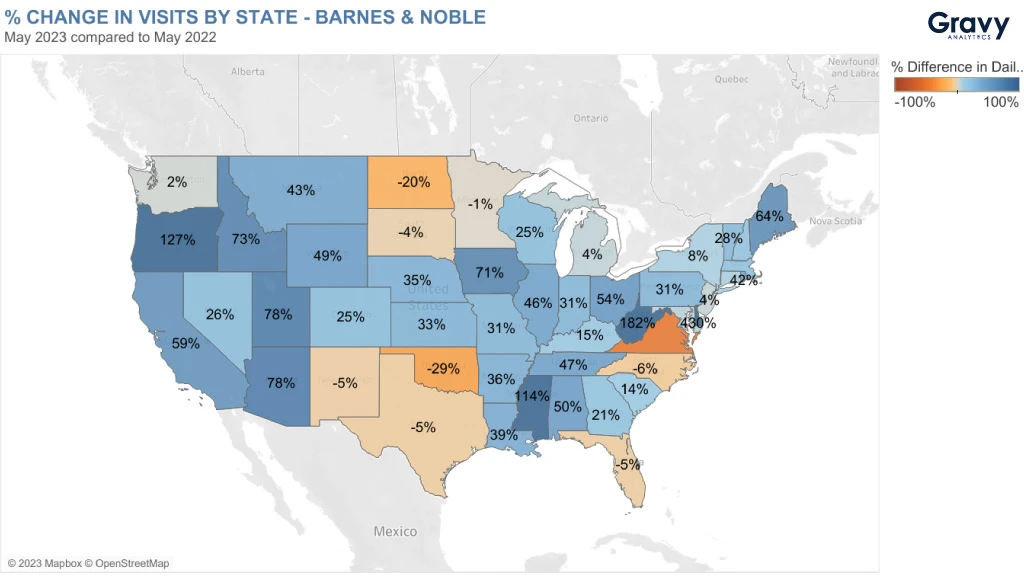

When examining foot traffic to Barnes & Noble stores by state, it’s obvious that in most of the U.S., Barnes & Noble has been gaining popularity. While there are a few states in which foot traffic to Barnes & Noble stores decreased, foot traffic increased in 40 states, plus the District of Columbia. The state seeing the greatest year-over-year growth in foot traffic to Barnes & Noble stores is Delaware, in which foot traffic grew by a staggering 430%. Other states that saw significant increases in foot traffic include West Virginia (182%), Oregon (127%), and Mississippi (114%).

While there were fluctuations in Barnes & Noble’s foot traffic levels over the last 12 months, the overall trajectory shows strong growth that will likely continue as the summer progresses and consumers look for ways to spend their leisure time.

Summertime in Retail

Last year, Barnes & Noble’s increase in foot traffic during the summer months mirrored the trends seen by GameStop, BestBuy, and Michaels. It seems as though, for specialty and hobby-based retailers, seasonality is a common theme affecting foot traffic. As the summer months progress, it is important to note that consumers tend to shop more during this season as the sunny weather inspires shoppers to spend time outside the home.

While summer is important for retailers of all types, it is particularly important for chains like Barnes & Noble as consumers tend to do most of their reading during the summer. This would explain the significant spike in foot traffic that Barnes & Noble experienced during the summer of 2022, and this could mean that more growth is yet to come for Barnes & Noble this year.

Rediscovering Reading in 2023

Following the pandemic, consumers gained a renewed appreciation for shopping and flocked to malls and shopping centers for in-person experiences. Consumers began to value shopping as social opportunities to connect with one another, boosting foot traffic to retail locations post-pandemic. This likely contributed to Barnes & Noble’s surges in foot traffic throughout 2022 and notable year-over-year growth. Moreover, as consumers began to prioritize their hobbies during the pandemic, reading took over social media, encouraging more and more users to become readers.

This resurgence of reading has had a positive impact on Barnes & Noble, prompting the company to open new stores for the first time in years. Plus, Barnes & Noble has recently revamped its rewards program and enhanced its customer experience to attract and retain a strong customer base of readers. These changes have the potential to drive continued growth for Barnes & Noble throughout 2023, with a strong likelihood of foot traffic persisting at their stores.

For more brand performance foot traffic analysis like this, subscribe to the Gravy Analytics email newsletter today.