2022: The Year of Rising Inflation and Rising Starbucks Foot Traffic

December 20, 2022

Amid heightened inflation and discount shopping trends, why is Starbucks’ foot traffic on the rise?

Coffees, sweet treats, and refreshing drinks are the perfect pick-me-up for millions of Americans every day. Even with recent foot traffic updates showing consumer trends moving away from luxury or pricey goods, foot traffic to Starbucks continues to rise. Why might this be? Are Americans still holding on to their favorite, daily buys, even if it isn’t necessary?

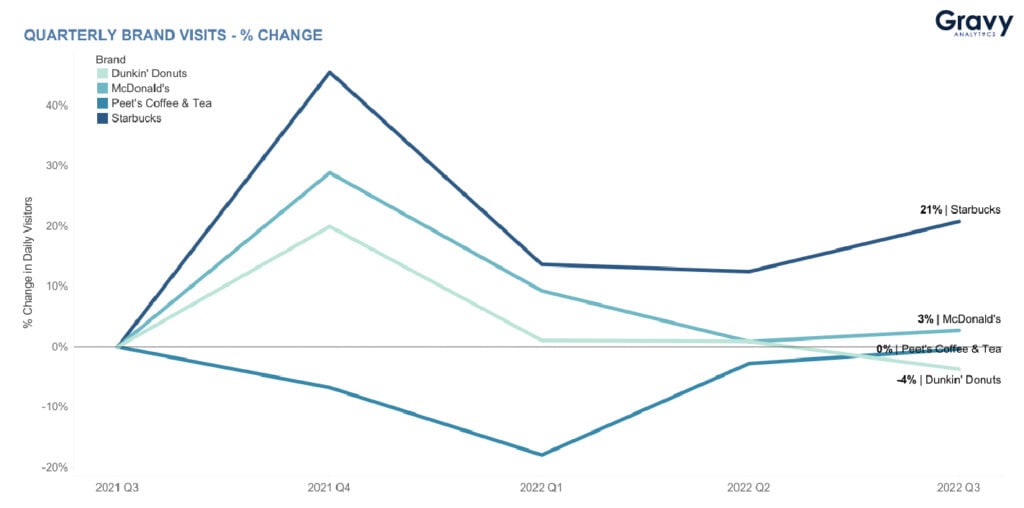

To better understand the rise in consumer visits to Starbucks, we analyzed the company’s foot traffic trends from Q3 2021 to Q3 2022—along with a few top competitors.

Starbucks, Foot Traffic, & QSR Competitors

We looked at Starbucks’ foot traffic compared to Peet’s Coffee & Tea, McDonald’s, and Dunkin’ Donuts. There was an overall similar pattern for all four companies analyzed, but with a few twists.

While Starbucks, McDonald’s, and Dunkin’ all saw significant spikes in foot traffic during Q4 2021, Peet’s was on a steady downslope. After that, Starbucks, McDonald’s, and Dunkin’ saw swift downturns before foot traffic began to even out. In Q2 2022, Peet’s was the only of the four seeing an increase in foot traffic, nearly regaining the level of foot traffic it lost earlier in the year.

As of Q3 2022, Starbucks had a 21% increase YoY. Meanwhile, Peet’s made it out of the negatives for a 0% change YoY. McDonald’s had a 3% increase compared to the previous year, and Dunkin’ Donuts had a decrease of 4% for the same time period. We’ve recently seen a dip in foot traffic to leading QSR chains, so why is Starbucks seeing such a significant increase in foot traffic these days?

Is Coffee a Necessity?

Starbucks serves 60 million Americans each week with over 15,000 locations in the U.S. As it continues to grow, Starbucks could see more dramatic increases in foot traffic throughout 2023.

Peet’s does not have the high increase in foot traffic that Starbucks does, as their significant drop in foot traffic in Q1 this year could indicate that there is more consumer interest in Starbucks or other competitors. Nevertheless, Peet’s continues to be a well-known chain competing with industry leaders. Peet’s is the pioneer in the American specialty coffee industry, so their appeal remains strong. Both Starbucks and Peet’s are experiencing foot traffic increases since Q1 2022, so they will likely see continued increases in Q1 2023. Both chains have one advantage compared to other fast casual or QSR competitors: the product.

The specialty coffee industry is growing rapidly, and the market for this product grows by 9.2% each year. Although Dunkin’ Donuts hasn’t seen the same foot traffic increase that Starbucks has, these companies remain leaders in their industry. As millennial spending power drives market changes, specialty coffee will likely continue to boom and attract in-person visitors. Starbucks has remained one step ahead of these market changes, and according to their foot traffic pattern, their appeal only strengthens.

Starbucks: Foot Traffic, Trends, & Coffee

Not only does Starbucks’ product sell itself these days, but the company has seen overall growth in foot traffic and sales this whole year—and it has weathered the wave of drive-through fatigue that is setting in. So what makes Starbucks so resilient? While the market grows a stronger affinity for Starbucks treats, the company’s business strategies are proving effective.

Starbucks is well known for their seasonal menu and cup changes. Seasonal campaigns allow customers to try new, relevant menu items and show off their purchases with uniquely-designed packaging. For example, this year’s summer brought refreshing and vibrant foods to Starbucks customers, and spring’s eye-catching cups helped set the tone for customers. Let’s not forget Starbucks’ popular holiday cups that take over Q4 every year. Loyal Starbucks customers look forward to these seasonal changes that may attract new or casual Starbucks customers as well. This clever marketing is part of an overall key factor at Starbucks: the customer and employee experience.

People-First Means People Visit

The chain has over 150 unionized stores and a plan to improve the Starbucks experience. Starbucks’ people-first values are an advantage as their traffic increases. Starbucks understands changes in consumer taste and preferences, and plans to meet consumers’ needs as well as employees’ needs to continue growing. This mix of popular products and positive in-person experiences are helping Starbucks’ visits and sales increase—with an optimistic outlook.

Although consumer trends show a decrease in spending on luxury goods, specialty coffee is becoming more important for consumers. This may be an example of the “lipstick effect” taking place. This means that, during this year’s economic downturn, consumers may not be completely doing away with luxury purchases but opting for less expensive luxury buys.

Starbucks, as an affordable luxury and the most expensive coffee company we analyzed, has found a consumer sweetspot this year. Not only is specialty coffee a sought-after product, but it can be conveniently purchased at a trendy location that’s likely close by. That’s why we think Starbucks’ foot traffic will continue to increase into 2023.

To learn more about what foot traffic data can do for your company, contact an expert from Gravy to learn about our location intelligence solutions.