The Changing Habits of the Post-Move American: Socializing & Saving Money

October 25, 2022

By Jolene Wiggins, CMO, Gravy Analytics

Gravy recently released its latest report, “The Changing Habits of the Post-Move American”. Using location analytics and survey data from 1,500 U.S. consumers, the report investigates why and where consumers moved in the aftermath of COVID-19, as well as how their habits have changed.

Whenever we create a data-driven report like this one, there are always a slew of data points that are left out. Sometimes the takeaways are minor or eccentric. At times, there are simply too many charts to include in the space available. In any case, they are always interesting examples of what aggregated location data and analytics can do. Continue reading to see a few more of my favorite outtakes from this project.

“Must-Haves” for Moving

People didn’t just move anywhere. They had specific requirements for their new hometowns. A good school system was important to 22% of survey respondents, and while people overwhelmingly moved to smaller markets, 14% still wanted to have plenty of restaurant and entertainment options available.

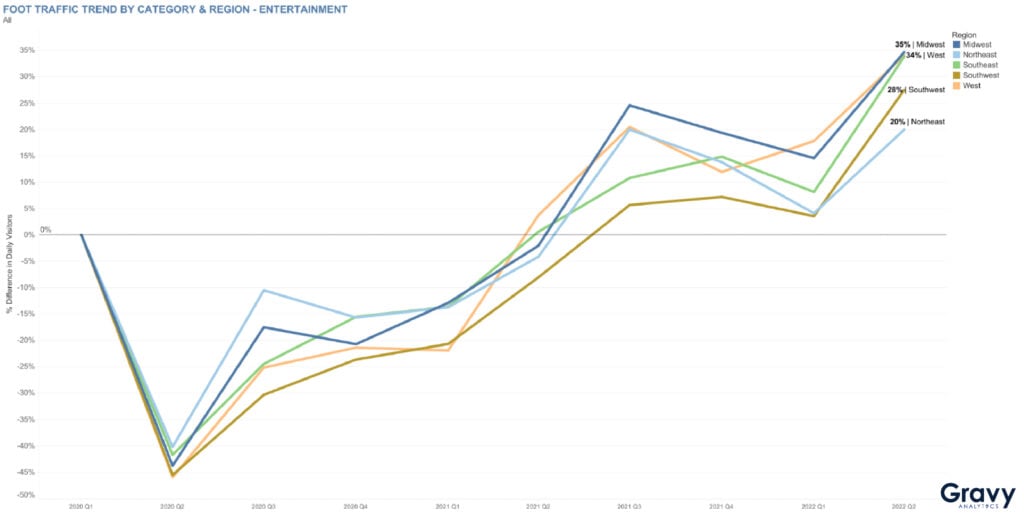

Proving that socializing never goes out of style, as of Q2 2022, foot traffic to entertainment venues was an average 31% higher than pre-pandemic. The chart below shows how foot traffic patterns have changed at entertainment venues in each region since the pandemic began.

In all regions, entertainment foot traffic has far surpassed pre-COVID levels. Consider the chart below, which shows foot traffic growth between Q1 2020 and Q2 2022. In all areas, foot traffic dropped precipitously in Q2 2020, and remained below Q1 2020 levels until mid-2021. Since then, foot traffic to entertainment venues like movie theaters, amusement parks, and bowling alleys, has only continued to rise. We’re accustomed to seeing much more pronounced differences in foot traffic by region; clearly, people living across the country have a lot in common when it comes to entertainment. Interestingly, the West was the first region to return to pre-COVID foot traffic levels, despite strict quarantine policies in California earlier in the pandemic.

It Increasingly Comes Down to Cost

Post-move, cost-of-living still looms large for consumers. 34% of respondents reported that a higher cost of living was their biggest challenge since moving. Shopping habits similarly reflect this, as low prices are the biggest deciding factor when it comes to choosing a grocery store.

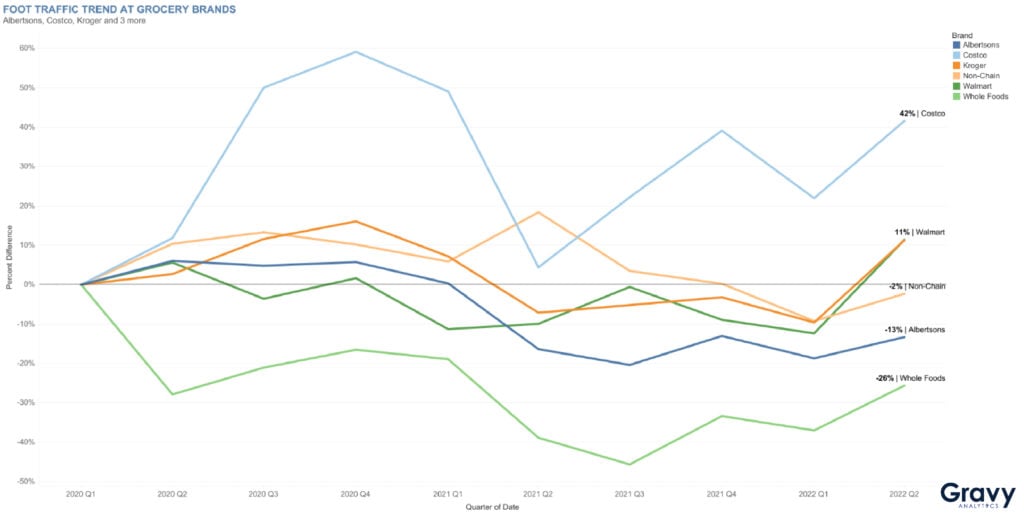

At the onset of the COVID-19 pandemic, foot traffic to grocery stores increased, as people stocked up on groceries and essentials. Due to unusual shopping patterns, staples like flour, sugar, and toilet paper had become increasingly hard to find. With restaurants temporarily closed and more people cooking at home, foot traffic at grocery stores remained high throughout 2020 and into 2021. Foot traffic began to slow after Q2 2021, as COVID rates decreased and vaccination rates increased, and continued to decline through Q1 2022. By the end of Q2 2022, foot traffic at grocery stores was slightly below (-4%) pre-COVID levels.

Compared to the other place categories we’ve discussed, grocery store foot traffic has remained relatively stable since 2020. When examining foot traffic by brand, however, some stark differences begin to emerge. Foot traffic to premium grocery brand Whole Foods has declined nearly -26%.

At the same time, mid-range grocery brands Kroger and Albertsons are performing very differently: Kroger ended Q2 2022 with foot traffic up nearly 11% compared to Q1 2020, while Albertsons’ foot traffic was down by -13%.

Why could this be the case? It appears that shoppers may increasingly be choosing to shop for food at grocery alternatives. During the same period, foot traffic to Walmart and Costco was up 11% and 42%, respectively. While not true grocery stores, both Costco and Walmart sell groceries alongside other goods at typically lower prices. This suggests that consumers may be doing more of their grocery shopping at wholesalers and big box stores in order to stretch their budgets during a time of high inflation.

For more insight into changing consumer habits, download our full report, “The Changing Habits of the Post-Move American”. You’ll see that some of the places that drew new residents at the start of the pandemic are now losing population. In other states, people who moved away have now started to return. As always, be sure to let us know what you think.

If you’d like to learn how your business can use location analytics to understand consumer behavior and new market trends, we’re here to help. Schedule time with a location data expert today.