Consumer Car Buying Behavior: An Analysis of Auto Buyers in 2019 vs. 2021

October 1, 2021

At the onset of the coronavirus pandemic, car companies and dealerships peddled rampant discounts in the hopes of curbing the economic impacts of the pandemic. It was a slow start, but eventually, consumers came back in droves, pushing their pandemic savings and stimulus checks into the car buying market. Now, we are facing a different economic situation in auto buying: supply chain disruptions, a semiconductor shortage, and soaring car prices.

To find out exactly how COVID-19 has impacted the automotive industry in 2021, we analyzed the personas of consumers interested in buying cars (Auto Buyers). We also ranked all 50 states, as well as Washington D.C., in order of persona prevalence. If a state had a higher percentage of residents fitting the persona, we gave it a higher rank on the list. Then we compared each state’s rank in 2021 to 2019 to see exactly how consumer personas in each state have changed.

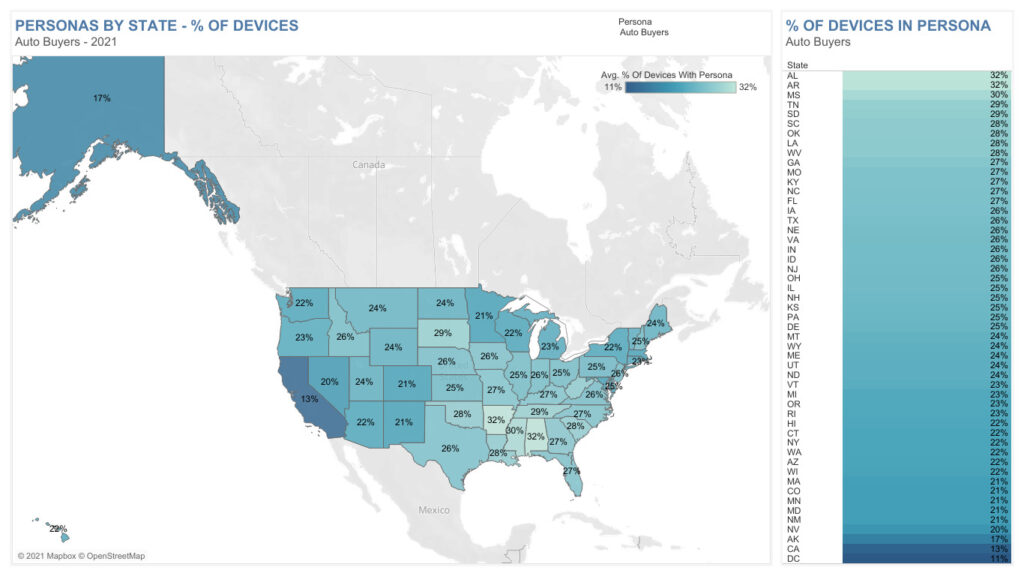

Consumer Interest in Car Buying by State

The states with the highest percentages of auto buyer personas in 2021 are Alabama (+32%), Arkansas (+32%), and Mississippi (+30%). The auto industry never foresaw the looming chip shortage or supply chain disruptions, parallel with rising consumer demand. Because of this, 2021 quickly became a seller’s market for used cars. People in these three states might be looking to upgrade their current vehicles or trade in their old ones to cash in on a thriving used car market.

States that didn’t see as much interest in car buying include California, D.C., and Alaska. Many consumers living in D.C. may rely more on public transportation and may not need their cars as much as they used to with the increase in remote working. Car prices in Alaska and California are often much higher compared to other states regardless of economic conditions. In addition, California and D.C. were subject to strict lockdowns due to COVID-19. As a result, people living in those areas more than likely put less wear and tear on their cars.

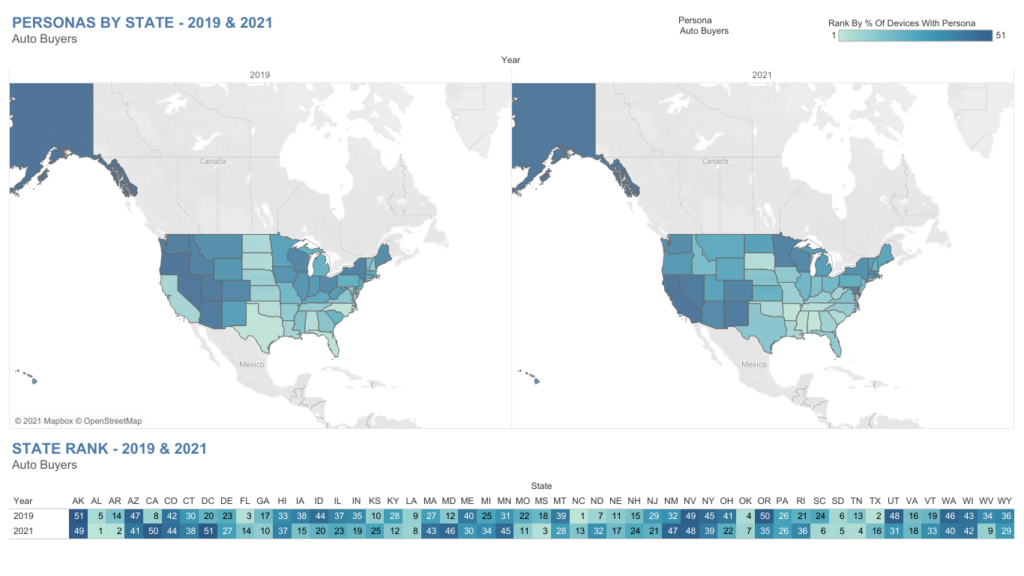

Changes in Consumer Car Buying Behavior: 2019 vs. 2021

The state rankings tell an interesting story about the shifts in consumer car buying behavior, especially when looking at the states that saw the most differences in ranking in 2019 versus 2021. In 2019, California ranked at #8 in the country for auto buyer personas, but now is ranked at #50, almost at the very bottom when compared to the rest of the country. Consumers in D.C. aren’t as interested in car buying as they were in 2019 when the district ranked at #20; D.C. is currently ranked at #51 in 2021.

Consumers living in California and D.C. may be holding on to the cars that they already have; wary consumers may want to hold on to their current vehicles until car prices drop again. Recently, California was named one of America’s 10 most expensive states to live in, which could be a reason why residents of the state may not want to spend money on a car in today’s auto buying market.

Alabama, Oklahoma, and South Dakota, which all had high percentages of consumer interest in auto buying in 2019, remained at the top of the list in 2021.

The Future of Consumer Car Buying Behavior

If there’s anything that can be garnered from the current state of car buying, it’s that people across the country have different priorities, and those priorities can shift dramatically from year to year. As 2021 continues, consumer interest in auto buying may improve in certain areas such as California and D.C. However, now that federal aid and unemployment benefits have paused for the foreseeable future, we may see a downward shift in car buying as consumers focus on saving rather than spending.

For more information on location intelligence, and how it can help you determine the ideal persona for your business, speak with the experts at Gravy Analytics today.