Consumer Sentiment Leans Towards In-Person Experiences

September 13, 2022

Traditionally, consumer sentiment is measured through surveys. These surveys provide companies with insight into consumer confidence, consumer attitudes, and consumer spending. Data enrichment can take consumer sentiment to a whole new level. Surveys aren’t the only way to understand consumer trends. One factor that is currently affecting consumer sentiment is inflation. Our recent consumer trends report looks at how inflation and other socioeconomic factors affected consumers during the second quarter of 2022. To measure inflation’s impact on consumer sentiment, we analyzed foot traffic data from Q2 2021 to Q2 2022 in a variety of place categories—from Accommodations to Transportation.

What did we find? We discovered consumers are leaning towards in-person experiences. Let’s look at our data to see which entertainment-related places are seeing the return of crowds.

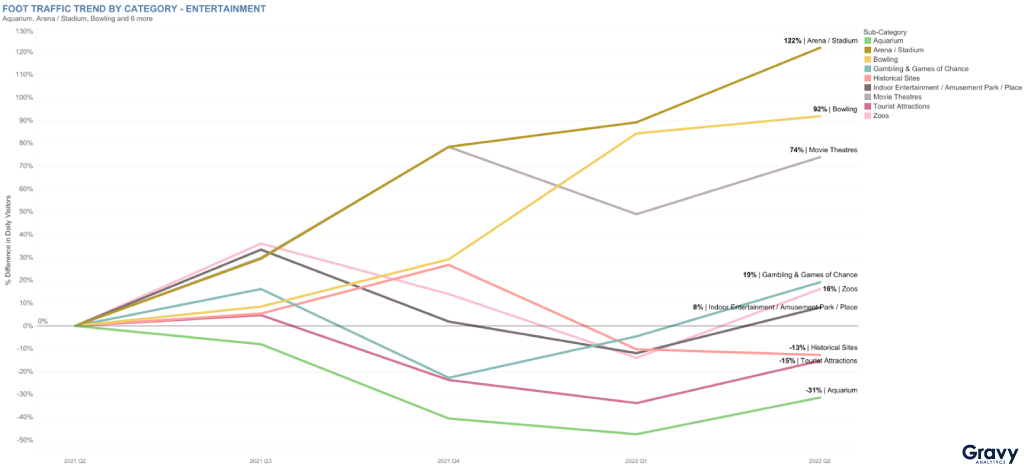

Crowds Returns to Movie Theaters, Bowling Alleys, and Arenas

Once again, consumers aren’t hesitating to return to big crowds. Foot traffic to venues that are often associated with socializing was significantly higher in Q2 2022 than in Q2 2021. Consumers are once again going bowling (+92%), catching a movie at their favorite theater (+74%), going to see a game or concert at their local arena (+122%), and visiting casinos (+19%). Visits to indoor entertainment venues and amusement parks were slightly up as well; Q2 2022 foot traffic was 8% higher compared to the same quarter of the previous year. While 2022 has been a crazy year for travel, consumers might have checked local tourist areas off their must-see lists earlier in the pandemic. This could explain why historical sites, tourist attractions, and aquariums didn’t see as much foot traffic this year.

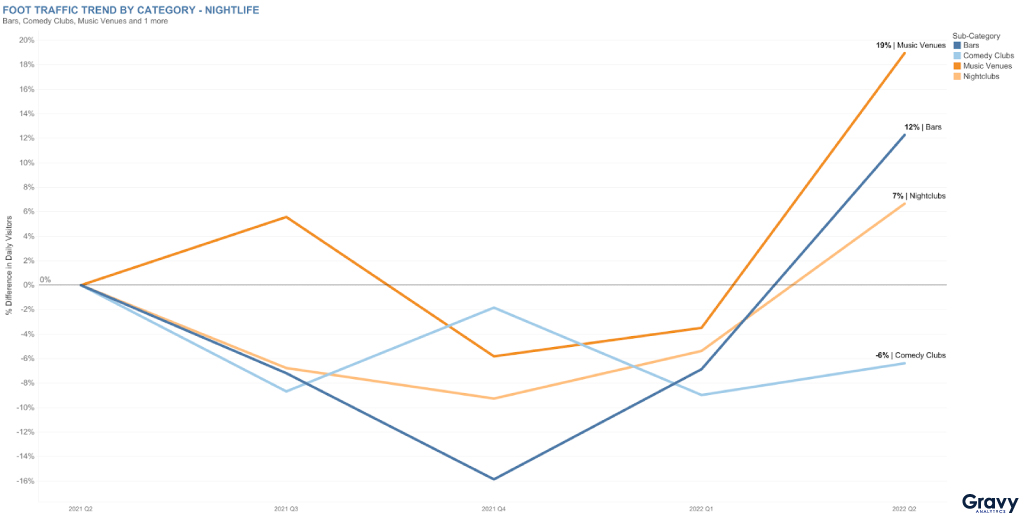

Consumers Clamor Back to Music Venues

If our general entertainment foot traffic data is any indication, people are clamoring back to see shows at music venues as well. Year over year, foot traffic to music venues was 19% higher. Concerts are definitely back, but are bars and nightclubs? Nightlife changed dramatically after 2020, resulting in many clubs and bars having to adapt. Our foot traffic data shows that bars and nightclubs are now recovering their clientele. Visits to nightclubs were up by 7% in Q2 2022 compared to Q2 2021, while bar visits were up by 12%. Interestingly, comedy club foot traffic was 6% lower, which might be an aftereffect of comedy tours getting canceled due to omicron and other coronavirus variants.

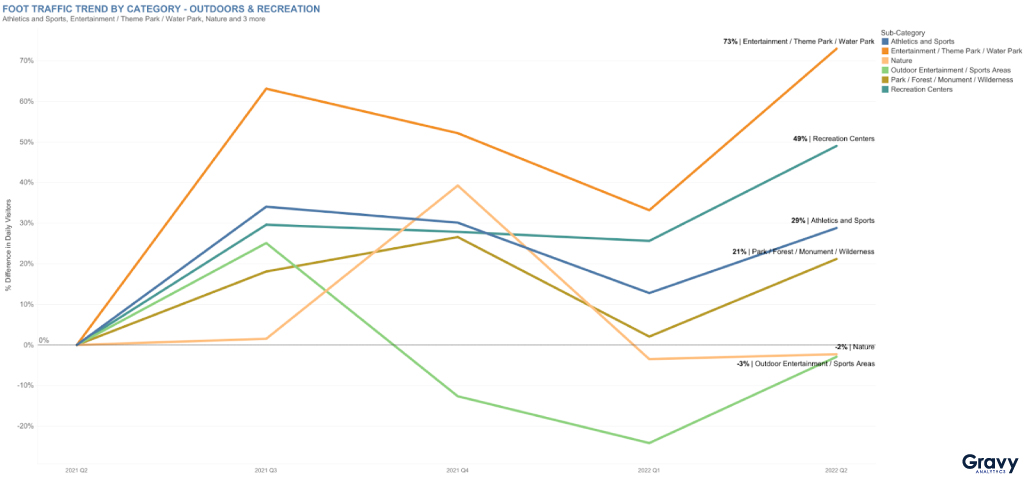

Consumers Spend Time at Theme Parks

After some theme parks remained closed throughout 2020 and the early part of last year, many people opted to spend time outdoors or partake in other socially-distanced activities. Now that many theme parks have reopened, consumers are taking advantage of the opportunity to go on as many roller coasters and thrill rides as possible. Foot traffic to theme and amusement parks was 73% higher year-over-year. Consumers are also starting to work out indoors again. By Q2 2022, foot traffic to recreation and athletic centers was 49% and 29% higher, respectively, than Q2 2021.

More Consumer Insights from Gravy

Based on our data, consumer sentiment towards in-person experiences has changed. Q2 2022 was great for entertainment-related places. What can those places expect in Q3 2022? Summer travel will more than likely provide an enormous boost in foot traffic to locations specializing in entertainment. As summer transitions to fall, entertainment-related location could see a continued increase in foot traffic because of the autumn holidays and cooler weather.

Interested in more consumer insights? Our Q2 2022 Consumer Trends Report is out now. Download it here.

Ready to talk about location analytics? Speak with one of our enterprise location intelligence.