How COVID-19 is Affecting Foot Traffic at Grocery Stores

April 15, 2020

With consumer behavior shifting in major cities and states due to COVID-19, many retailers, including major brands, are seeing changes in foot traffic patterns. Grocery stores remain open as essential businesses, but they still are seeing less store traffic than average. As of March 31, food retail saw a 40% decline in consumer visits. This decline could be due to the increase in consumer spending on grocery delivery and ordering grocery items online. But, are individual grocery brands all experiencing the same trend? Gravy wondered if this was the case, and decided to take our analysis one step further by analyzing major grocery chains.

Using aggregated and pseudonymized location data, we analyzed unique visits at ten major grocery chains, including Whole Foods and Safeway, to see how current consumer behavior is affecting these brands. To determine this, we compared average daily unique visits in March to same day-of-week unique visits in February.

Which grocery chains experienced increases in foot traffic in March? Which ones saw decreases?

Here is what we found as a result of our analysis:

Overall Decline in Store Traffic

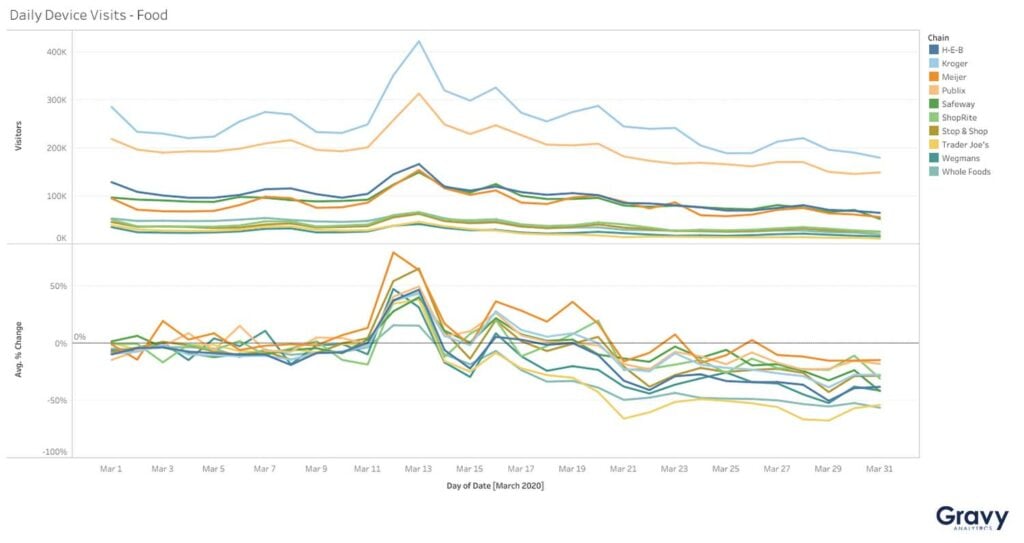

Foot traffic remained steady for grocery chains, and then increased significantly on March 12, possibly caused by shoppers wanting to stock up on essentials.

After March 13, visits began to decline for most chains, possibly due to stores beginning to reduce their hours and an increase in consumers ordering grocery delivery.

Foot Traffic at Specialty Grocers

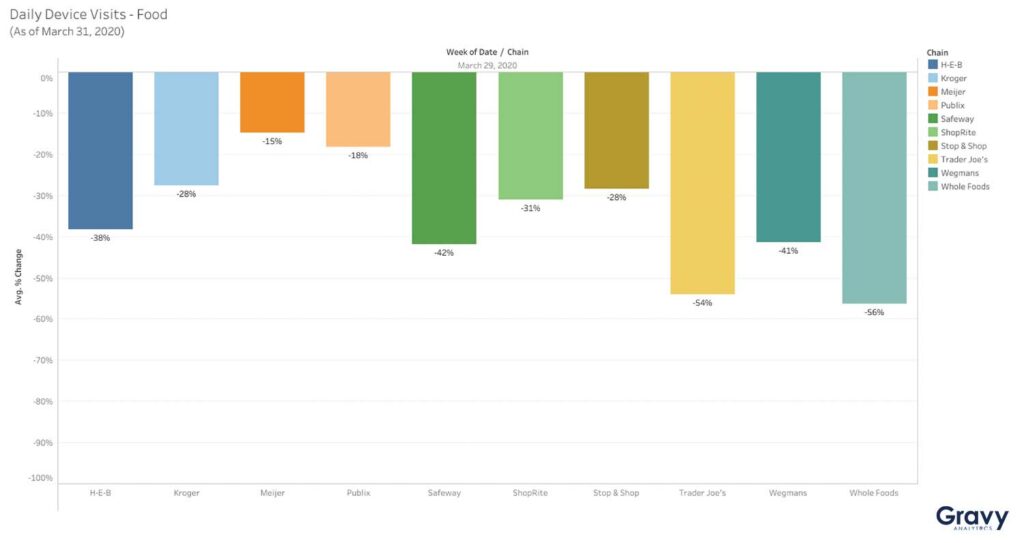

Whole Foods, Trader Joe’s, and Wegmans saw the greatest decreases in foot traffic. Unique device visits to these chains declined dramatically between March 16 and March 21. As of March 31, foot traffic had declined by 56%, 54%, and 41% respectively for these specialty grocery brands.

Whole Foods and Wegmans may have seen fewer visitors to their stores since they offer delivery and curbside pick-up options. Trader Joe’s doesn’t offer delivery, but their decline in unique visits might have been due to its reputation as a destination for snacks and party food. Like other chains, foot traffic at these brands remained below average for the rest of March.

Rise of the Supercenter

Compared to other grocers, Meijer saw the least impact to unique consumer visits, with just a 15% decline in foot traffic as of March 31. Foot traffic at the Michigan-based supercenter chain remained strong through St. Patrick’s Day (March 17) and above average through March 20. This increase could have been due to holiday-related traffic combined with people stocking up on essentials after Meijer announced that their store hours would change starting March 20.

Meijer is similar to Walmart and Costco in their offerings as a supercenter, which gives consumers looking to stock up on essentials ample opportunity to find what they are looking for. Like Meijer, Publix was less impacted; it experienced only an 18% decline in foot traffic as of March 31. The Florida-based chain could have seen less of an impact due to the success of their senior shopping hours including early pharmacy access.

How Did Other Grocers Fare?

H-E-B, Kroger, ShopRite, and Stop & Shop also saw declines in foot traffic at their stores, but they didn’t see as large a drop in foot traffic as specialty grocers. These grocery chains also have curbside pickup or delivery options, but it seems that more of their shoppers are still willing to go into stores to get what they need. Foot traffic at Safeway had declined by 42% as of March 31. This suggests that Safeway shoppers are using delivery and pickup options more than their counterparts at H-E-B, Kroger, ShopRite, and Stop & Shop.

How has COVID-19 impacted your local grocery store? Are you ordering grocery delivery or going into the store? Let us know on social media, or contact us.