How Is Inflation Changing Consumer Foot Traffic to Dollar Stores?

March 9, 2023

Recently, some of the most popular shopping destinations have been dollar stores. As inflation, nationwide layoffs, and other economic challenges persist this year, will foot traffic to dollar stores shift? As recent trends show, consumers are spending less on big purchases like cars or homes, and opting for cheaper, quicker food options. This tells us that consumers have been cost-conscious and strategic about their spending. Are these trends favoring dollar stores? To learn more about these consumer trends, we analyzed foot traffic to Dollar General, Dollar Tree, and Family Dollar.

Dollar General vs. Dollar Tree and Family Dollar

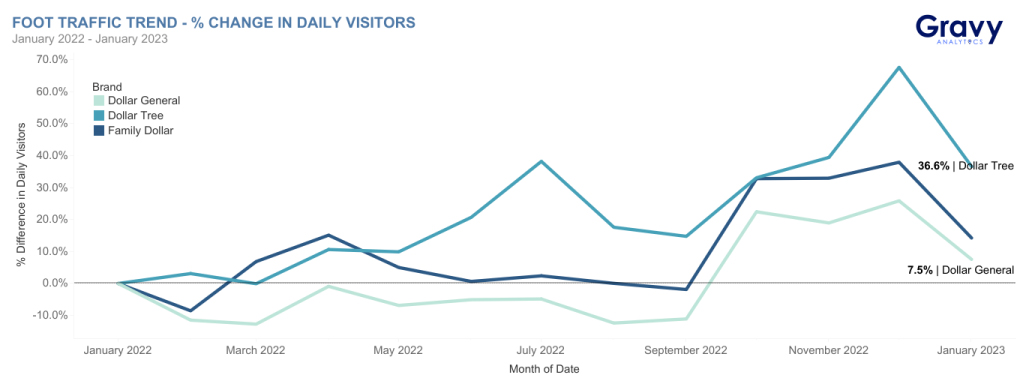

We analyzed year-over-year foot traffic to Dollar General, Dollar Tree, and Family Dollar (a Dollar Tree company) from January 2022 to January 2023. Dollar General saw the least foot traffic growth year-over-year with a 7.5% increase. Family Dollar’s foot traffic grew by 14.2% year-over-year, and Dollar Tree’s grew by 36.6%. With the greatest year-over-year foot traffic growth, Dollar Tree also saw a significant spike in foot traffic during July 2022. This was likely due to consumers’ draw to Dollar Tree’s highly affordable prices. Even in comparison to other dollar stores, Dollar Tree’s prices remained low as record-high inflation set in.

Except for the foot traffic spike Dollar Tree saw in July 2022, all three companies saw similar patterns in foot traffic throughout the year. Most recently, each brand saw spikes in foot traffic in December of last year, which was then followed by dips in foot traffic at the start of 2023. However, this doesn’t mean foot traffic to dollar stores will continue to drop. At the bottom line, foot traffic to dollar stores increased across the board year-over-year, and it may continue on an upward trend as 2023 continues. Recent consumer spending behavior is in favor of dollar stores, so Dollar General and its competitors may see more visitors soon.

How Is Current Consumer Behavior Favoring Dollar Stores?

Recently, we’ve learned that food stores are some of the most popular shopping destinations. Convenient, affordable grocery stores are popular, and grocery shopping has recently gotten more competitive. Along with grocery stores, fast food chains have been attracting the most foot traffic in the restaurant category. These recent trends emphasizing convenience and value, will likely favor dollar stores as people shop for essentials like groceries.

Dollar General is known for its wide selection of grocery goods and other merchandise. So, why are consumers flocking to Dollar Tree or Family Dollar more and more? It likely comes down to cost. Dollar General is generally more expensive than its dollar store competitors. Last year, Dollar Tree increased its price cap from $1 to $1.25, a controversial but strategic move. The price increase is still significantly lower than average Dollar General or Family Dollar prices. This increased price cap allowed Dollar Tree to expand its product line, boost sales, and attract new shoppers. As affordability continues dominating consumer interest, dollar stores will keep attracting in-person shoppers—especially Dollar Tree.

Foot Traffic to Dollar Stores in 2023

Although the most inexpensive and convenient stores are likely to appeal to more consumers this year, Dollar General may be making some strategic decisions of its own.

Recently investing in private brands, Dollar General has announced its revamped premium pet food. If Dollar General continues to build upon private-held brands and offer premium products at value prices, foot traffic could grow significantly.

It’s no secret Dollar stores like Dollar General or Dollar Tree skew toward essential items like food or personal care products. However, other dollar stores may take the lead this year. Dollar General is now launching its new spinoff project, Popshelf. This is a dollar store that focuses on selling home goods, kitchenware, and other products. As Americans pull away from large purchases, 2023 may be the year for dollar and discount store expansion into new retail industries. Although foot traffic to dollar stores for essential products is on the rise, could up-and-coming dollar stores like Popshelf or Five Below grow their market share?

This year, business strategies will need to emphasize value above all, but it will be interesting to see how dollar stores will continue competing for shoppers.

For more brand performance and foot traffic insights like these, join the Gravy Analytics newsletter list today.