McDonald’s in 2023: How Does the Company’s Foot Traffic Compare to Its Top Competitors?

April 20, 2023

One of the most prominent consumer trends we’ve seen lately has been an emphasis on convenience and affordability, especially when it comes to dining. Recent foot traffic data shows that consumers have largely been choosing one of the most convenient and affordable options of them all: fast food restaurants. So, with recent consumer trends favoring fast food chains, what does consumer foot traffic look like to the nation’s leader in fast food, McDonald’s? As post-pandemic economic disruptions like inflation continue on, are consumers increasingly being drawn toward fast food options like McDonald’s in 2023?

Earlier this year, we analyzed foot traffic within the food and beverage industry during Q4 2022 and found that many fast food chains experienced an increase in year-over-year foot traffic. However, McDonald’s, one of the leading fast food chains, saw a decrease in year-over-year foot traffic in Q4 2022. So, have McDonald’s customers returned to its locations in 2023, or are the brand’s competitors continuing to attract more foot traffic?

McDonald’s Foot Traffic Analysis

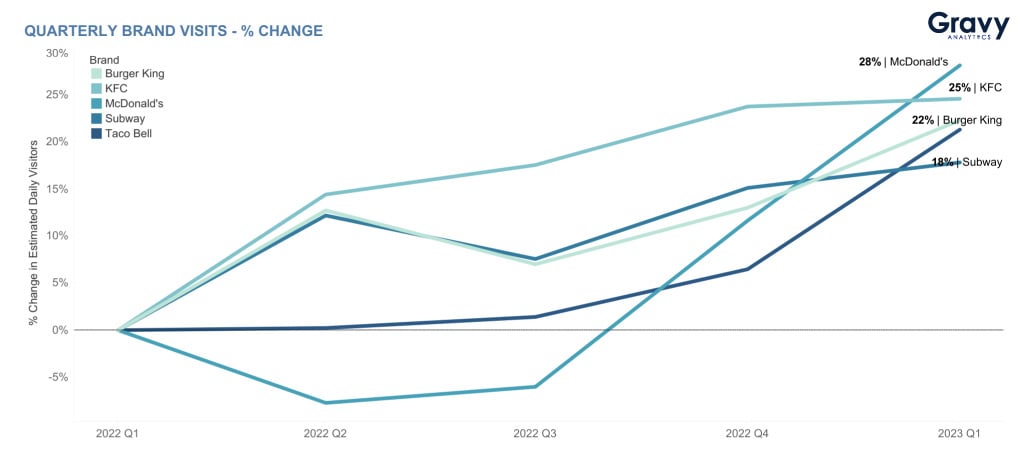

We analyzed year-over-year foot traffic to McDonald’s and some of its competitors, including KFC, Burger King, Subway, and Taco Bell. We looked at foot traffic to all five chains from Q1 2022 to Q1 2023.

From our analysis, it seems as if McDonald’s customers are beginning to return to its quick service restaurant (QSR) locations as the company has seen significant growth in foot traffic. Although foot traffic was beginning to dip for McDonald’s late last year in Q4 2022, McDonald’s saw foot traffic rise in the new year, ending Q1 2023 with a 28% increase in year-over-year foot traffic. Meanwhile, KFC’s foot traffic increased by 25% and Burger King’s grew by 22%. Furthermore, Taco Bell and Subway experienced rises in foot traffic of 21% and 18%, respectively. With all five companies seeing significant growth in foot traffic over the last year, it seems as though consumers are valuing the quickness and affordability of these top QSR chains. So, how might foot traffic look for McDOnald’s and its competitors as 2023 progresses?

McDonald’s Customers in 2023

This year, some McDonald’s customers have already been experiencing a staffless QSR experience. McDonald’s recently unveiled its fully automated design in Texas, functioning as a takeout location with fully computerized systems. As consumers continue to value ease and convenience when dining, could automated store locations become more trendy this year?

McDonald’s isn’t the only restaurant chain dabbling in automation. Taco Bell’s innovative drive-thru concept and Wingstop’s new digital-first design allow for effectiveness and smooth customer experiences. As the year progresses, we’ll likely see more fast food companies incorporating technology into their operations to not only streamline their processes and reduce costs but to save their customers time and money as well.

As automation continues to gain prominence in the QSR industry, how will McDonald’s customers, and those of other top fast food chains, react? If customer needs are consistently met and customer experiences continue to evolve positively, QSR brands may continue seeing significant growth in foot traffic as they attract more and more visitors.

For more foot traffic analyses like this one, subscribe to Gravy Analytics’ email newsletter today.