Q2 2022 Shopping and Dining Trends

August 31, 2022

Q2 2022 proved to be an interesting quarter for retailers and restaurants as they dealt with shifts in consumer sentiment due to inflation. Surprisingly, retail sales increased in June 2022, according to data from the National Retail Federation (NRF), which reflects a resilience in consumer spending, despite high prices for certain products and services. Shopping and dining trends (including at-home cooking) are continuing to change. Year-over-year, grocery prices rose 12.2%, but prices in some retail-related categories fell. Meat and consumer electronics were areas that saw significant price drops. To understand how inflation affected shopping trends and consumer dining behavior, we compared Q2 2022 and Q2 2021 foot traffic for a selection of retail and restaurant categories.

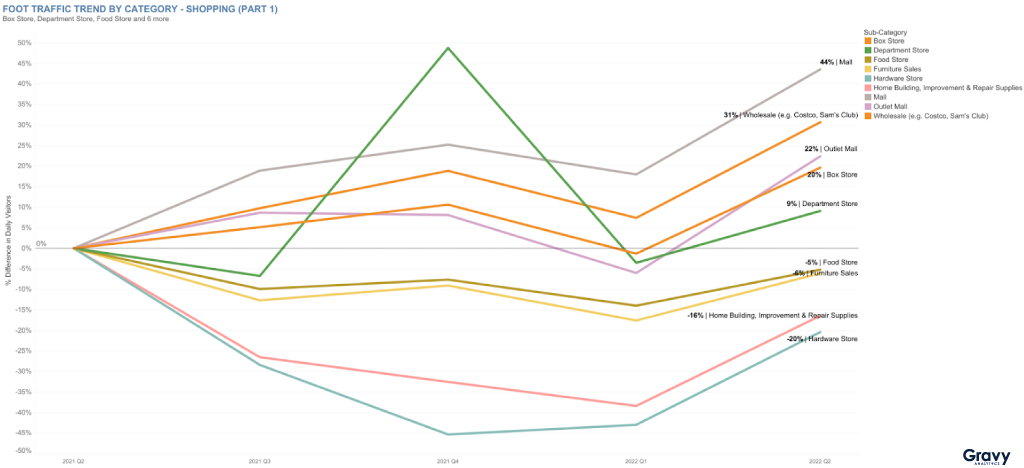

Shopping Malls Are Back Again

Malls are said to be “dead,” but according to our foot traffic data, this certainly isn’t the case, as visits to malls (+44%) and outlet malls (+22%) were significantly up. It seems like the days of social distancing while shopping may be over (at least for now). Wholesalers, which were very popular during the surge of bulk purchasing at the start of COVID, are still among consumers’ favorite places to shop; visits to wholesalers were up by 31%.

Big-box stores also benefited from this shift towards more in-person shopping; Q2 2022 foot traffic was 20% higher than in Q2 2021. Visits to department stores were up by only 9%, a slight rebound from Q1 2022 but nowhere near the holiday peak of Q4 2021. Consumers didn’t shop as much at food stores, furniture stores, or home improvement retailers; visits were down for all of these place categories in Q2 2022 compared to Q2 2021. Again, this most likely has to do with changes in discretionary spending.

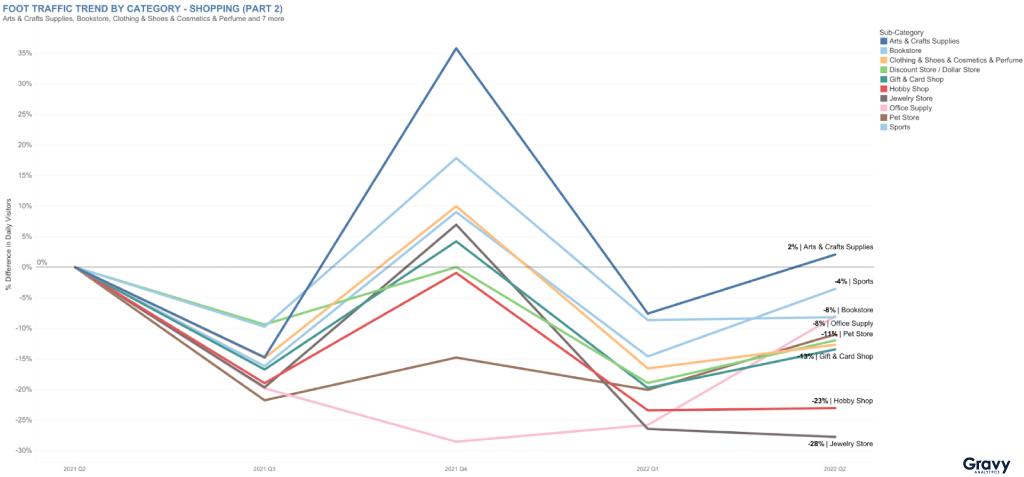

Discretionary Purchases Aren’t a High Priority for Consumers

During the holidays in Q4 2021, visits were up for stores specializing in gifts and other consumer goods like books, jewelry, and sporting goods. Now, consumers aren’t as interested in purchasing goods related to hobbies, gifts, and recreational activities, which could reflect both seasonal trends and changes in consumer priorities. Our data suggests there is sustained consumer interest in arts and crafts, just like there was during COVID-related lockdowns in 2020. Year-over-year, foot traffic to arts and crafts supply stores was 2% higher. Discretionary purchases that require large monetary investments, like hobby supplies (-23%) and jewelry (-28%), weren’t top of mind for consumers, as visits to these places were noticeably down.

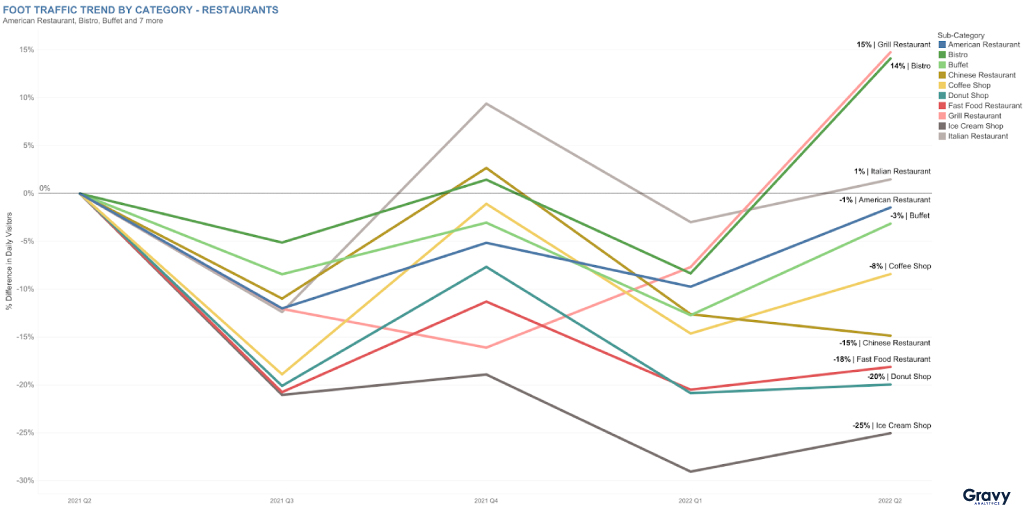

Consumers Aren’t Enthusiastic About Fast Food

During the height of the COVID pandemic, many consumers didn’t go to sit-down restaurants and chose to go for quick bites like fast food, donuts, or ice cream, instead. Now, visits to sit-down restaurants are on the rise, and consumers are choosing to cut back on the fast food options that used to be their go-tos. In Q2 2022, foot traffic to fast food restaurants was 18% lower, compared to the second quarter of 2021. Consumers are more interested in eating at bistros (+14%) and grills (+15%), which aren’t too expensive, but are still avoiding buffets (-3%), even though they have become more comfortable dining indoors. Between rising inflation and changes to discretionary spending, business lunches and coffee shop meetings may be things of the past; visits to steakhouses (included in American restaurants) were flat, while visits to coffee shops were down by 8%.

What Retailers Could Expect by the End of Q3 2022

Retail sales were flat in July 2022, compared to the previous month. How will the retail industry fare in the autumn? Back-to-school shopping and purchases in anticipation of the upcoming fall holidays may increase retail foot traffic and sales. We predict that this boost in retail performance from seasonality could continue into the last quarter of 2022.

If you’re interested in learning more about Q2 2022 consumer trends, download our report here.

Ready to chat about how your business can use location intelligence? Schedule some time to speak with one of our experts.