Q3 2022 Consumer Trends: Shopping Highlights

November 10, 2022

Foot traffic patterns at shopping-related places of interest, like clothing, hardware, and electronics stores, tell us a lot about what’s important to today’s consumers. The third quarter of 2022 ushered in a number of new consumer shopping trends, some good and some bad.

On the positive side, hotels are once again welcoming guests, stores and restaurants are open, and theaters are selling tickets. However, many industries are still struggling with supply chain issues caused by COVID-19, leading to widespread shortages of goods, and causing a lot of frustration among shoppers. And, while inflation has finally started to come down from the highs seen earlier this year, the topic still dominates the headlines.

One reason for these continued challenges is that new COVID-19 variants keep emerging. As a result, many retail businesses are still having trouble getting back to normal. In addition, many shoppers remain worried about their financial security and are reluctant to spend money on non-essential items.

Nevertheless, there are some bright spots in the shopping category. For example, Gravy’s Q3 foot traffic data shows that in-person shopping is back in a big way. And while luxury brands continue to be hit hard as a result of the recession, value brands have seen increased demand as consumers put more focus on getting the most for their money.

The Return of In-Person Shopping

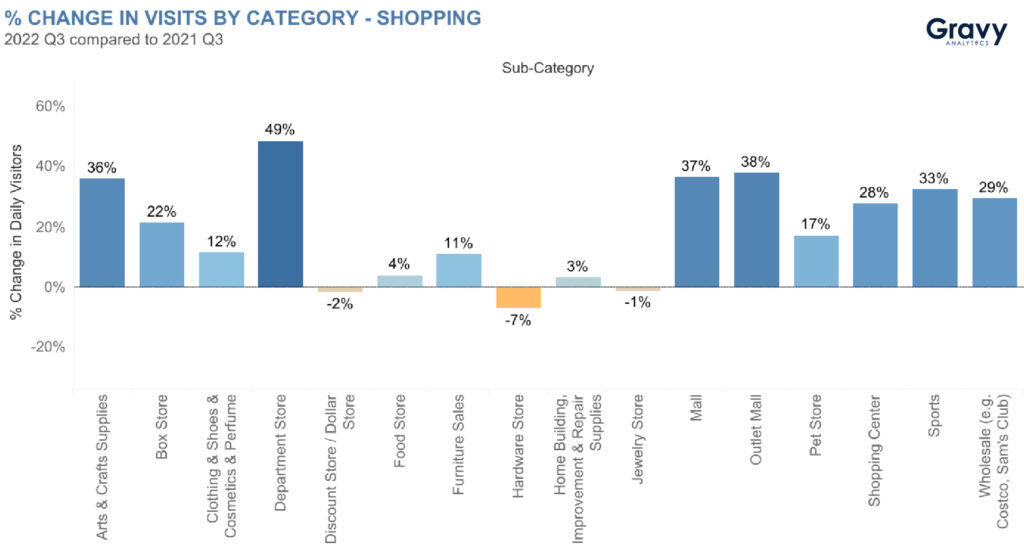

Compared to Q3 2021, foot traffic to shopping destinations was 15% higher in Q3 2022. Department stores and malls saw the biggest increases in foot traffic during the period. It may be that consumers are once again enjoying the social experience of shopping together.

This trend is great news for department stores and malls, which have been struggling in recent years. In 2021, department store brands like Macy’s, JCPenney, and Bed Bath & Beyond were closing stores at a rapid pace, and retail vacancy rates were on the rise. While it’s still too early to say for sure if this is a long-term trend, the recent increase in foot traffic could help provide a much-needed boost to these businesses.

Shoppers Place a Premium on Value

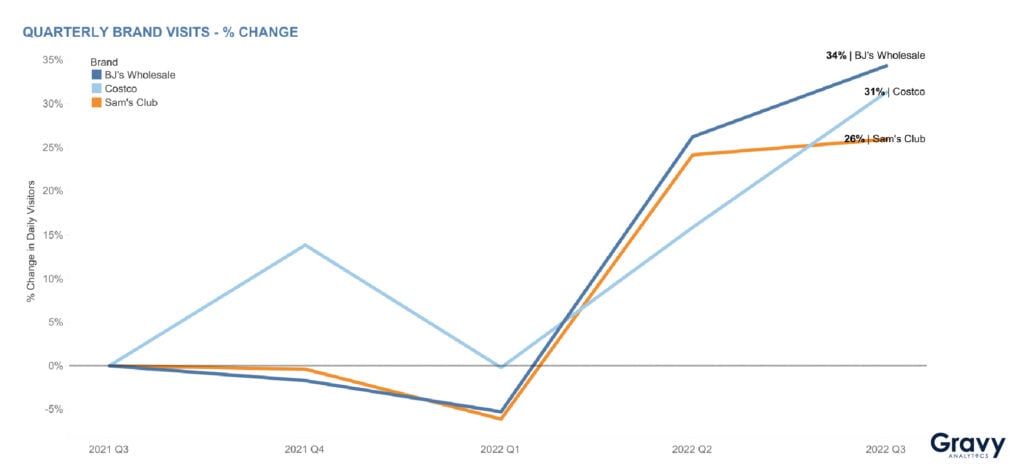

Wholesalers have also become more popular as consumers look for ways to save money. Compared to Q3 2021, foot traffic to Sam’s Club, Costco, and BJ’s Wholesale was at least 25% higher in Q3 of this year. This is likely due to the fact that groceries have become more expensive as inflation continues to take its toll on the economy. Wholesalers offer great value on groceries and other goods, which means that consumers can still get the products they need at a fraction of the cost.

Looking ahead, it will be interesting to see how retailers continue to adapt to meet the demands of today’s shoppers. In 2022, shoppers are more focused than ever on shopping as a social experience while also getting the most bang for their buck. It is clear that there is still a lot of work to be done by brick-and-mortar retailers that want to remain the shopping destinations of choice for in-market consumers.

For even more insight into current consumer trends, download the full Q3 Consumer Trends report, or schedule time to speak with a location data expert today.