Is the US Economy Heading Towards a Recession Due to Inflation?

August 30, 2022

The U.S. economy is in a state of fluctuation—all thanks to inflation. Inflation continues to be a big topic in the news and in households across the country as many Americans deal with high prices on everything from groceries to services. Whether or not the U.S. economy will see a recession soon is any economist’s guess, but what is certain right now is that consumers are going places once again while also watching their budgets.

Consumer spending is one of the biggest indicators of how the economy is performing. Additional types of information that can be used to measure economic success are stock prices and consumer sentiment. However, there is another type of data that isn’t considered as often as economic data: consumer foot traffic. Foot traffic data provides companies with real-world insights into consumer behavior and emerging trends.

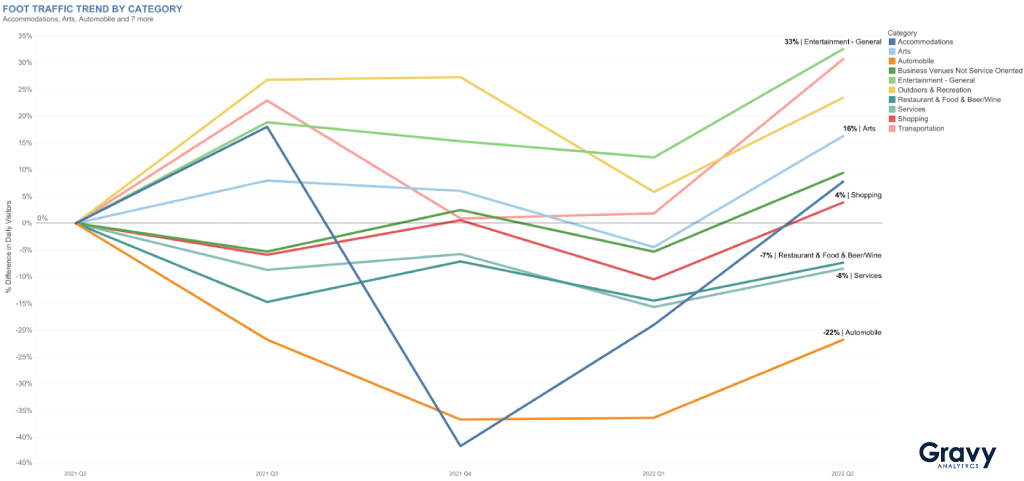

To assess how inflation and other socioeconomic issues are affecting consumer behavior in the U.S., we analyzed foot traffic data from Q2 2021 to Q2 2022 in a variety of place categories—from Accommodations to Transportation.

A Possible Sign of Economic Resilience

A majority of place categories are up, a possible sign of economic resilience. Year over year, foot traffic to entertainment venues was 33% higher, while outdoor and recreational locations saw 23% higher foot traffic. Consumers are returning to both indoor and outdoor activities with crowds as “mask fatigue” sets in and social distancing becomes less of a norm. Like entertainment and outdoor activities, traffic to transportation locations was also up significantly (+31%), compared to the second quarter of the previous year.

Inflation is causing many consumers to reconsider how (and where) they spend their discretionary income. While people are excited for experiences again, it seems that they are deprioritizing services, car maintenance, restaurants, and food/beverage stores. In Q2 2022, auto-related locations saw 22% less foot traffic than in Q2 2021. Q2 2022 food store and restaurant foot traffic was 7% lower, while foot traffic to services was 8% lower, compared to Q2 2021. While consumers are watching their budgets, consumer foot traffic related to shopping was only 4% higher in Q2 2022 than in the second quarter of 2021. This could mean that, although consumers are going back to malls and shopping centers, they may still be doing much of their shopping online.

Predicting Economic Trends with Location Intelligence

We are optimistic about the resilience of the U.S. economy, especially since consumer spending grew fast in June. Based on the foot traffic data featured in our Q2 2022 Consumer Trends Report, we predict that it is possible for the country to avoid a recession. With consumer visits up across multiple categories, such as Accommodations and Entertainment, it appears that Americans are carefully considering where they spend their money and reallocating their discretionary income. So, will the U.S. see a recession or an economic upswing? If foot traffic data is any indication, then an economic upswing might be in our future.

If you’re interested in learning more about location intelligence and how it can be used to understand the economy, schedule some time to speak with the experts at Gravy Analytics.